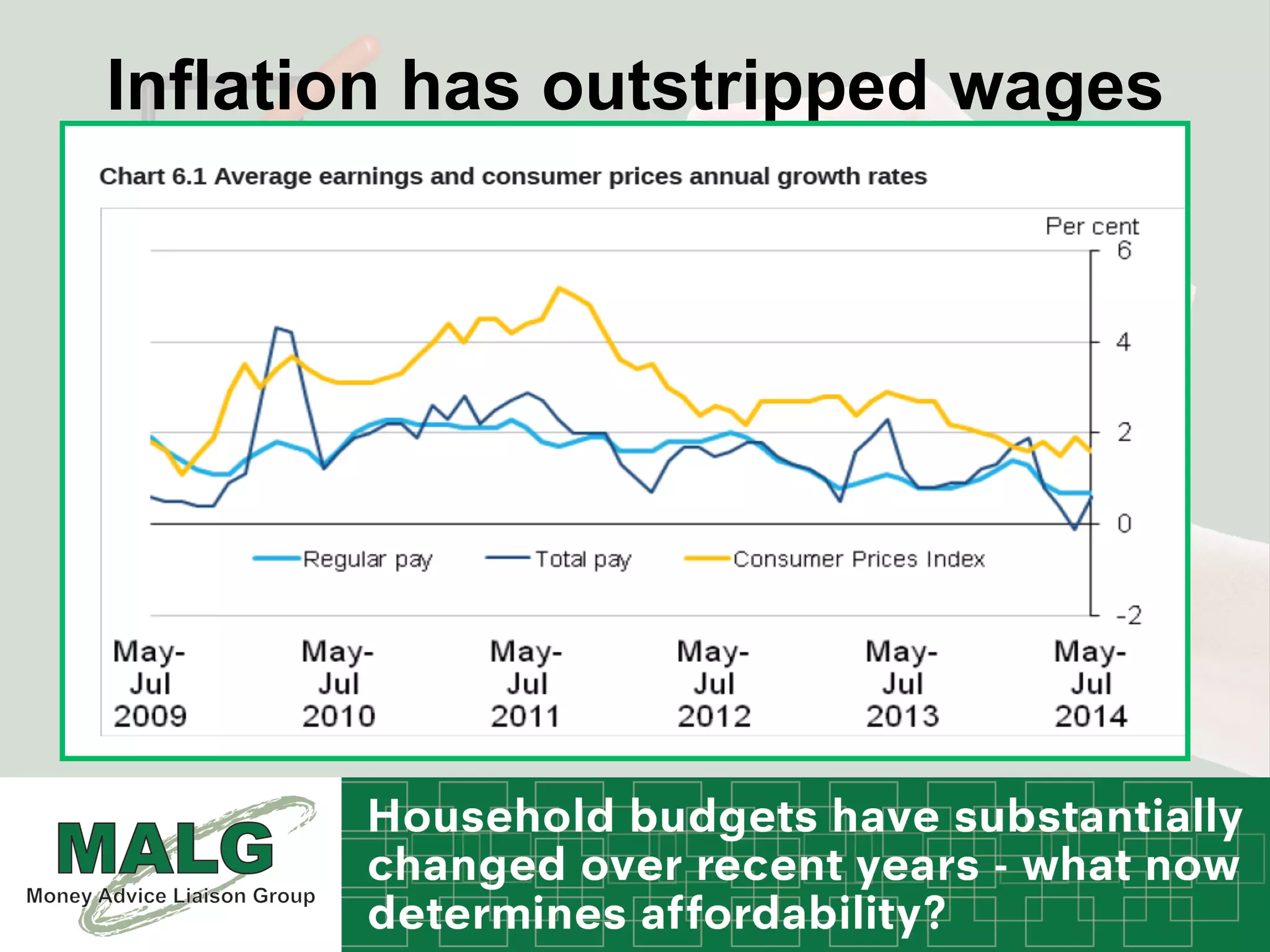

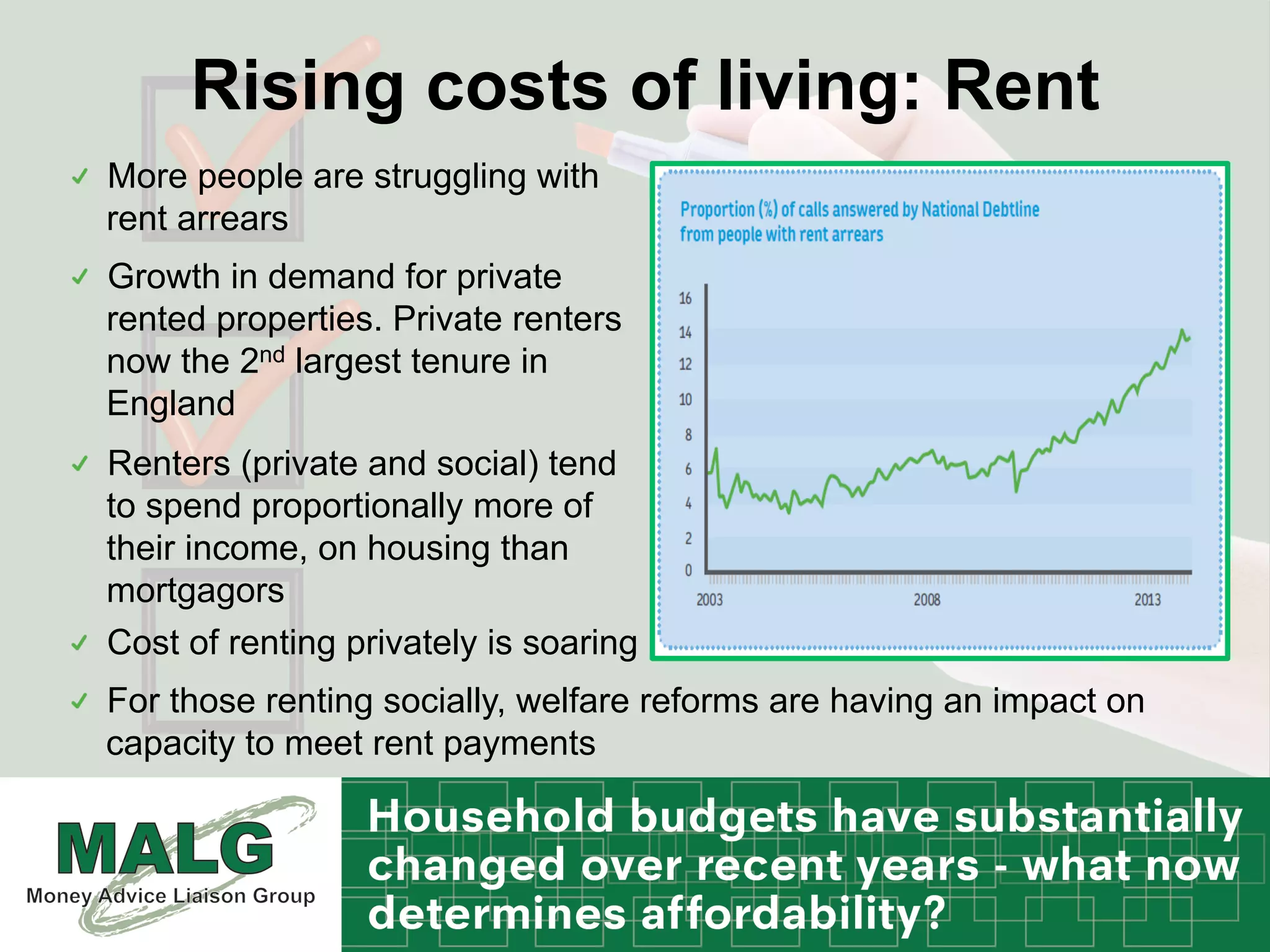

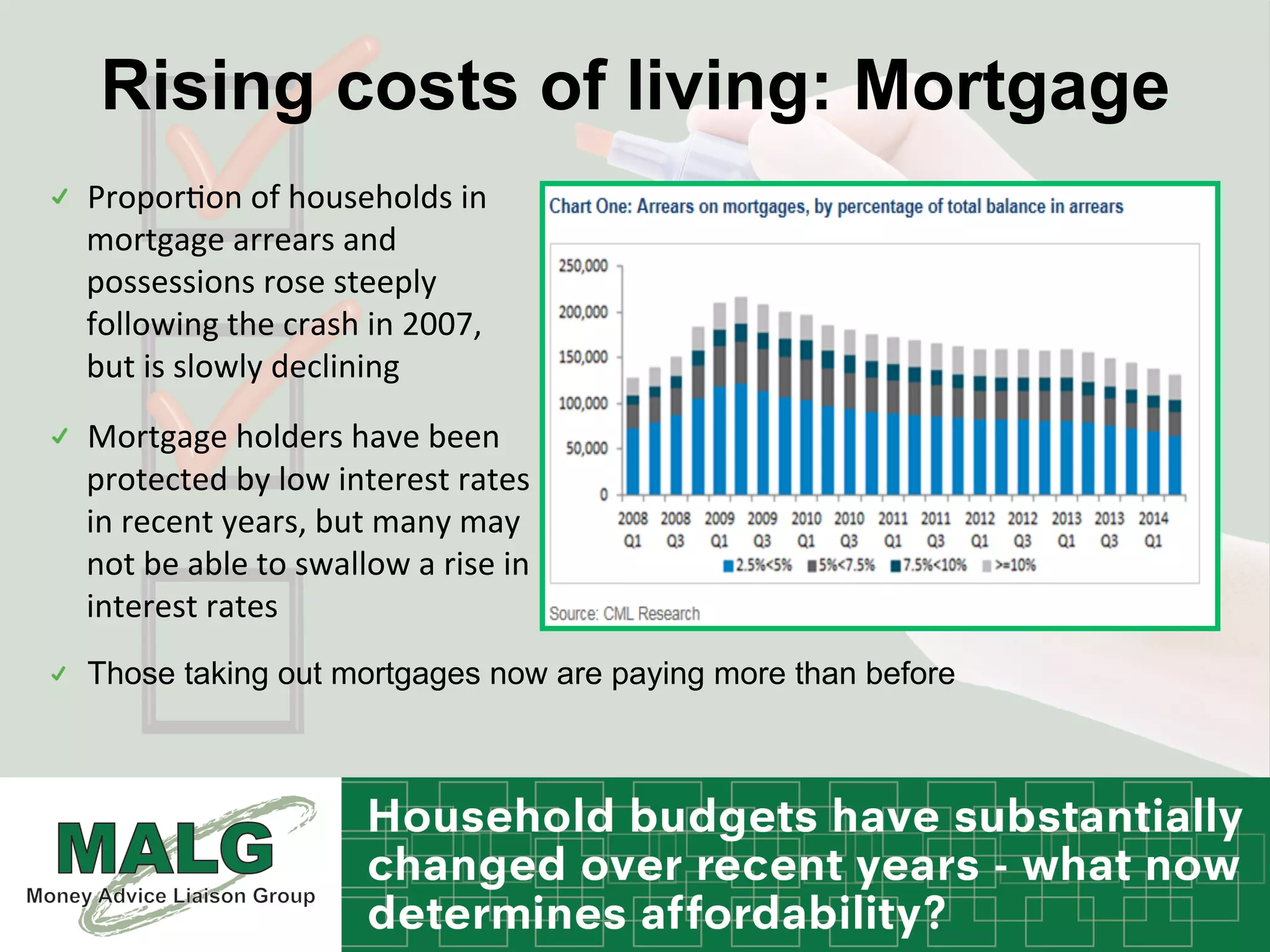

