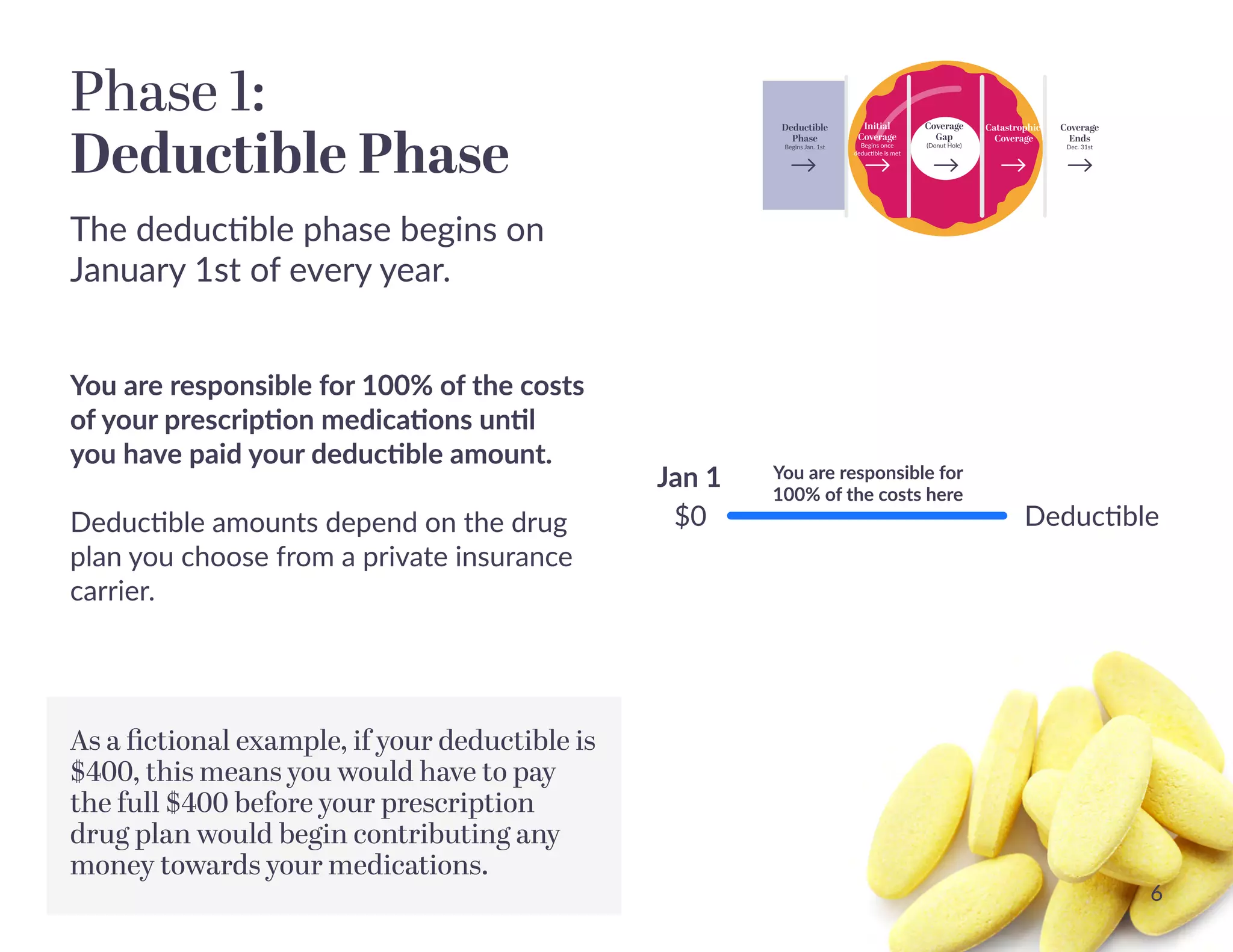

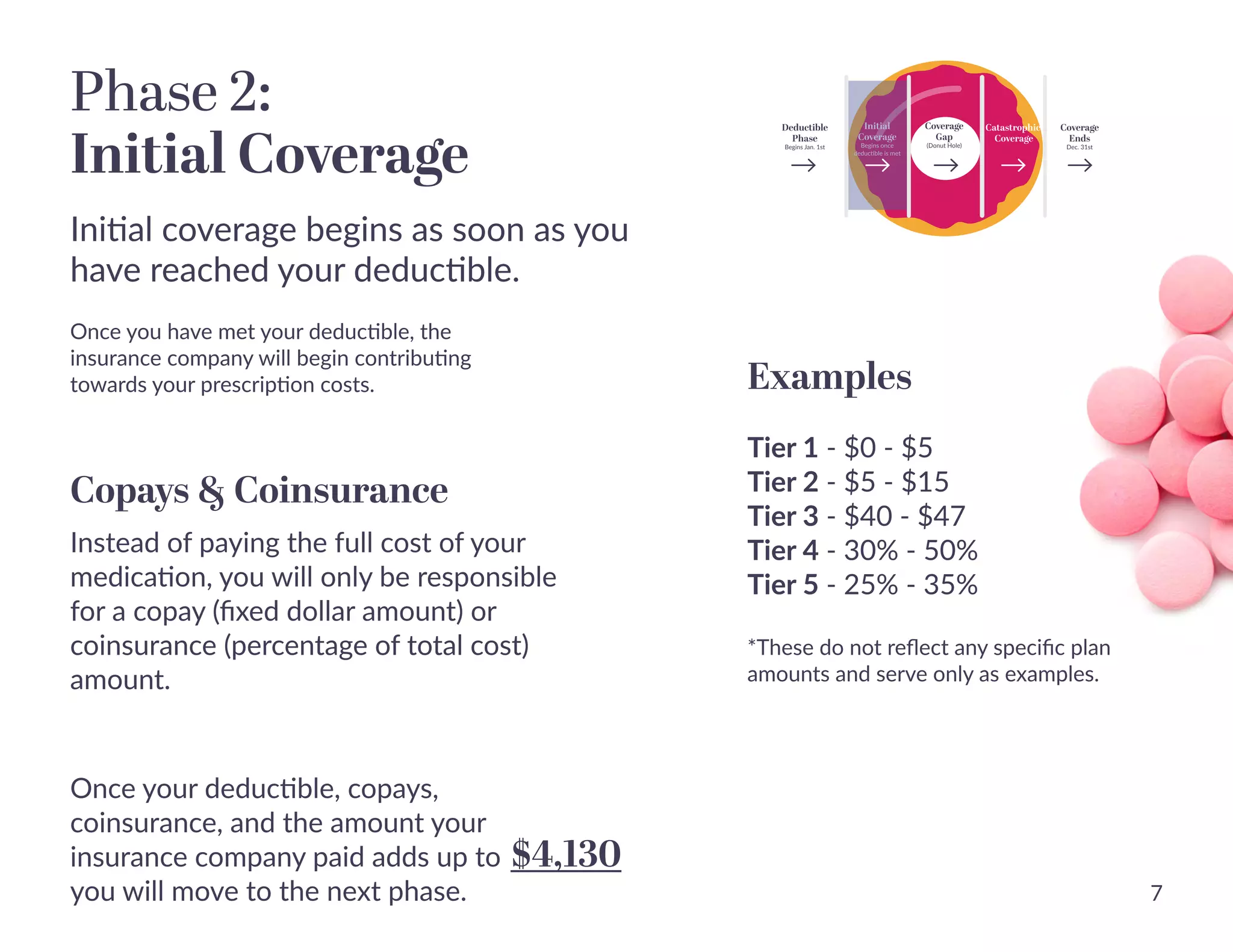

Medicare Part D provides coverage for prescription drugs, filling a gap left by original Medicare, and is administered by private insurance companies with their own formularies and tiered medication lists. It consists of four phases: deductible, initial coverage, coverage gap (donut hole), and catastrophic coverage, affecting costs and payment responsibilities at each stage. Enrollment is crucial to avoid penalties and high out-of-pocket costs for medications if a plan is not selected during the initial enrollment window.