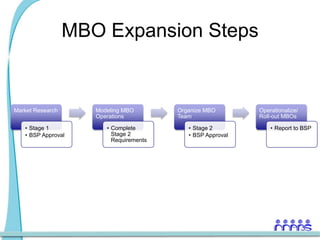

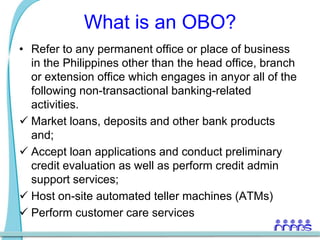

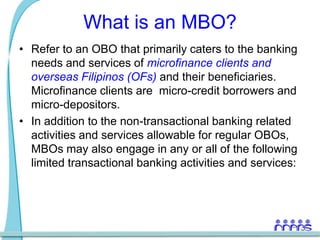

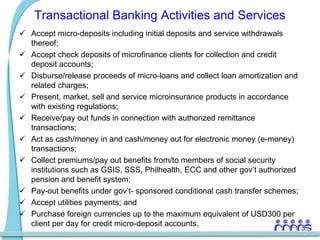

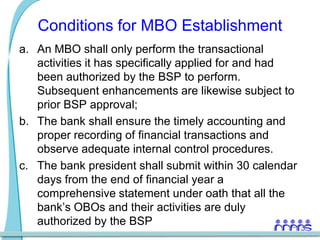

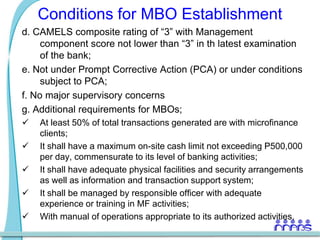

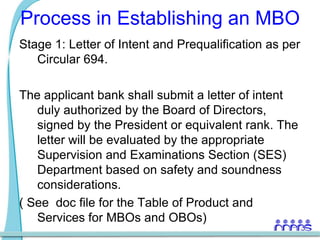

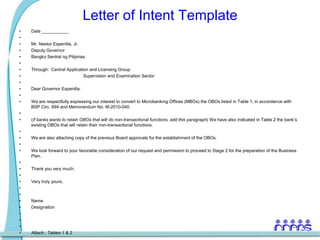

The document discusses the process for banks to establish Microbanking Offices (MBOs) in the Philippines. It defines MBOs as Off-Banking Offices (OBOs) that primarily serve microfinance clients and overseas Filipinos. MBOs can perform limited transactional activities like accepting deposits, disbursing loans, and selling microinsurance. The process involves submitting a letter of intent and business plan to regulators for approval. The business plan must contain strategic and operational details on how the MBO will serve microfinance clients. Regulators will evaluate requests based on the bank's financial condition, management quality, and ability to comply with requirements for MBO operations.