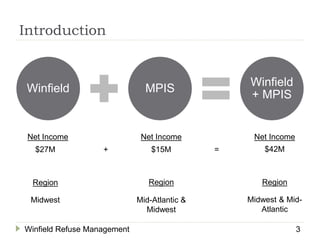

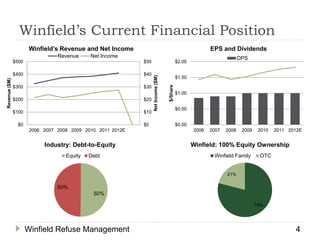

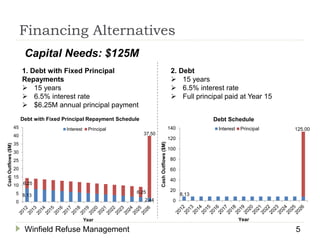

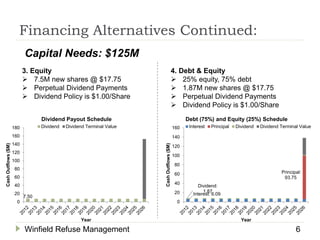

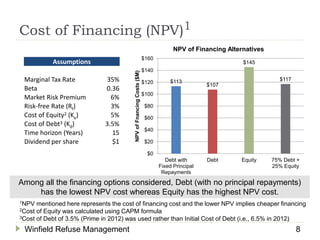

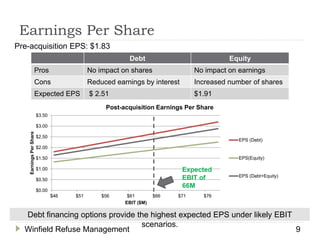

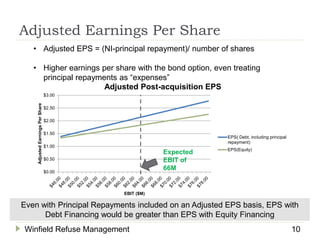

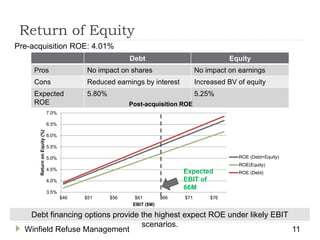

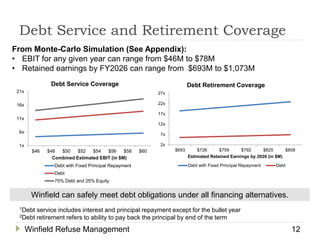

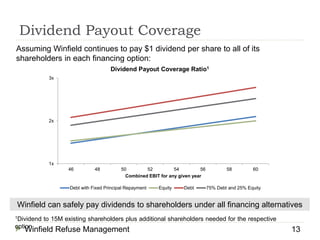

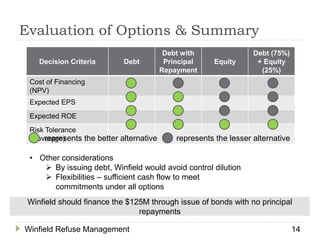

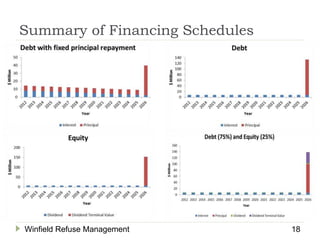

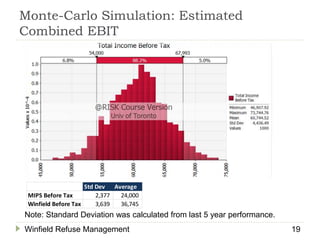

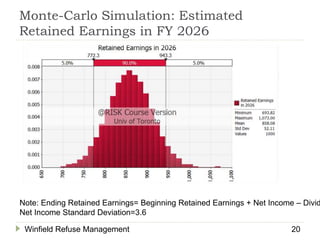

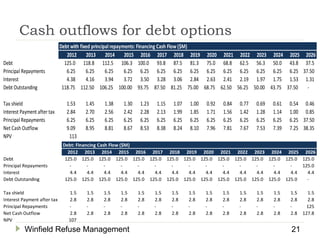

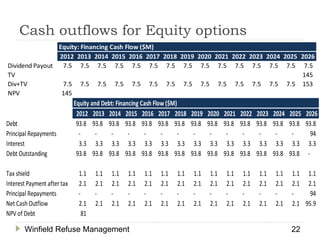

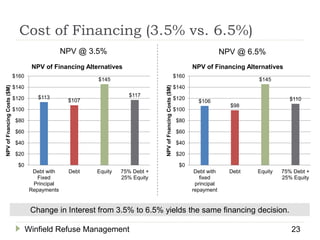

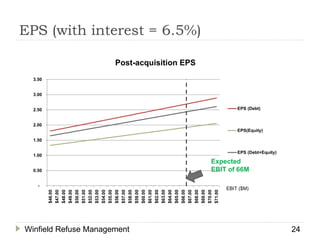

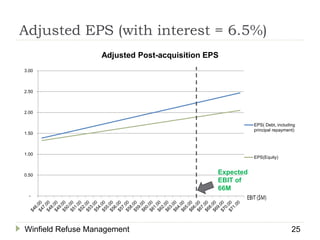

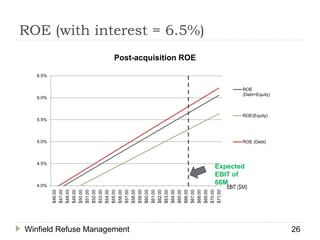

Winfield Refuse Management is considering financing options for a $125M acquisition of Mott-Pliese Integrated Solutions. The options considered are: 1) Debt with fixed principal repayments, 2) Debt only, 3) Equity, 4) Debt and equity. Debt only has the lowest NPV cost of financing, while equity has the highest. Debt options provide the highest expected earnings per share and return on equity under likely earnings scenarios. Monte Carlo simulations show Winfield can meet debt obligations and dividend payments under varying earnings outcomes for all financing alternatives. Winfield should finance through issuing bonds with no principal repayments.