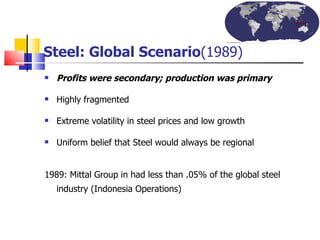

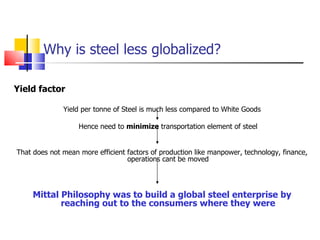

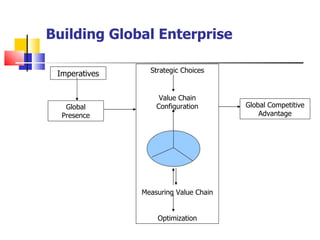

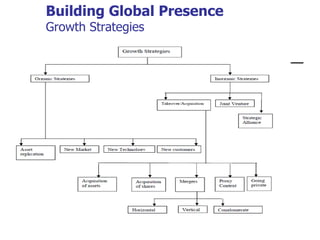

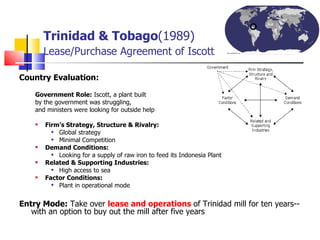

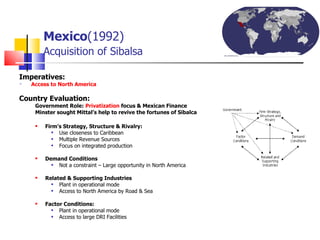

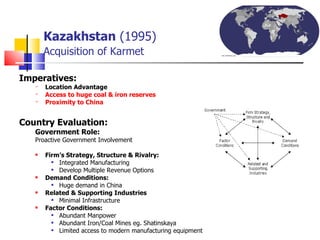

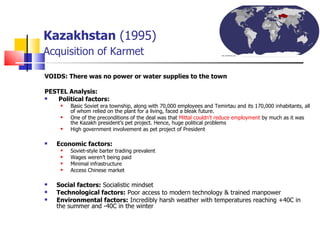

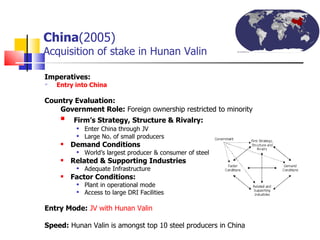

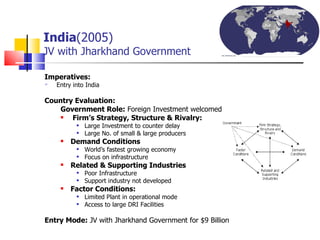

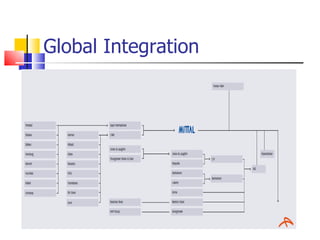

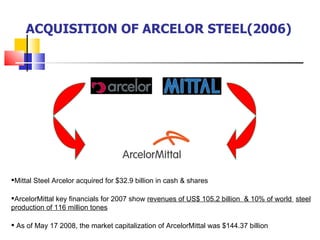

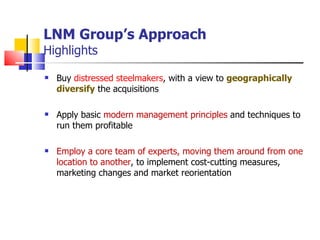

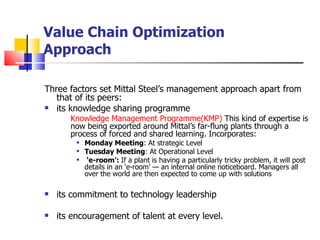

The document provides a detailed overview of the Mittal Group's evolution and growth strategies in the steel industry, highlighting significant acquisitions and strategic choices made since 1989. It examines factors influencing the global steel market, such as local responsiveness, global integration, and operational efficiencies, particularly through partnerships and acquisitions in various countries. The analysis underscores Mittal’s commitment to technology, knowledge sharing, and creating a global competitive advantage while navigating challenges in diverse economic and political environments.