The document discusses the importance of making a will and the legal requirements for wills to be valid. Some key points:

- 65% of adults in England and Wales do not have a will, often due to ignorance of laws, superstition about death, or putting it off.

- Having a valid will ensures your wishes are followed, provides for loved ones, and avoids disputes. It allows you to appoint executors and guardians.

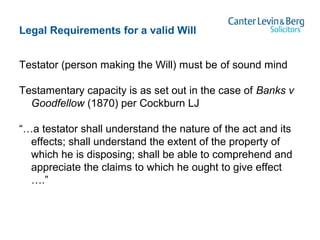

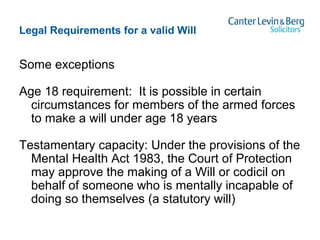

- Legal requirements for a valid will include being over 18 years old (or younger for armed forces), sound mental capacity, being in writing and signed by the testator in front of two witnesses.

- If no valid will exists, the rules of intest