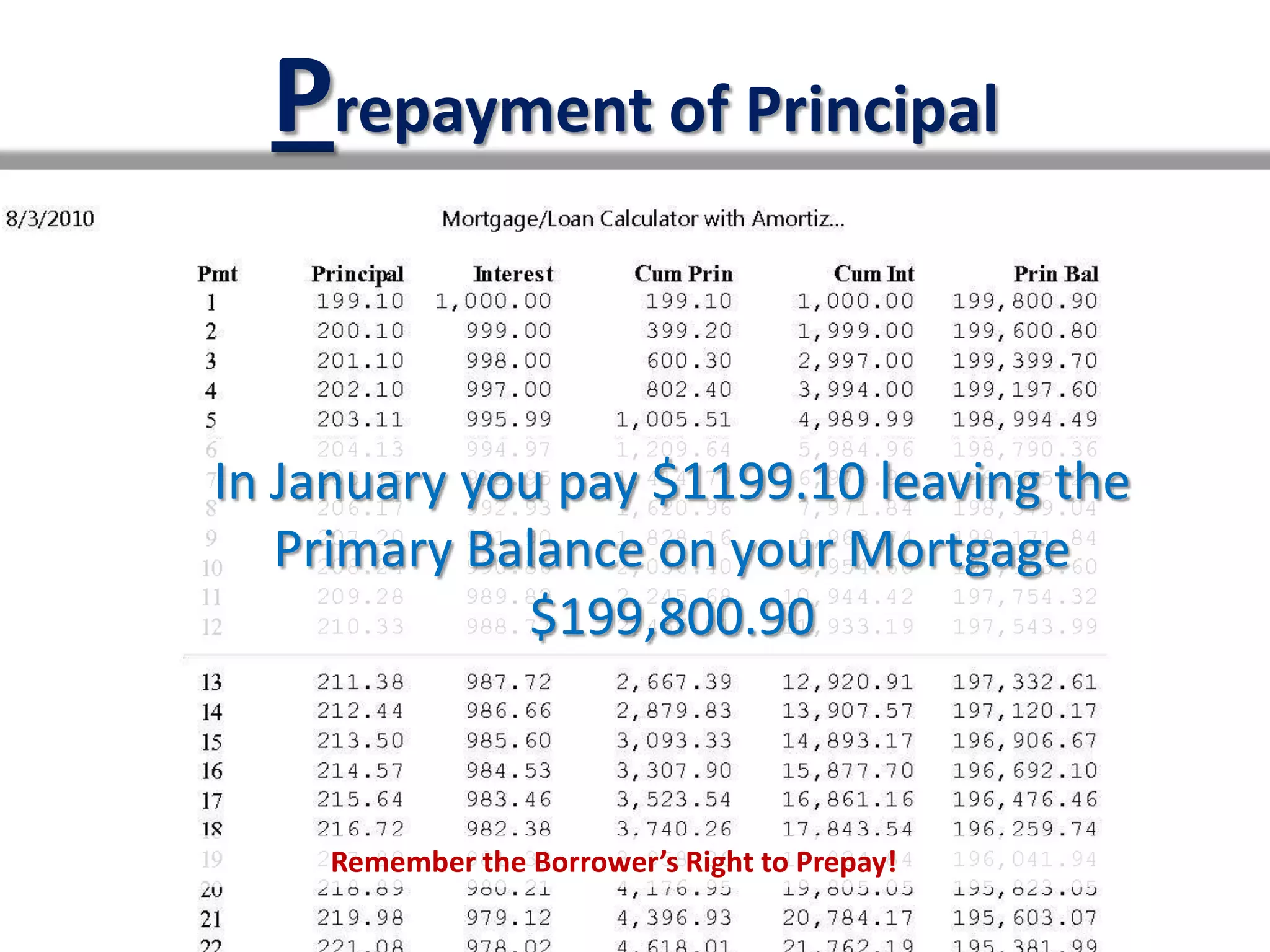

