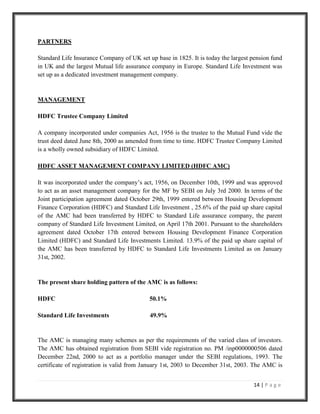

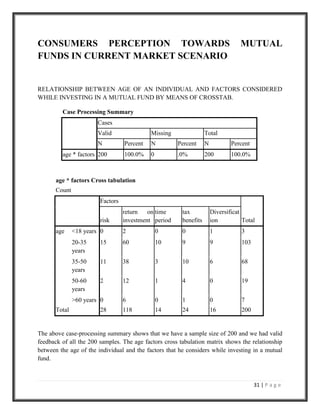

This document summarizes a market research project report submitted by Sunil Sanjodiya to the Sanghvi Institute of Management and Science in partial fulfillment of requirements for a postgraduate diploma in management. The report studies the attractive features of HDFC Mutual Fund to develop investor perception levels in Indore, India. It includes an acknowledgement, declaration, certificate from faculty guide, preface, and chapters on the history and phases of development of the Indian mutual fund industry as well as the company profile of HDFC Mutual Fund.