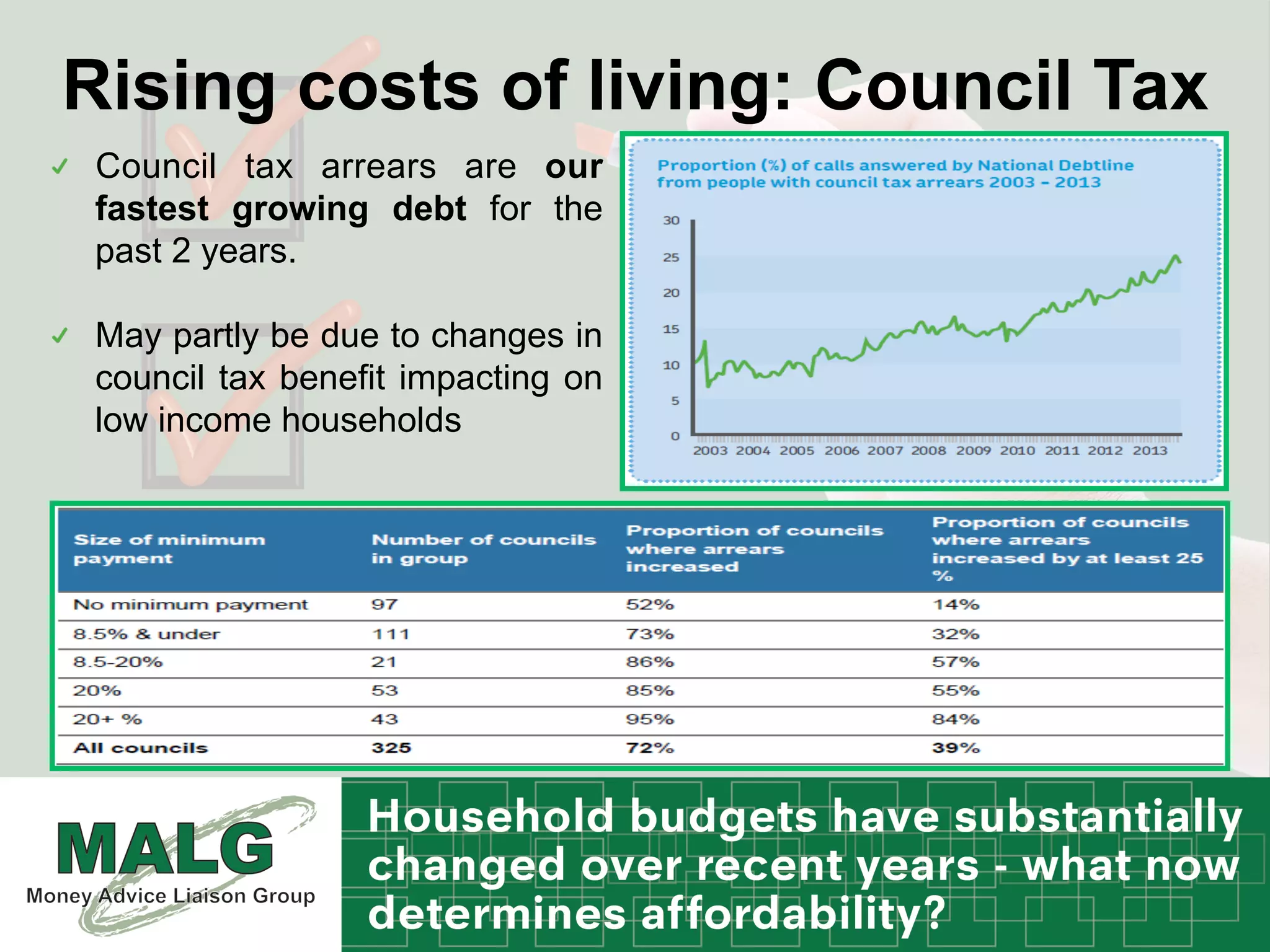

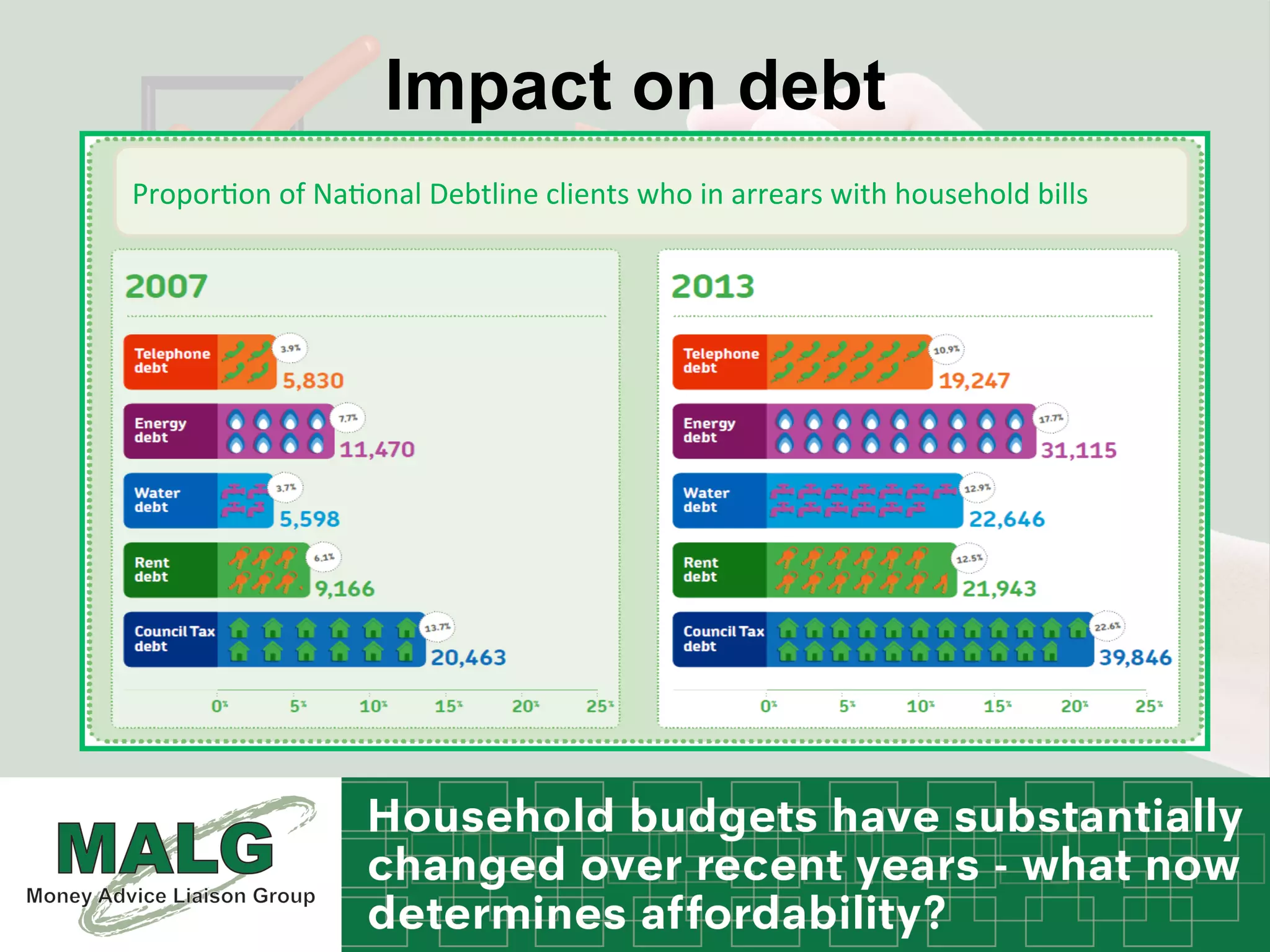

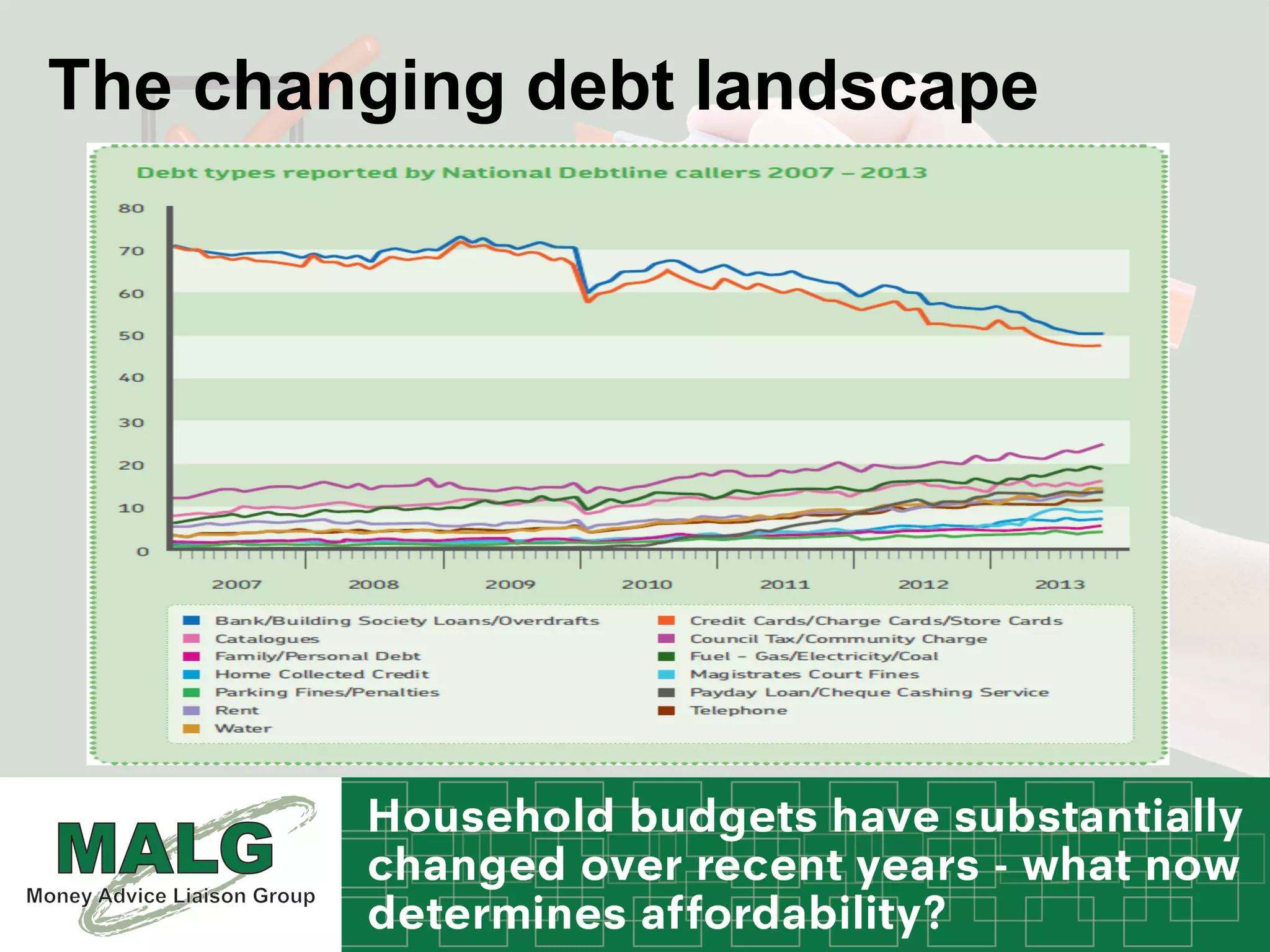