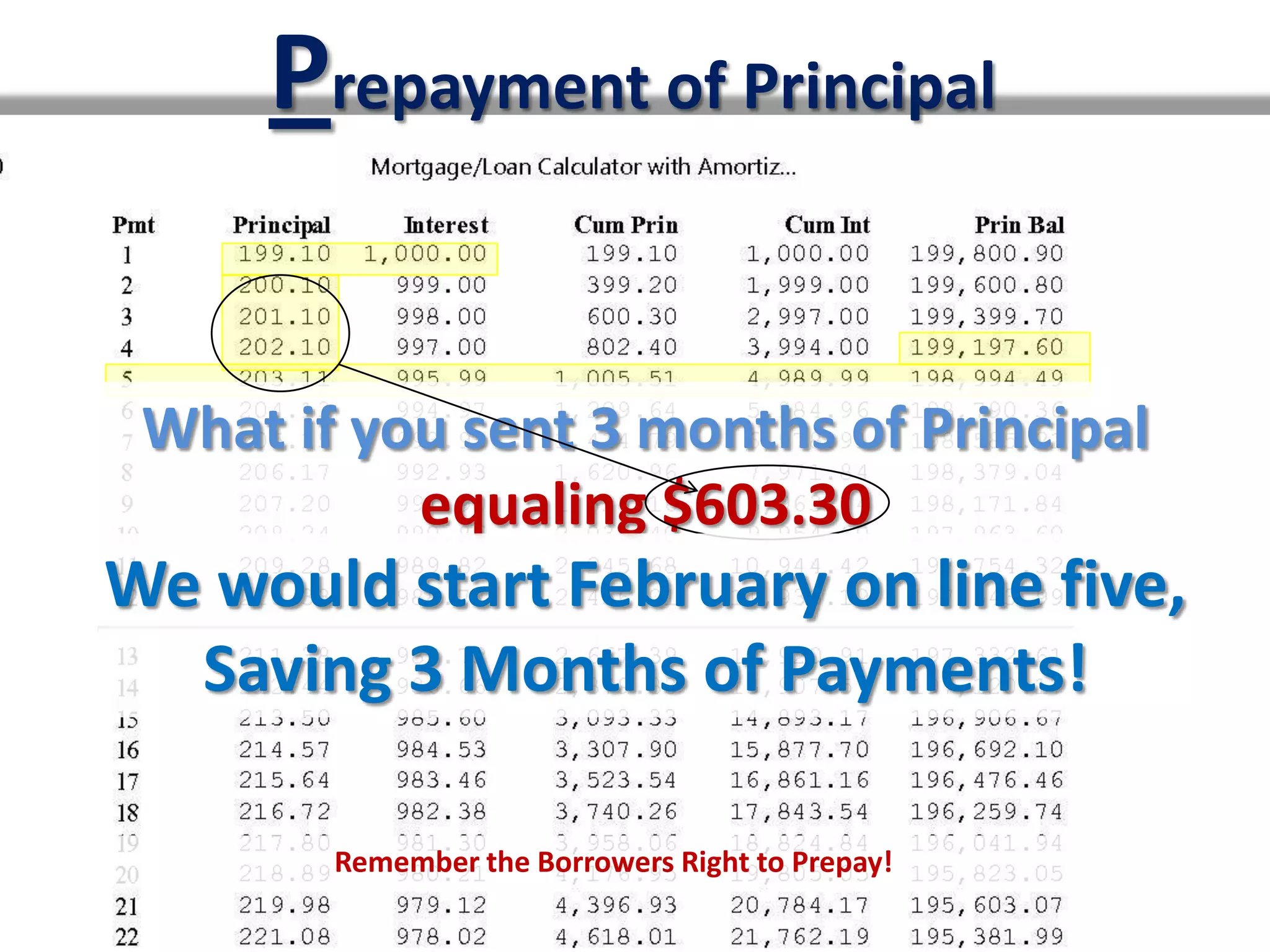

