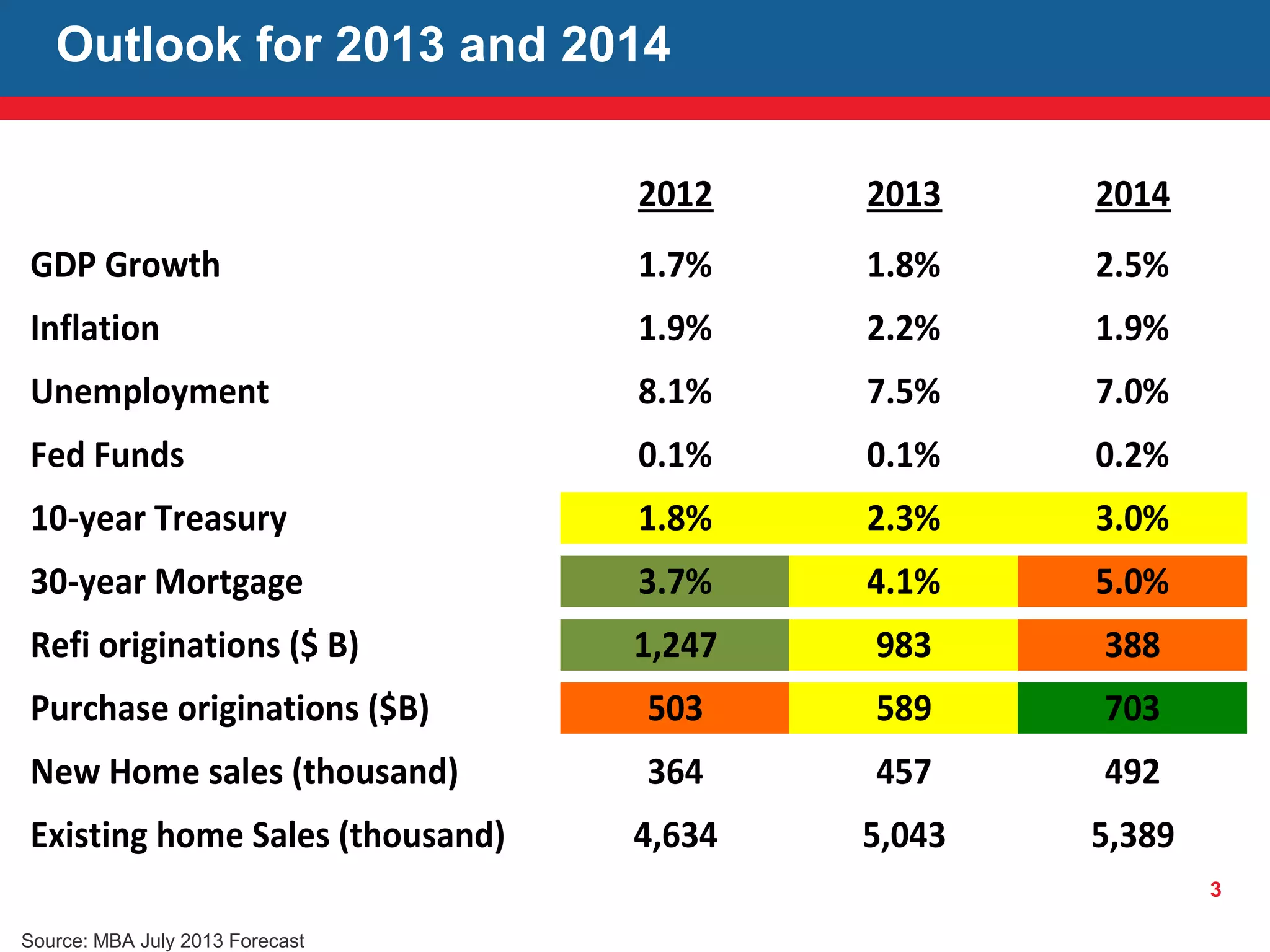

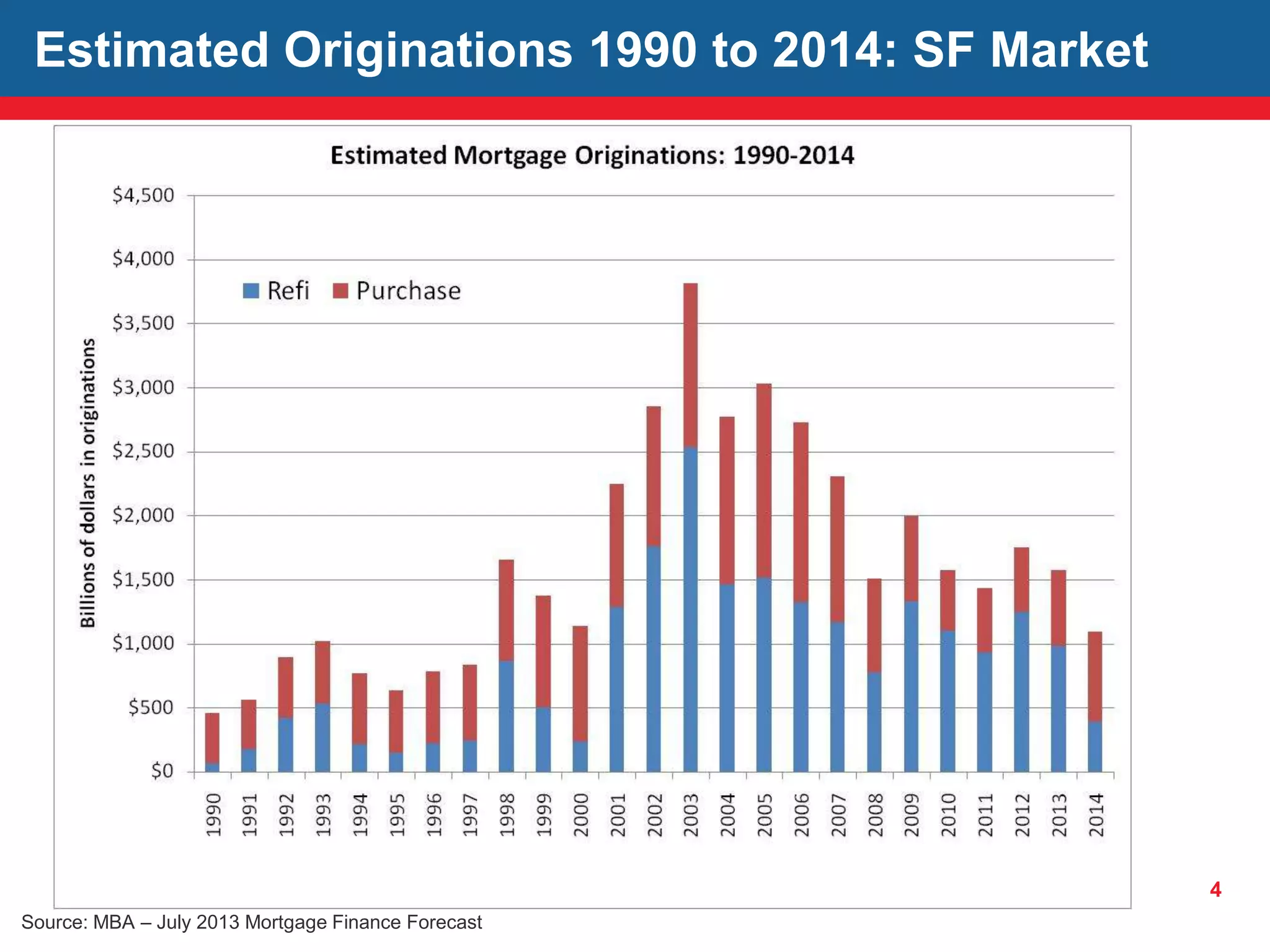

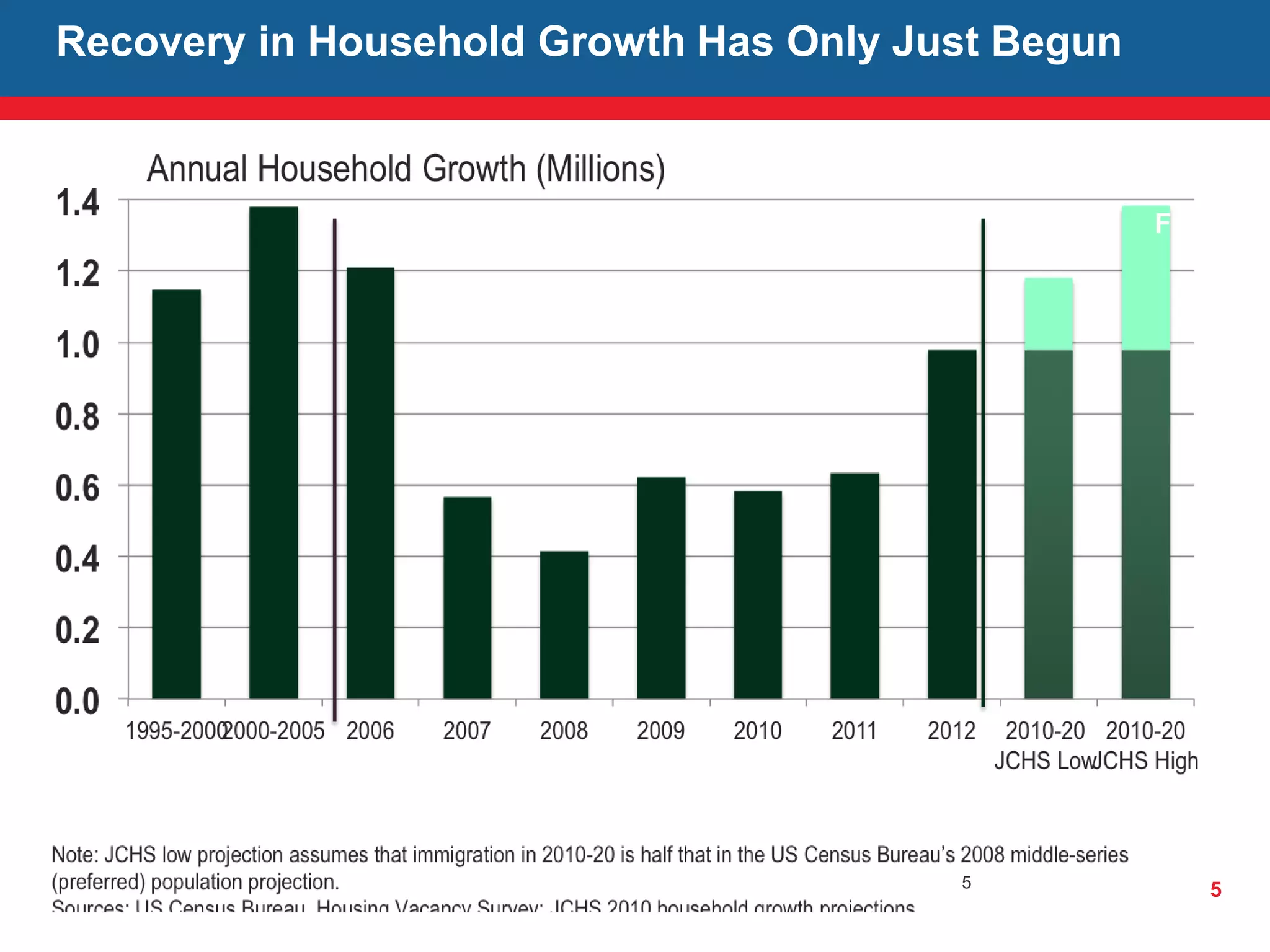

