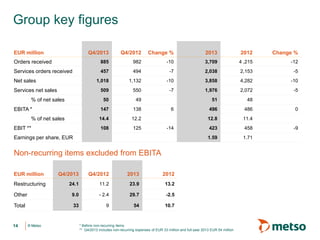

Metso reported its fourth quarter and full year 2013 results. Key highlights include:

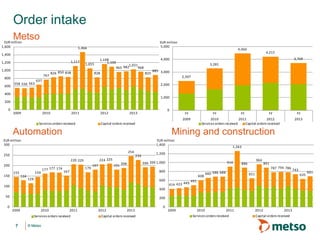

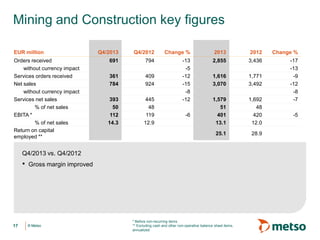

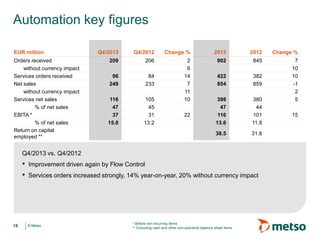

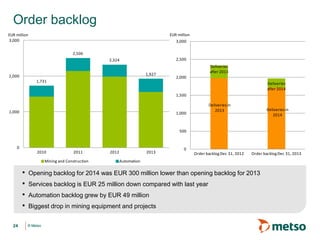

- Orders received in Q4 2013 were EUR 885 million, down 10% year-over-year. Full year orders were EUR 3,709 million, down 12%.

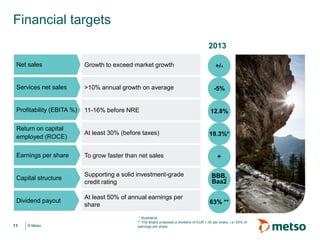

- Net sales in Q4 2013 were EUR 1,018 million, down 10% year-over-year. Full year net sales were EUR 3,858 million, down 10%.

- EBITA for Q4 2013 was EUR 147 million at a 14.4% margin, up from EUR 138 million at 12.2% margin in Q4 2012. Full year EBITA was EUR 496 million at a