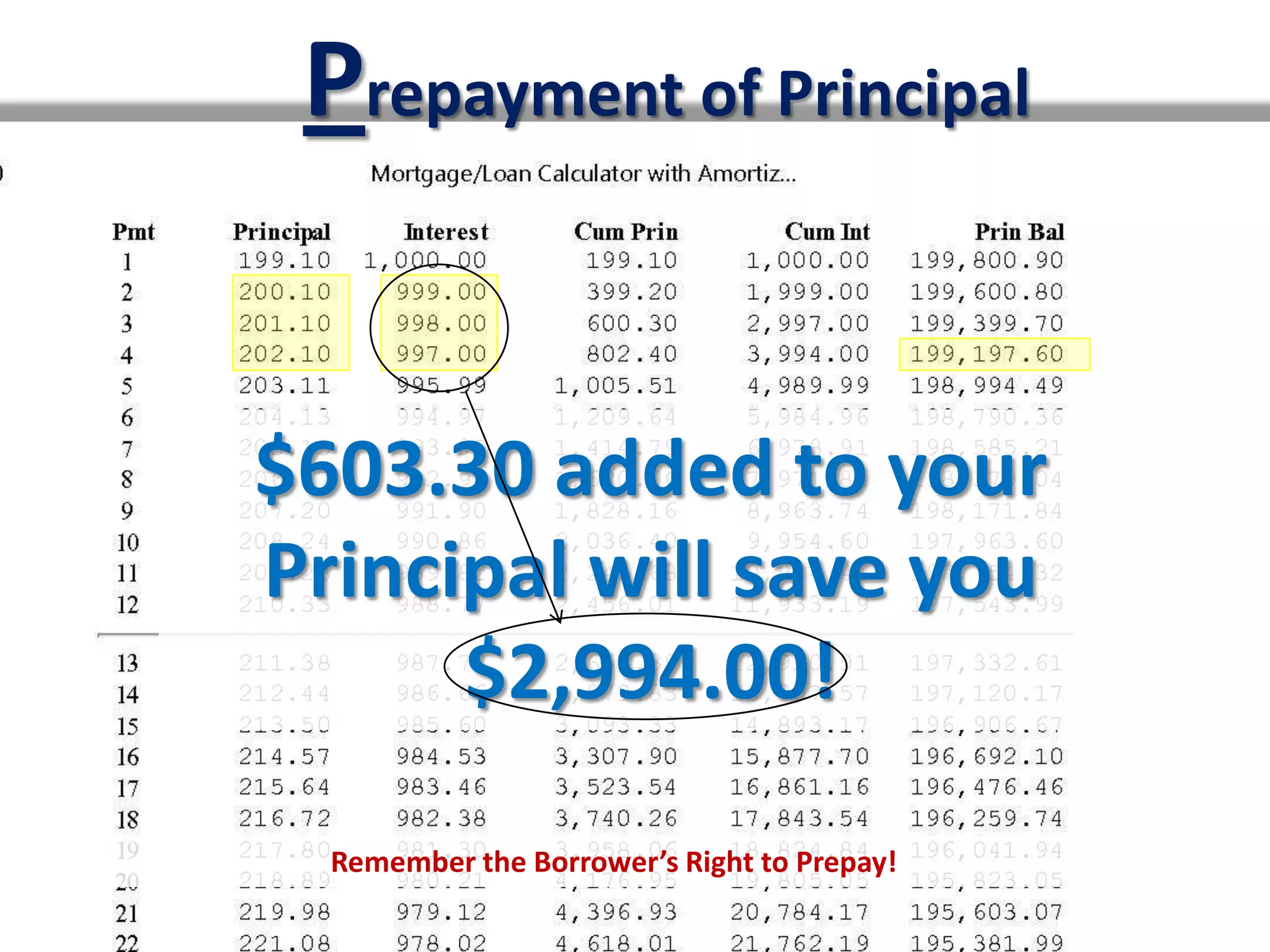