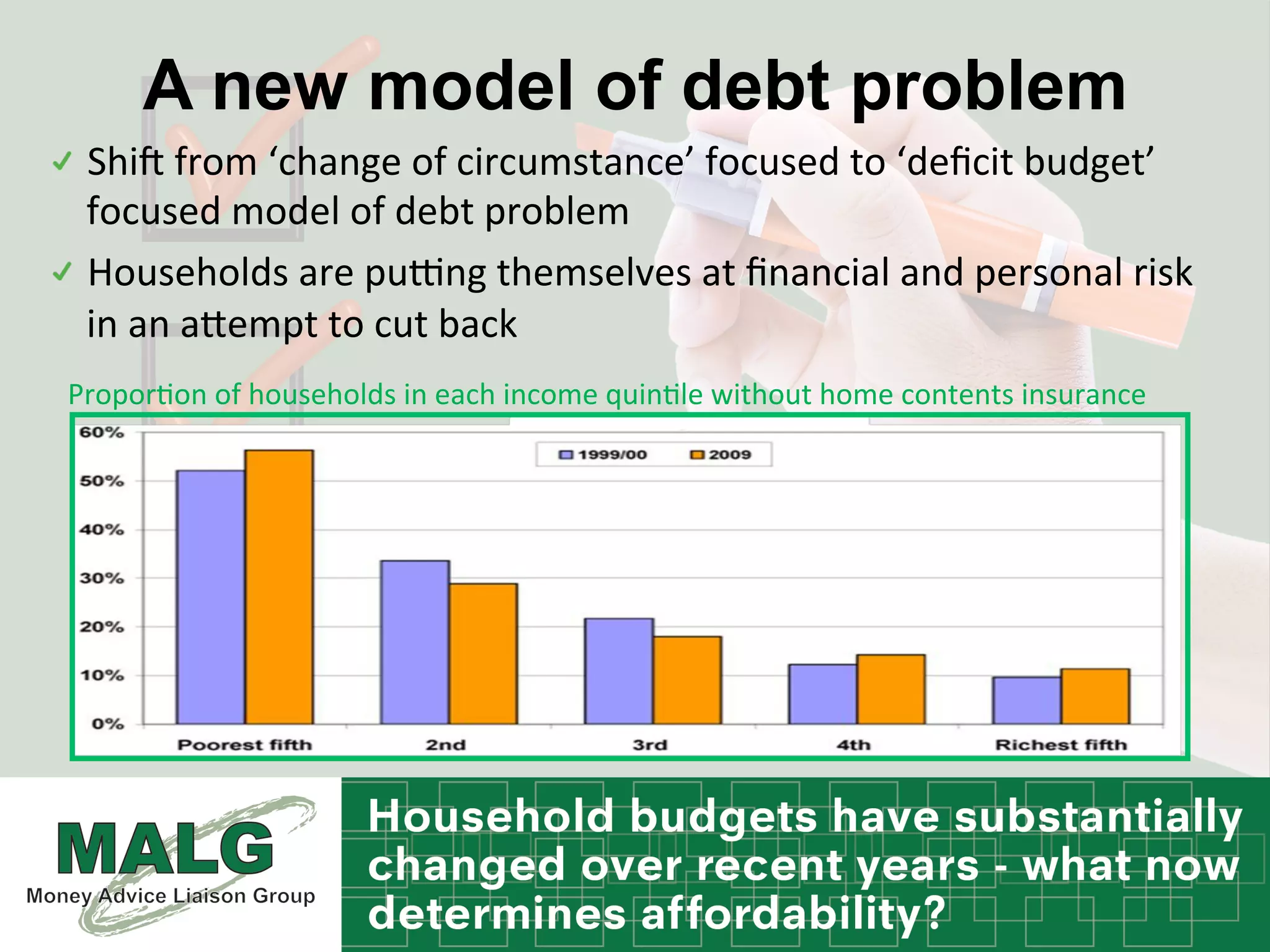

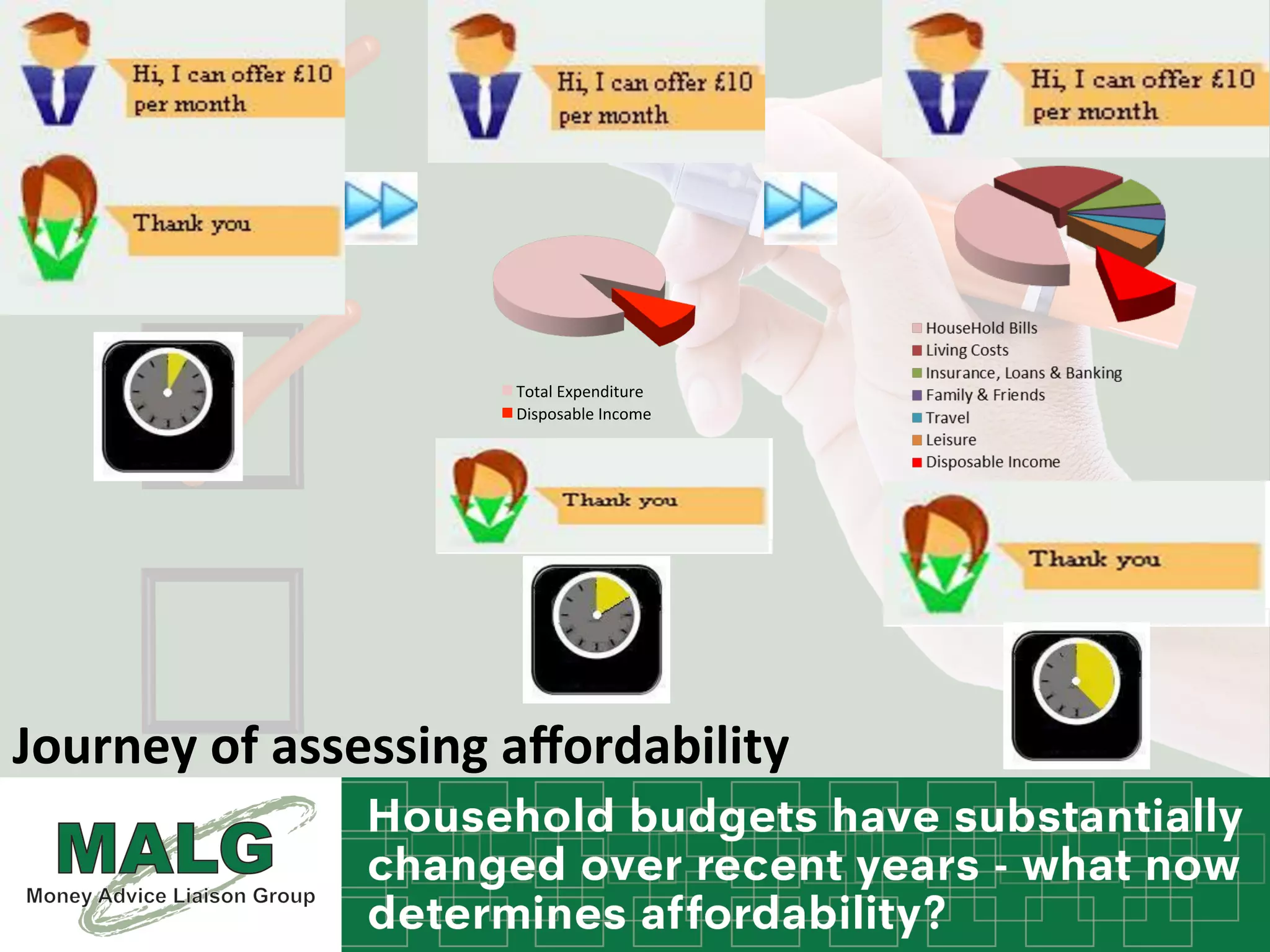

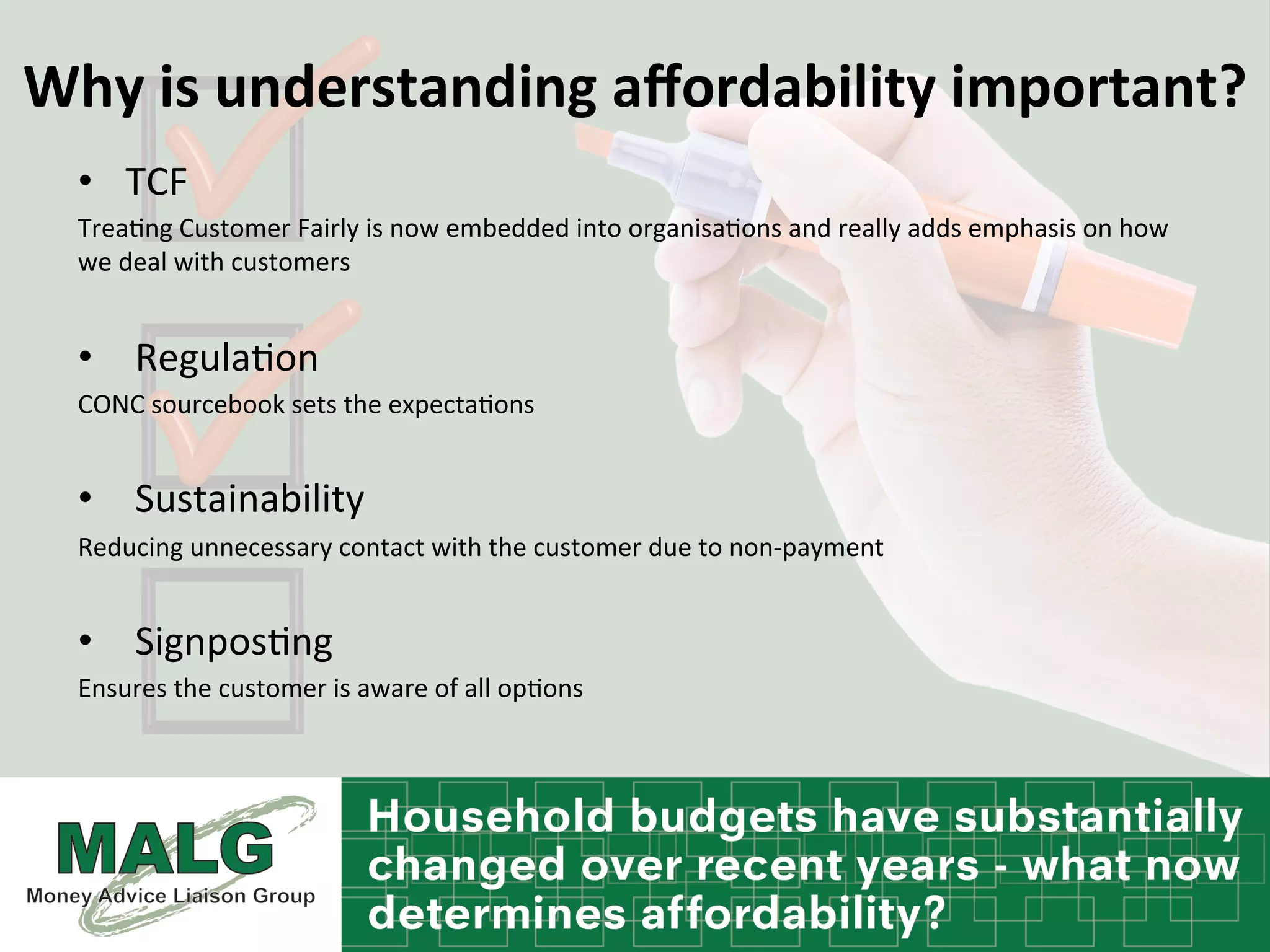

