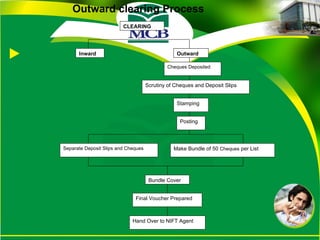

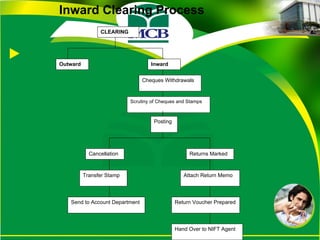

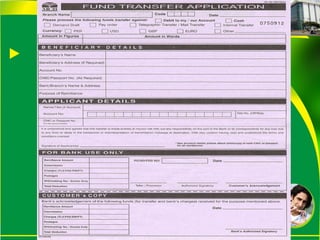

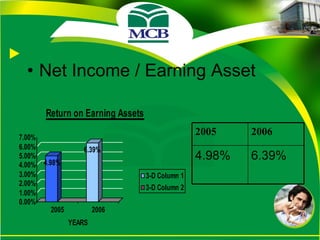

MCB Bank has grown significantly since being established in 1947 in Calcutta, India and later moving to Pakistan. It has over 900 branches and over 4 million customers. MCB has received several awards for being the best domestic bank. The operations department handles tasks like account opening, clearing checks, and processing remittances. While MCB has achieved much success and growth, opportunities remain to improve coordination, customer relationships, training, and technology.