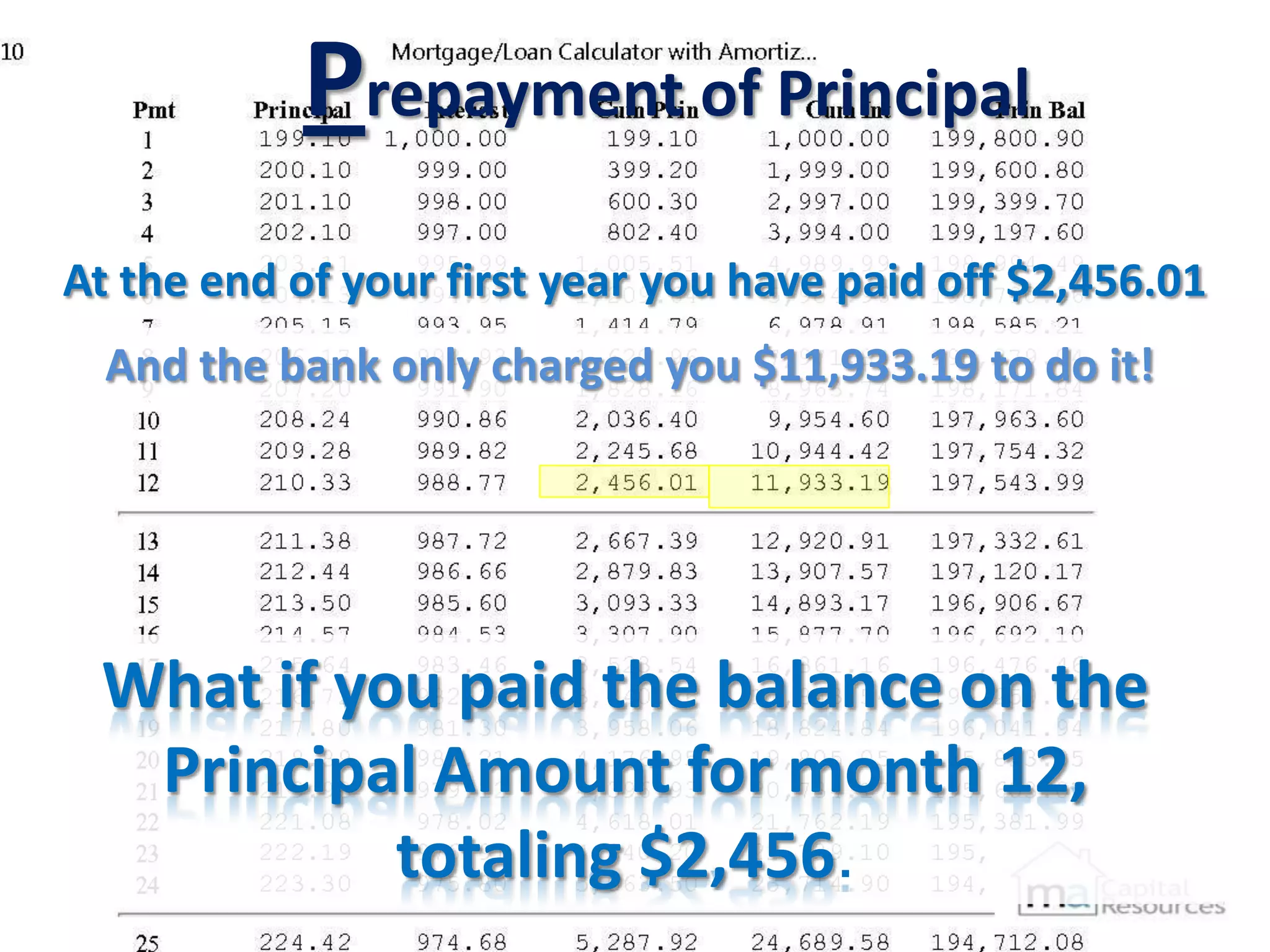

