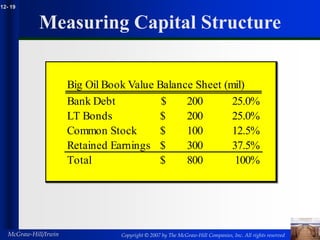

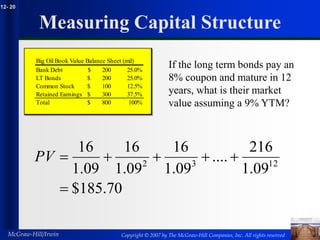

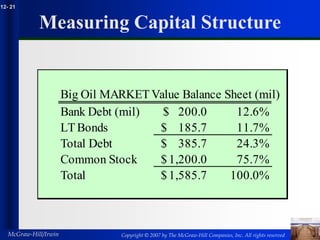

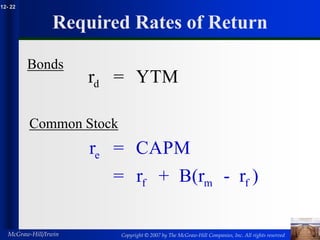

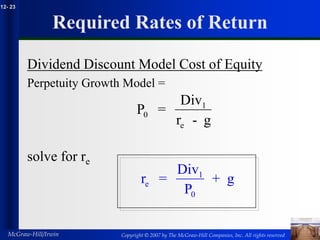

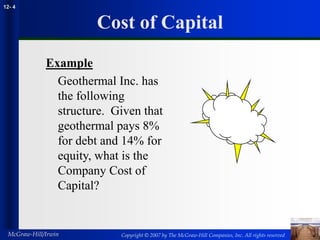

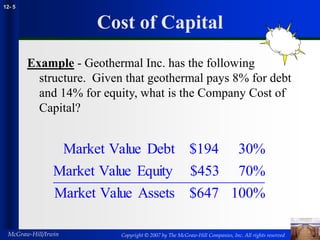

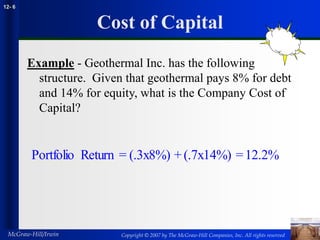

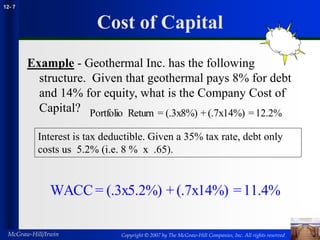

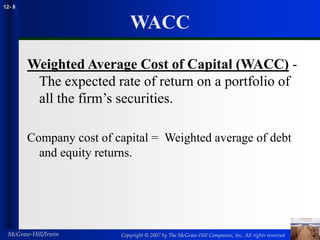

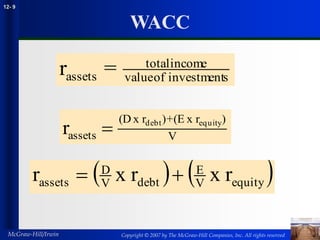

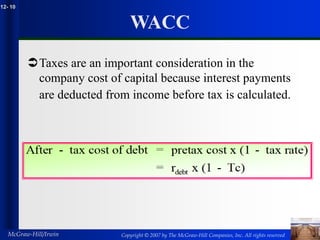

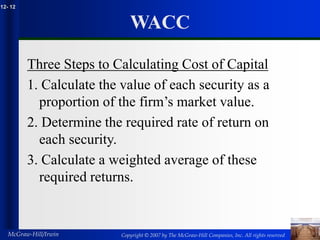

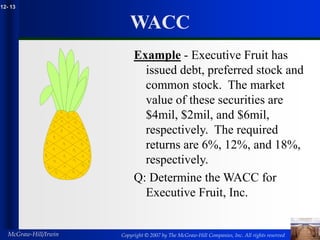

The document discusses the weighted average cost of capital (WACC) and how it is used to value companies. It provides examples of calculating WACC based on a company's capital structure and required rates of return on debt and equity. WACC is the weighted average of the cost of the company's various sources of financing and provides the minimum return needed to attract investors. The document outlines the steps for determining a company's WACC, including calculating market values for debt and equity and determining required rates of return for each.

![Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

12- 11

WACC

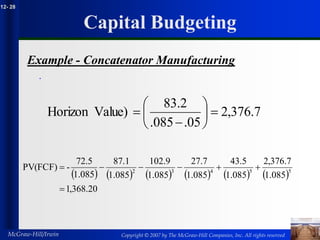

Weighted -average cost of capital=

[ ] [ ]

WACC = x (1 - Tc)r + x r

D

V debt

E

V equity](https://image.slidesharecdn.com/chap012-221123151246-ca428d6f/85/chap012-ppt-11-320.jpg)

![Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

12- 14

WACC

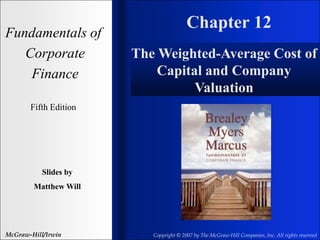

Example - continued

Step 1

Firm Value = 4 + 2 + 6 = $12 mil

Step 2

Required returns are given

Step 3

[ ] ( ) ( )

WACC = x(1-.35).06 + x.12 + x.18

=.123 or 12.3%

4

12

2

12

6

12](https://image.slidesharecdn.com/chap012-221123151246-ca428d6f/85/chap012-ppt-14-320.jpg)

![Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

12- 15

WACC

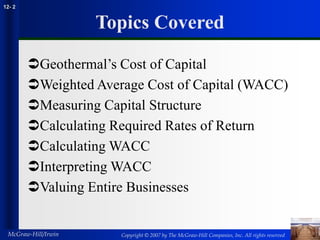

Issues in Using WACC

Debt has two costs. 1)return on debt and 2)increased cost of

equity demanded due to the increase in risk

Betas may change with capital structure

Corporate taxes complicate the analysis and may change

our decision

[ ] [ ]

B = x B + x B

assets

D

V debt

E

V equity](https://image.slidesharecdn.com/chap012-221123151246-ca428d6f/85/chap012-ppt-15-320.jpg)