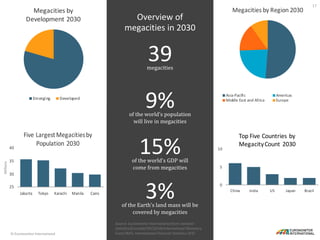

This document provides an overview and analysis of current and future megacities around the world. The following key points are made:

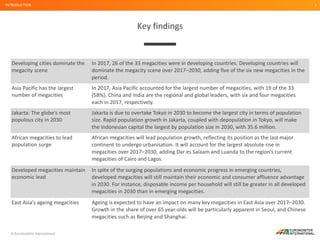

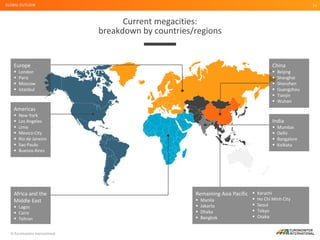

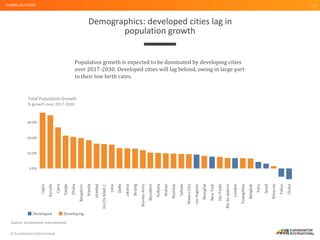

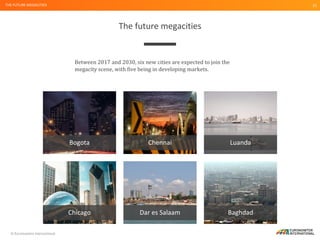

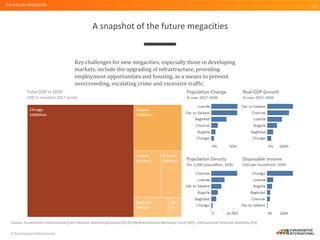

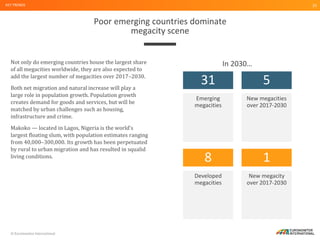

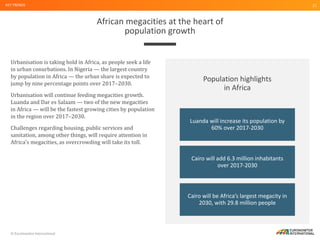

- Developing countries currently dominate the megacity scene and will add the most new megacities between 2017-2030. African megacities will experience the largest population growth.

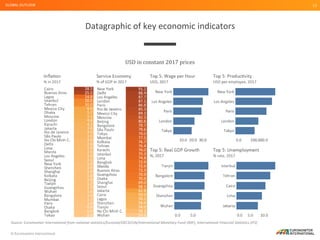

- Jakarta is projected to become the most populous city in the world, surpassing Tokyo, with a population of 35.6 million by 2030 due to its rapid growth.

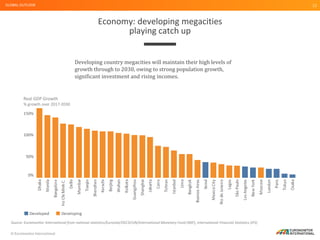

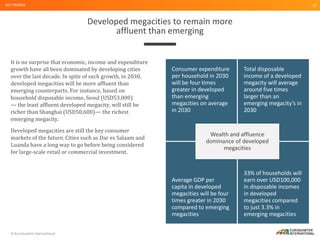

- While economic growth is stronger in emerging megacity economies, developed megacities will remain more affluent and higher-income in 2030 based on measures like household disposable income.

-