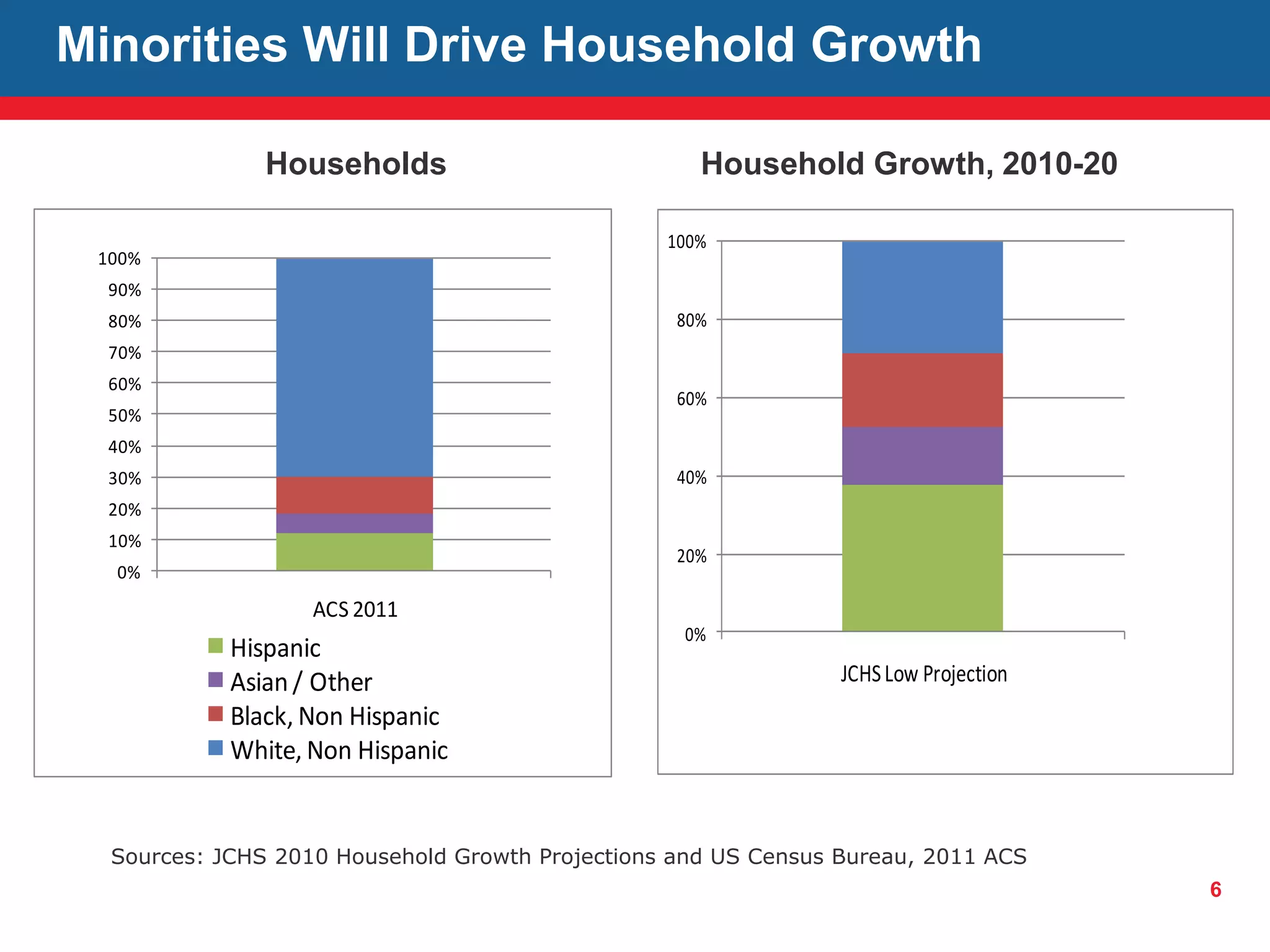

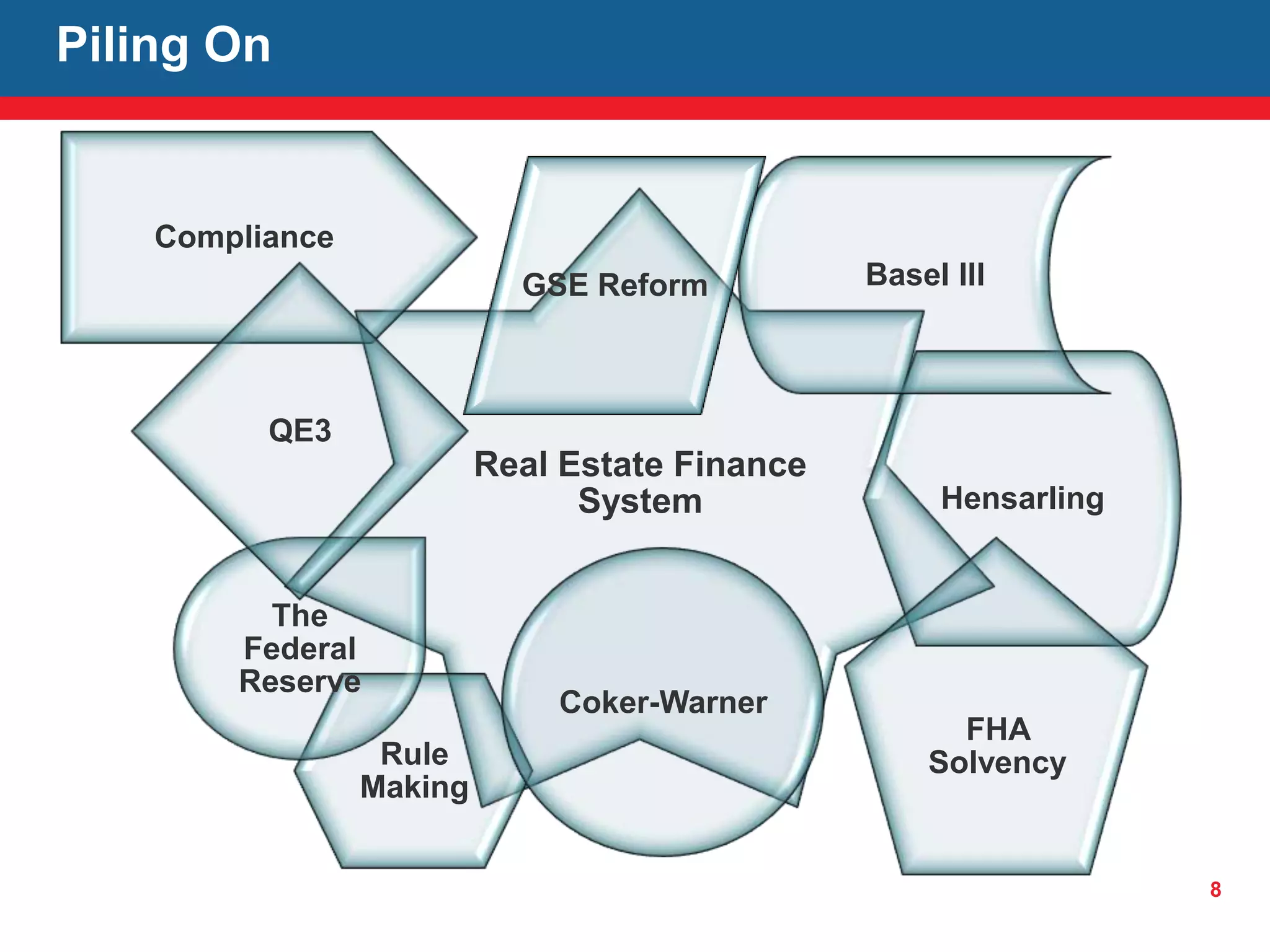

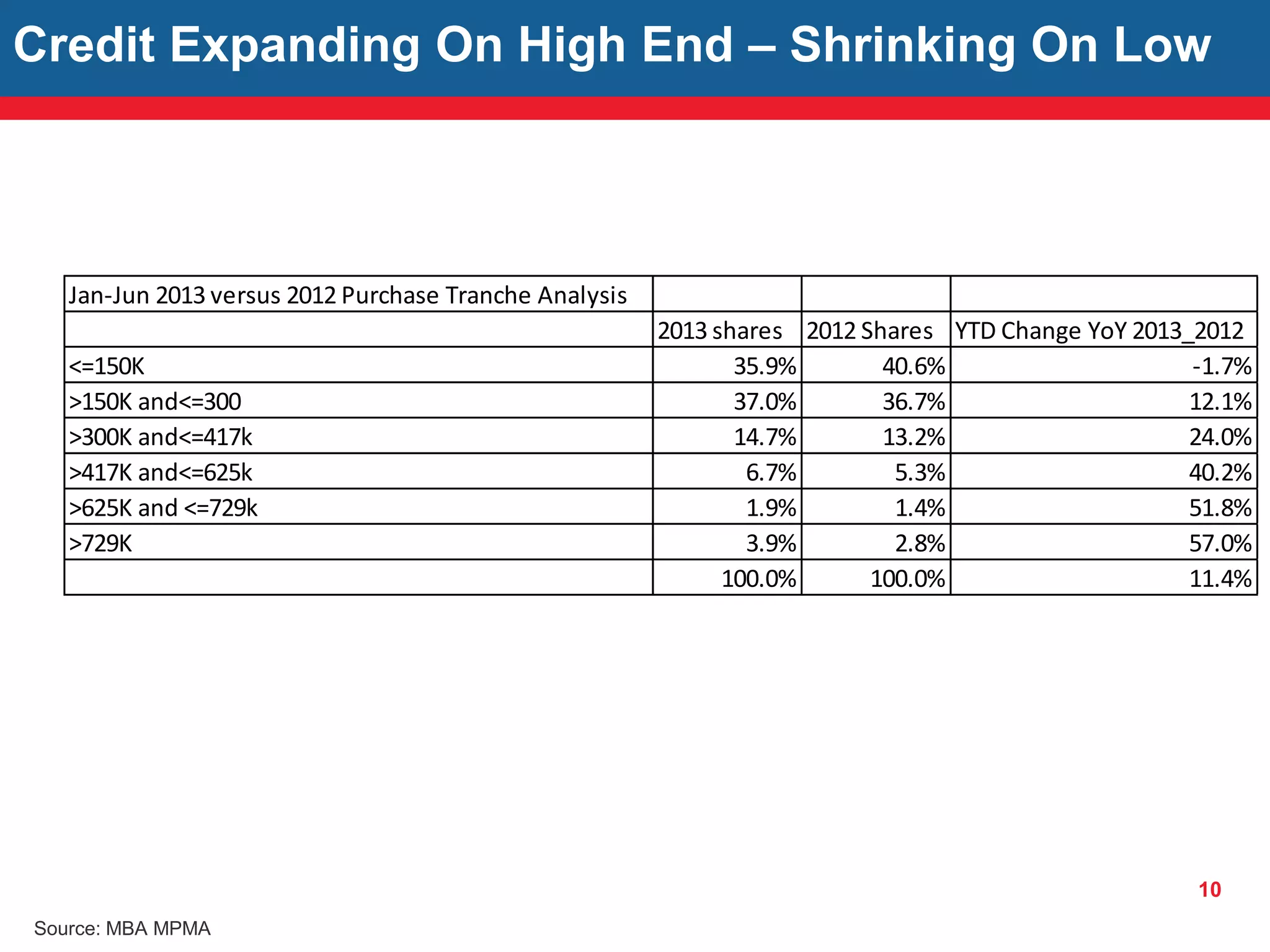

The document discusses the outlook for mortgage rates and housing market trends from 2012 to 2014, highlighting GDP growth, inflation rates, and unemployment forecasts. It emphasizes the role of minorities and foreign-born individuals in driving household growth, while noting a trend of tightening credit for lower-income buyers. The document also outlines legislative options for GSE reform, stressing the importance of proactive measures to shape the future of the mortgage finance system.