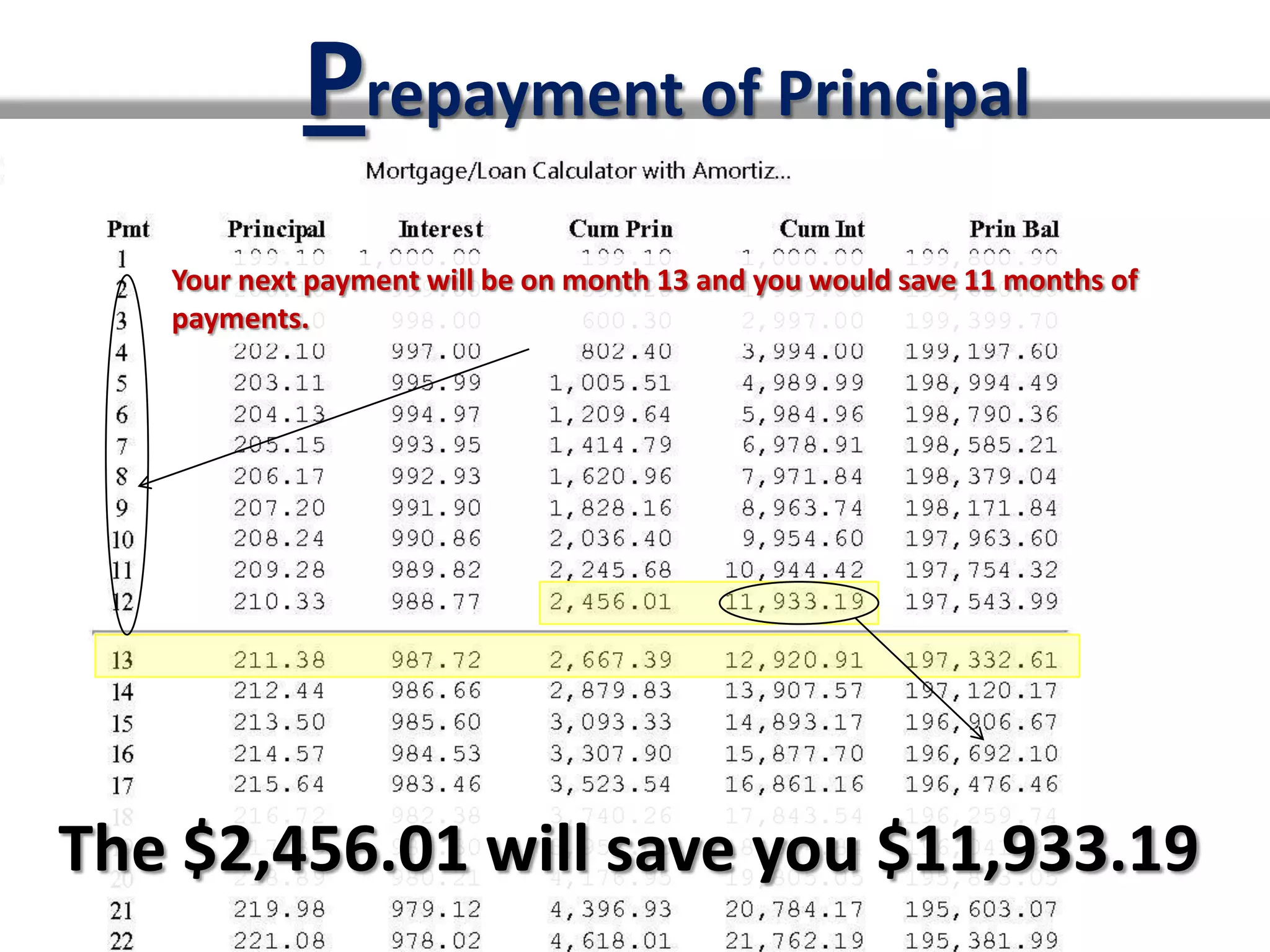

