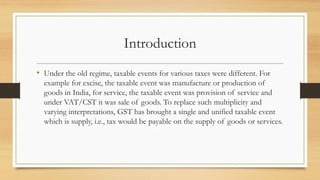

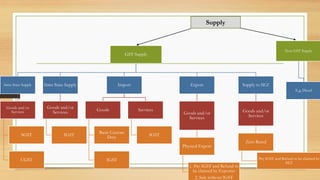

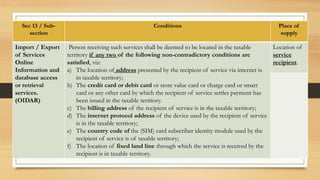

The document provides information on key concepts related to GST including levy and collection of GST, taxable events, place of supply for goods and services, time of supply, valuation, exemptions, and classification of goods and services. Specifically, it covers:

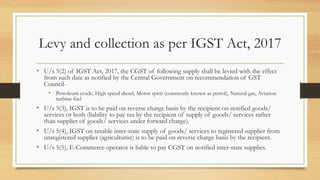

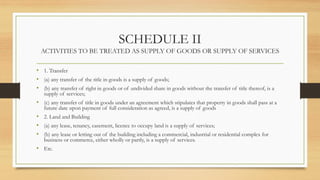

- Levy and collection of CGST, SGST, and IGST on intra-state and inter-state supplies of goods and services.

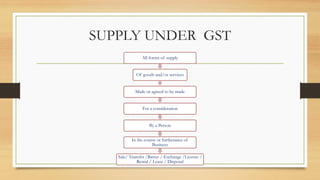

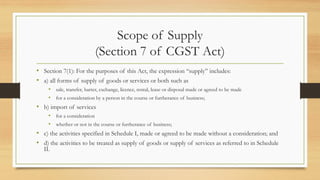

- Taxable events under GST include all supplies of goods or services made for a consideration in the course of business.

- Place of supply rules for determining whether a supply is intra-state or inter-state.

- Time of supply rules for determining when tax is payable on

![Sec Rule Place of Supply Remarks

10(1)(a) Supply involves movement of

goods.

Location of the goods at

the time at which

movement of goods

terminates for delivery

to the recipient.

Movement may be

caused by the

supplier or the

recipient or any

other person.

10(1)(b) Triangular situation

1. Goods are delivered by a

supplier to a recipient or

any other person.

2. On the direction of a third

person [whether acting as

an agent or otherwise].

3. Before or during movement

of goods.

4. Either by way of transfer of

title to the goods or

otherwise.

The principal place of

business of such third

person.

Third person shall

be deemed to have

received the goods.](https://image.slidesharecdn.com/gstunit2-230909103526-5920599a/85/GST-UNIT-2-pdf-29-320.jpg)

![Rule Place of Supply Remarks

10(1)(c) Supply does not

involve movement of

goods.

Location of such goods

at the time delivery to the

recipient.

10(1)(d) Goods are assembled

or installed at site.

The place of such

installation or

assembly.

10(1))(e) Where the goods are

supplied on board a

conveyance [such as

vessel, an aircraft, a train

or motor vehicle].

Location at which such

goods are taken on

board.

30

Section 10(2): Residuary: Where the place of supply cannot be determined as

per above sub-sections, the same shall be determined in a manner as may be

prescribed.](https://image.slidesharecdn.com/gstunit2-230909103526-5920599a/85/GST-UNIT-2-pdf-30-320.jpg)

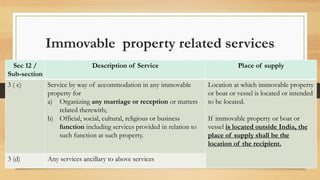

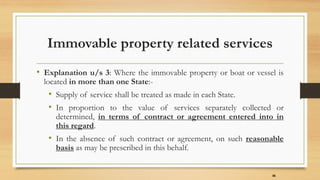

![Sec 12 /

Sub-

section

Description of Service Place of supply

3(a) Services directly in relation to immovable property

[architects, interior decorators, surveyors, engineers and other

related experts or estate agents].