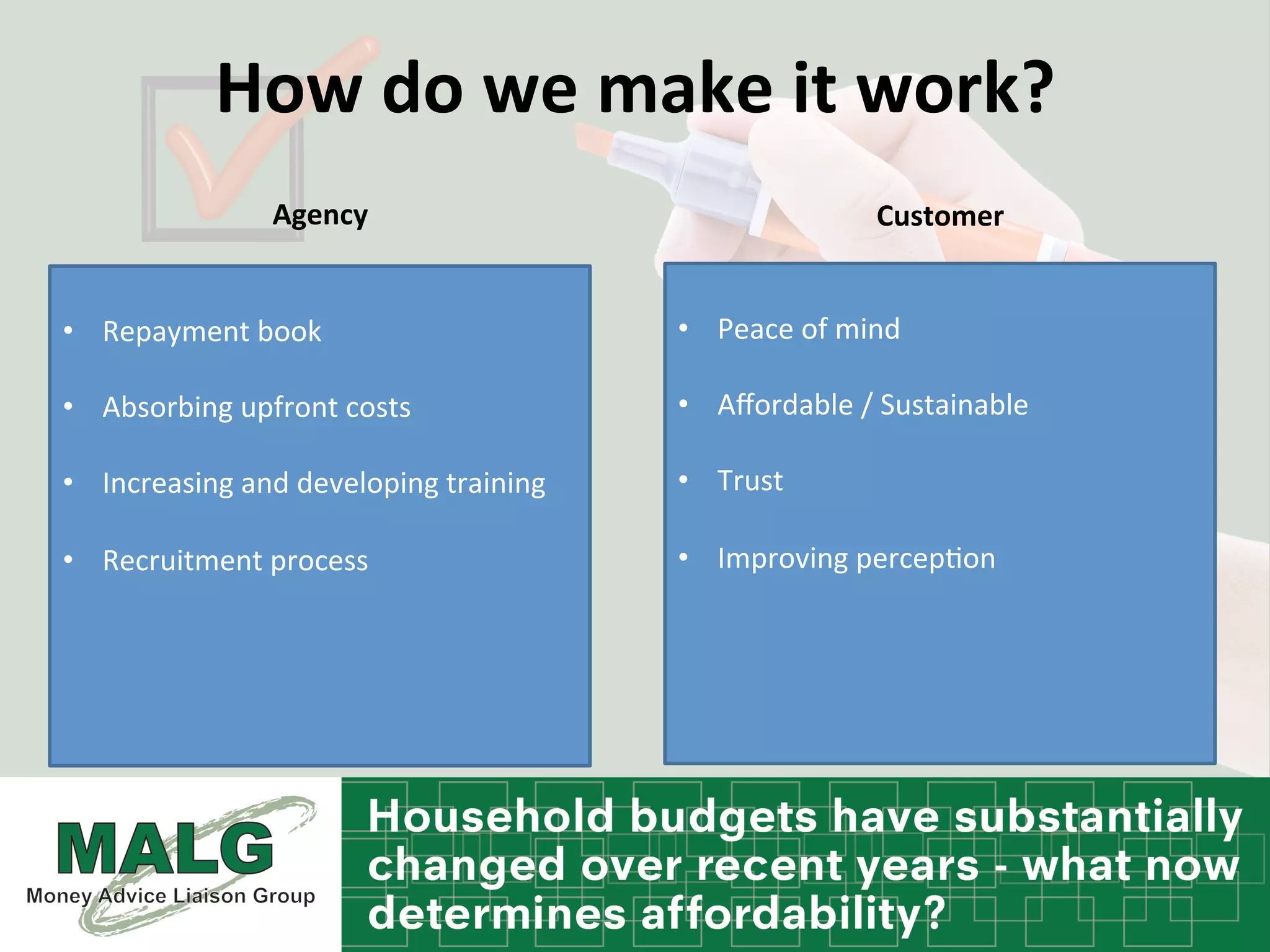

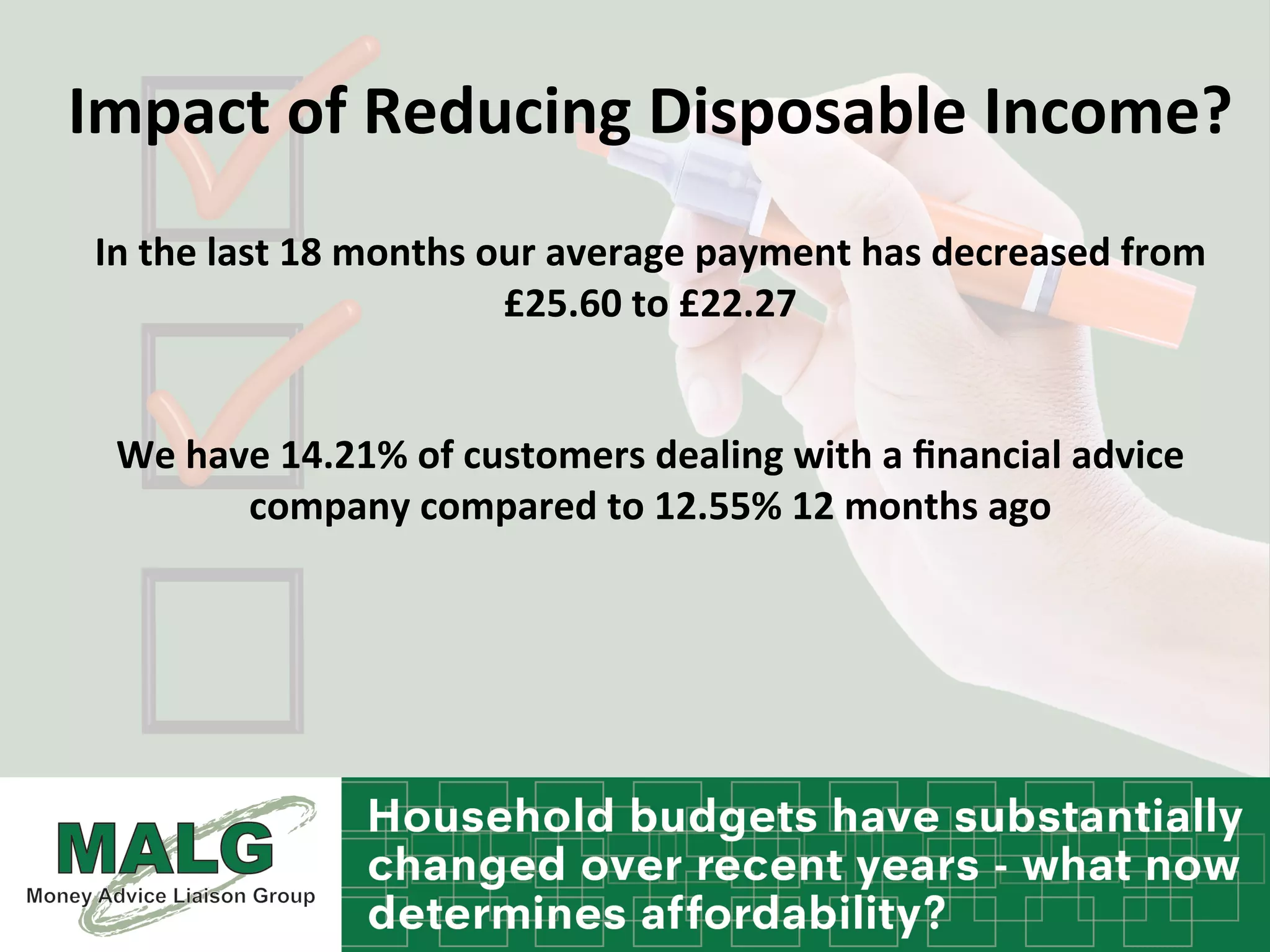

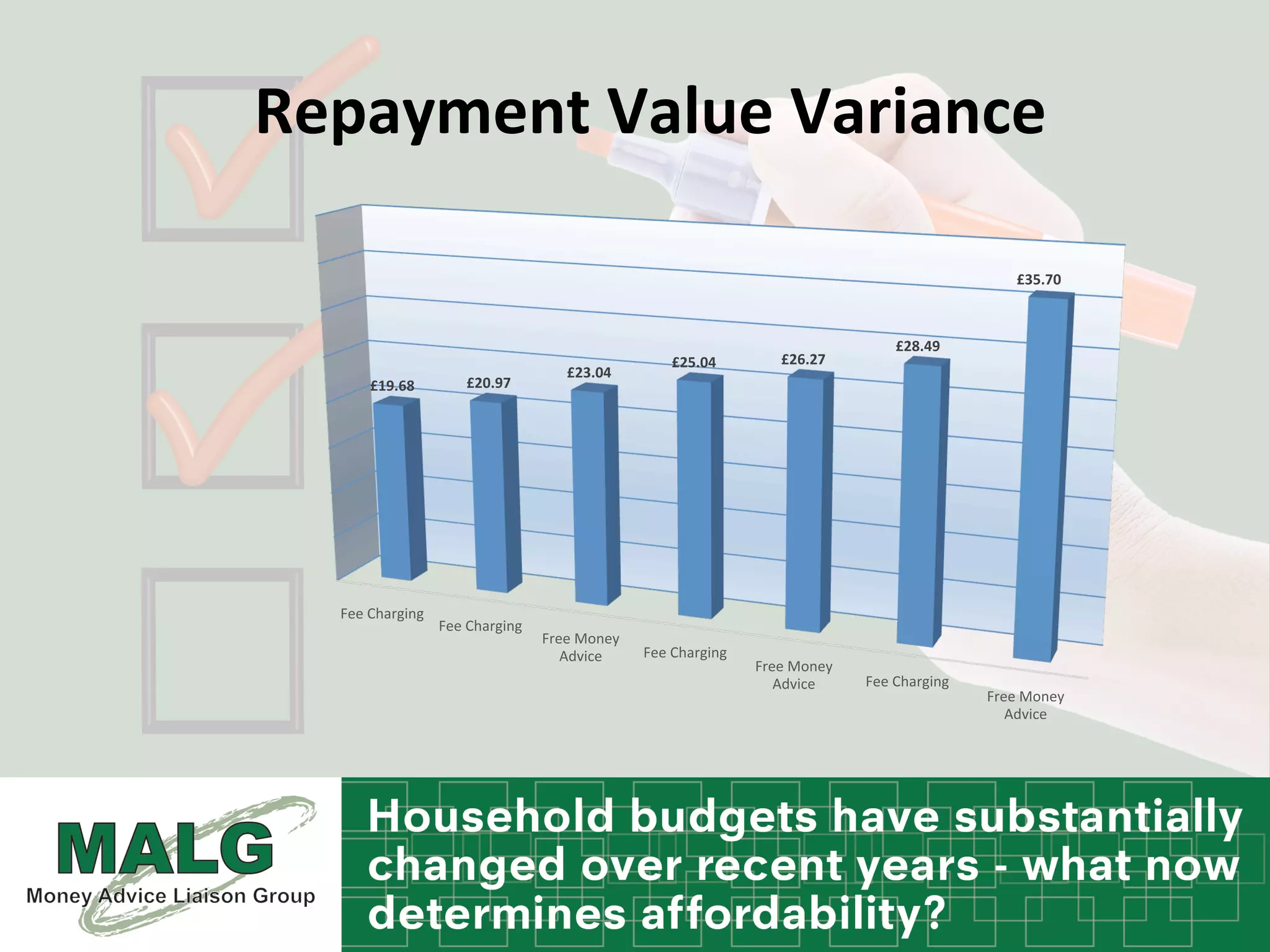

The document discusses changes in household budgets and the factors influencing affordability, highlighting the rising costs of living, including rent, mortgages, and council tax. It emphasizes the shift towards a new model of understanding debt problems and the importance of assessing affordability to ensure long-term financial well-being. Additionally, it underscores the necessity for transparency and common financial statements in managing debt and repayments.