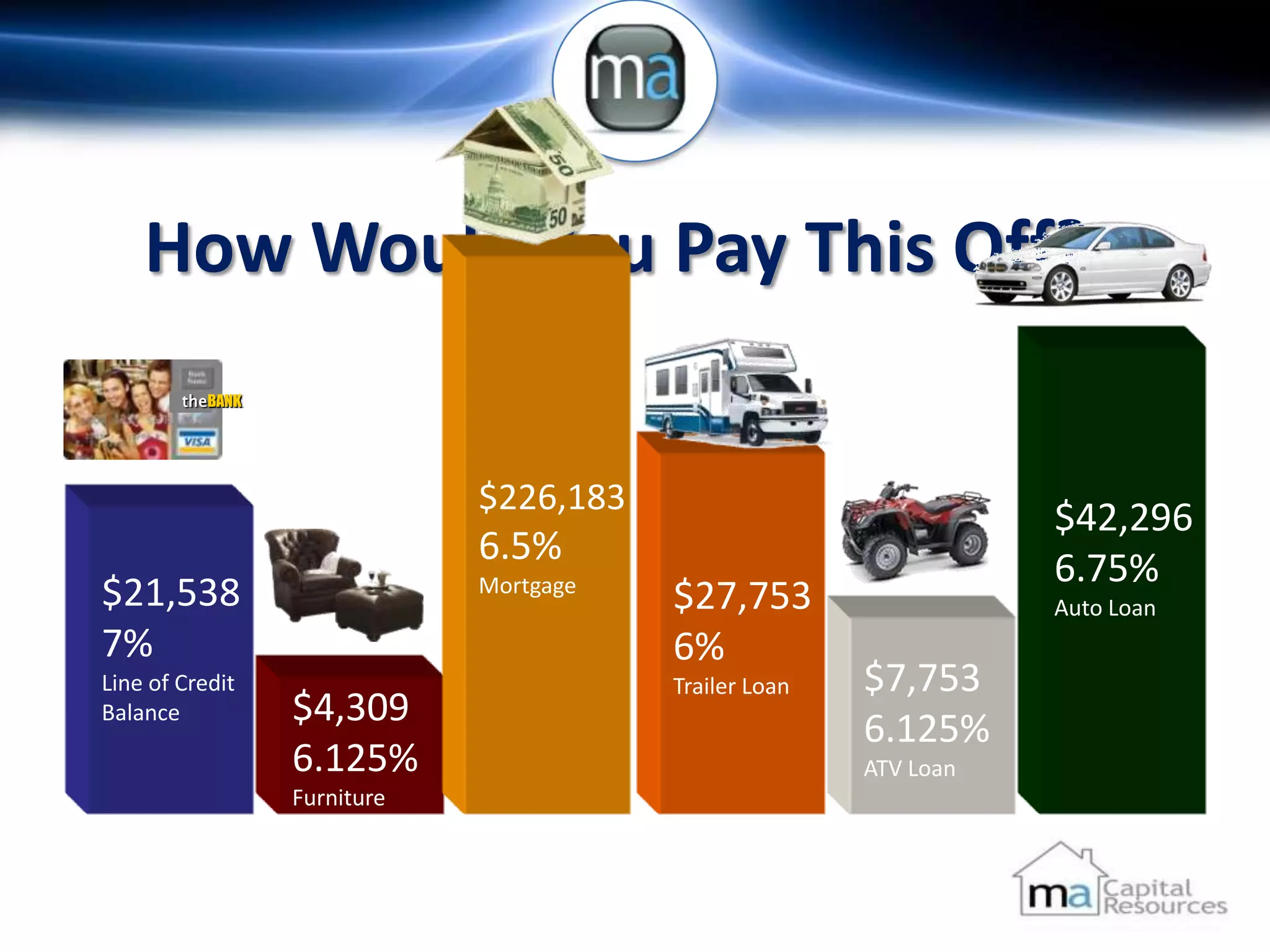