Location at which

immovable property or

boat or vessel is located or

intended to be located.

If immovable property or

boat or vessel is located

outside India, the place

of supply shall be the

location of the recipient.

Rent / Lease: Any service provided by way of grant of rights to

use immovable property.

Carrying out co-ordination of construction work

3(b) Service by way of lodging accommodation by a hotel, inn,

guest house, homestay, club or campsite including house boat or

any other vessel

34

Immovable property related services](https://image.slidesharecdn.com/gstunit2-230909103526-5920599a/85/GST-UNIT-2-pdf-34-320.jpg)

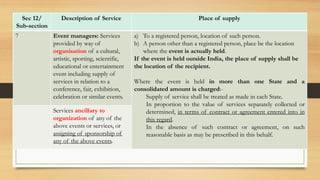

![Sec 12 /

Sub-section

Description of Service Place of supply

4 Performance based:

a) Restaurant & Catering services,

b) Personal grooming, fitness, beauty treatment,

c) Health service including cosmetic and plastic

surgery.

Location where the services are actually

performed.

6 Admission to Events: Services provided by way

of admission to an event [cultural, artistic,

sporting, scientific, educational or entertainment

event or amusement park or any other place] and

services ancillary thereto.

Place where the event is actually held.

Park or such other place is located.

37

Performance based / Event related services](https://image.slidesharecdn.com/gstunit2-230909103526-5920599a/85/GST-UNIT-2-pdf-37-320.jpg)

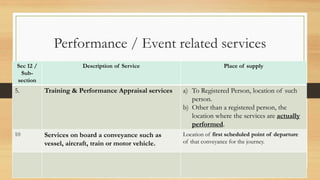

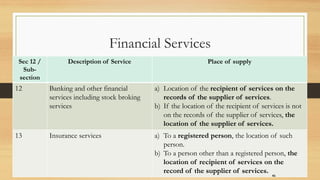

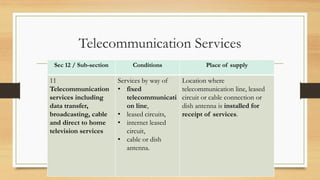

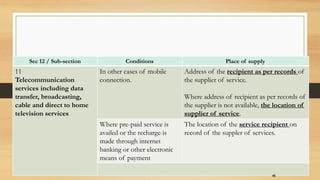

![Sec 12 / Sub-section Conditions Place of supply

11

Telecommunication

services including data

transfer, broadcasting,

cable and direct to home

television services

Post Paid Mobile

connection for

telecommunication and

internet services provided.

Location of billing address of recipient

of services on record of the supplier of

services.

Pre-paid Mobile

connection for

telecommunication, internet

service and DTH television

service are provided [on

pre-payment through a

voucher or any other

means].

a) Through a selling agent or a re-seller or a

distributor of SIM card or re-charge

voucher – address of the selling agent

etc. as per the record of the supplier of

service.

b) Final subscriber – location where the

pre-payment is received or such vouchers

are sold.

44

Telecommunication Services](https://image.slidesharecdn.com/gstunit2-230909103526-5920599a/85/GST-UNIT-2-pdf-44-320.jpg)

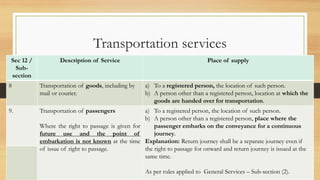

![Prevention of double taxation or non-taxation [S 10(13)]

1. To prevent double taxation or non-taxation of the supply of a service

2. For uniform application of rules.

3. The Central Government shall have the power to notify a description

of service or circumstances in which the place of supply shall be the

place of effective use and enjoyment of a service.

52](https://image.slidesharecdn.com/gstunit2-230909103526-5920599a/85/GST-UNIT-2-pdf-52-320.jpg)