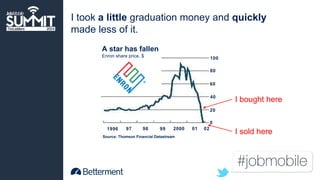

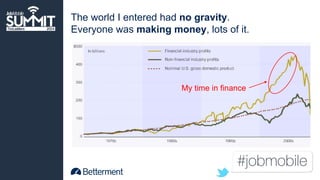

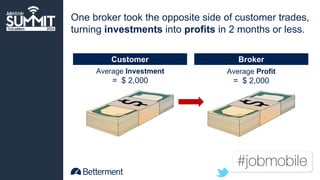

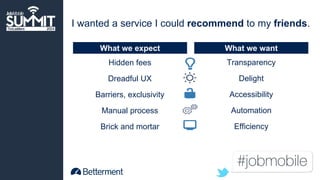

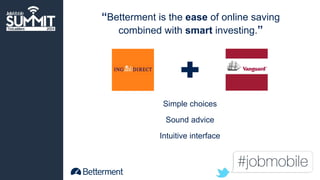

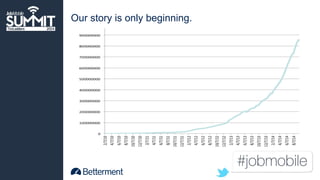

Jon Stein founded Betterment to disrupt the finance industry by creating a more transparent and customer-centric personal finance service. After studying economics and psychology, Stein realized most financial services hid fees and prioritized profits over customers. He drew upon the work of Daniel Kahneman and Richard Thaler to develop Betterment, which launched in 2010. Betterment offers automated investing, financial planning tools, and a simple interface to help users achieve financial peace of mind. The company has since grown significantly and continues innovating to better serve customers.