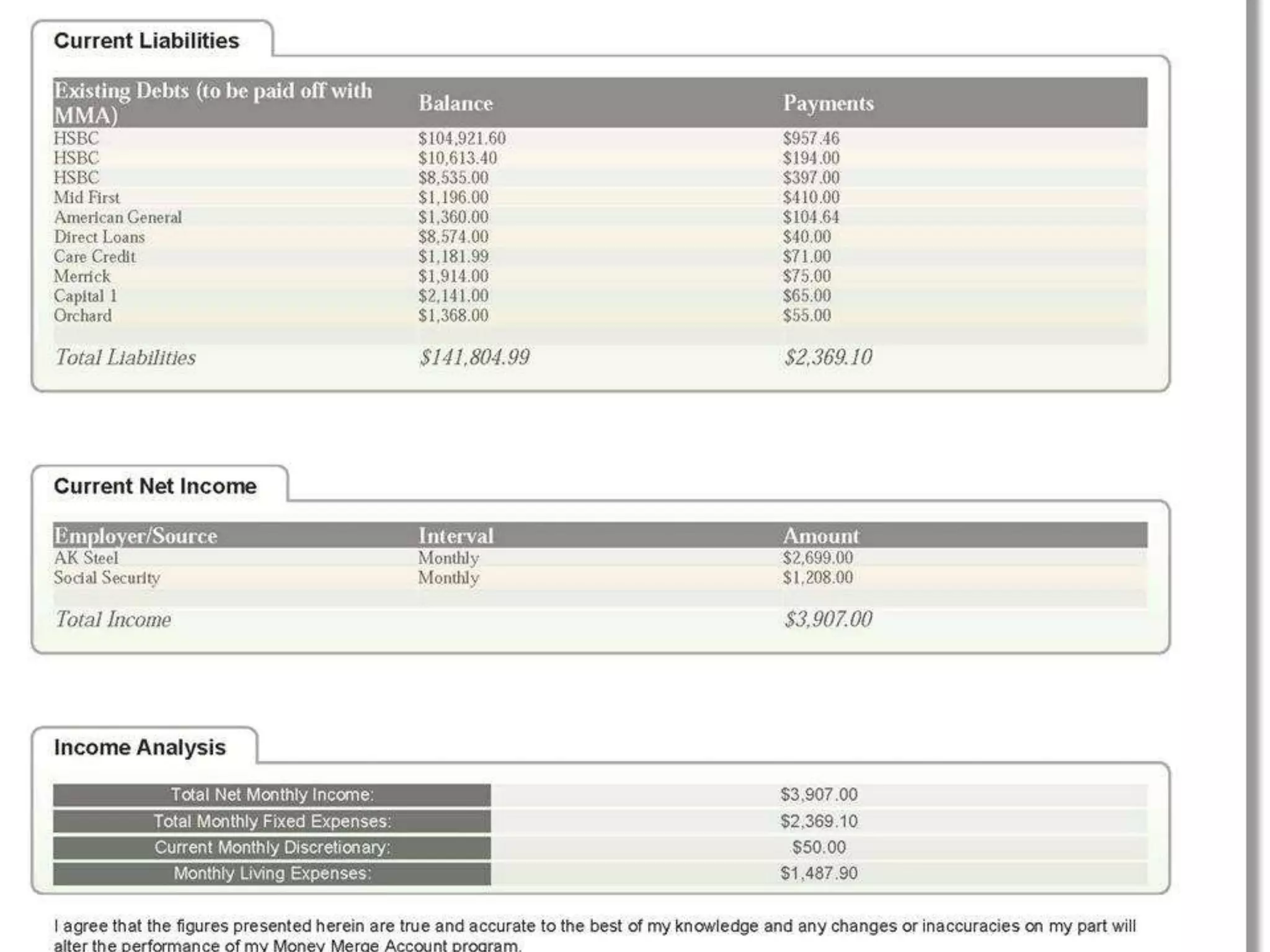

