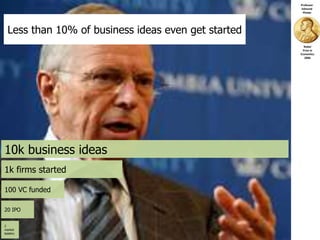

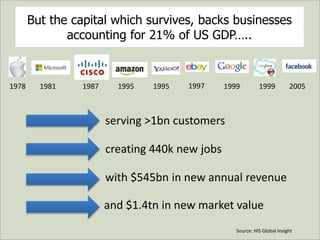

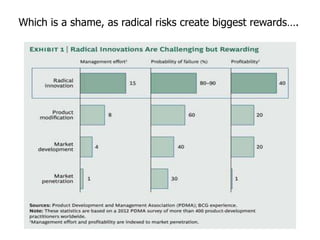

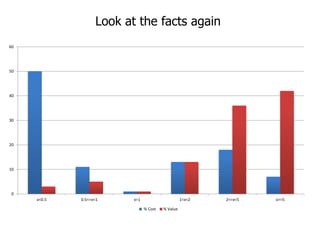

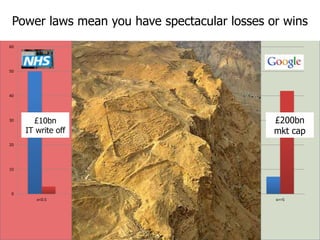

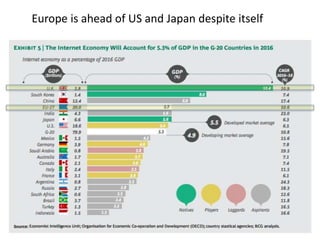

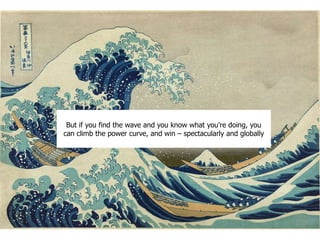

- Less than 10% of business ideas are started, and over half of venture capital investments are written off, yet the businesses that receive funding account for a large percentage of GDP and job growth.

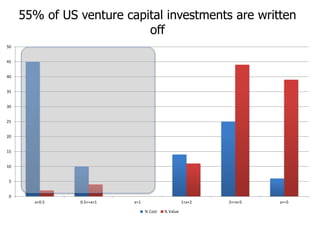

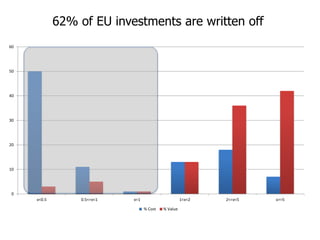

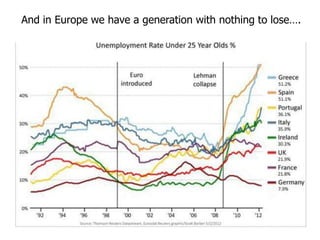

- There is a huge amount of capital available globally but it is often not allocated to more innovative, risky ideas due to a focus on low loss ratios.

- While extreme risk (62% write-off rate for venture capital) may not be for everyone, embracing more risk could unlock greater rewards and there is a large area of risk between the 2% tolerated by banks and 62% level of venture capital where more capital could be invested.