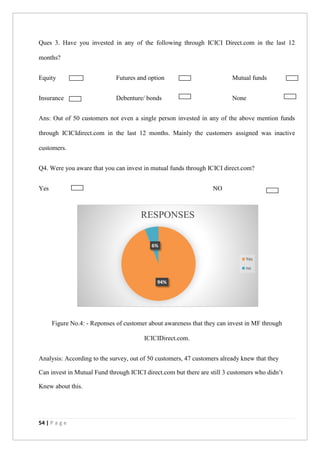

The document is a summer internship project report titled 'Mutual Fund Simplified' by Amit Kumar Jha, submitted for the PGDM program at Asia Pacific Institute of Management. It includes sections on company profiles, research methodology, data analysis, and findings, focusing on customer awareness regarding mutual funds at ICICI Securities. The project reflects a comprehensive evaluation of mutual fund concepts and practical implementation during an eight-week internship.