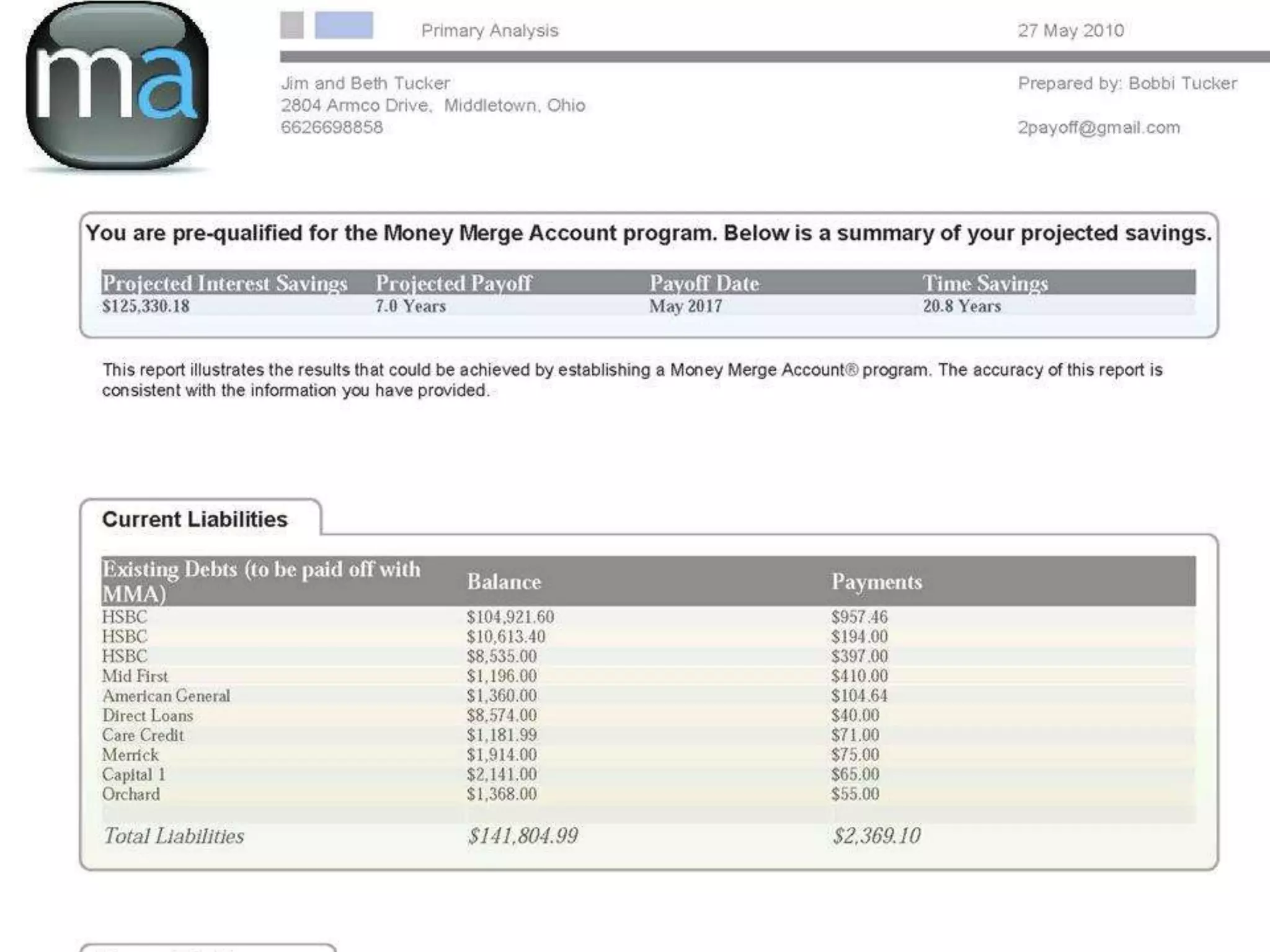

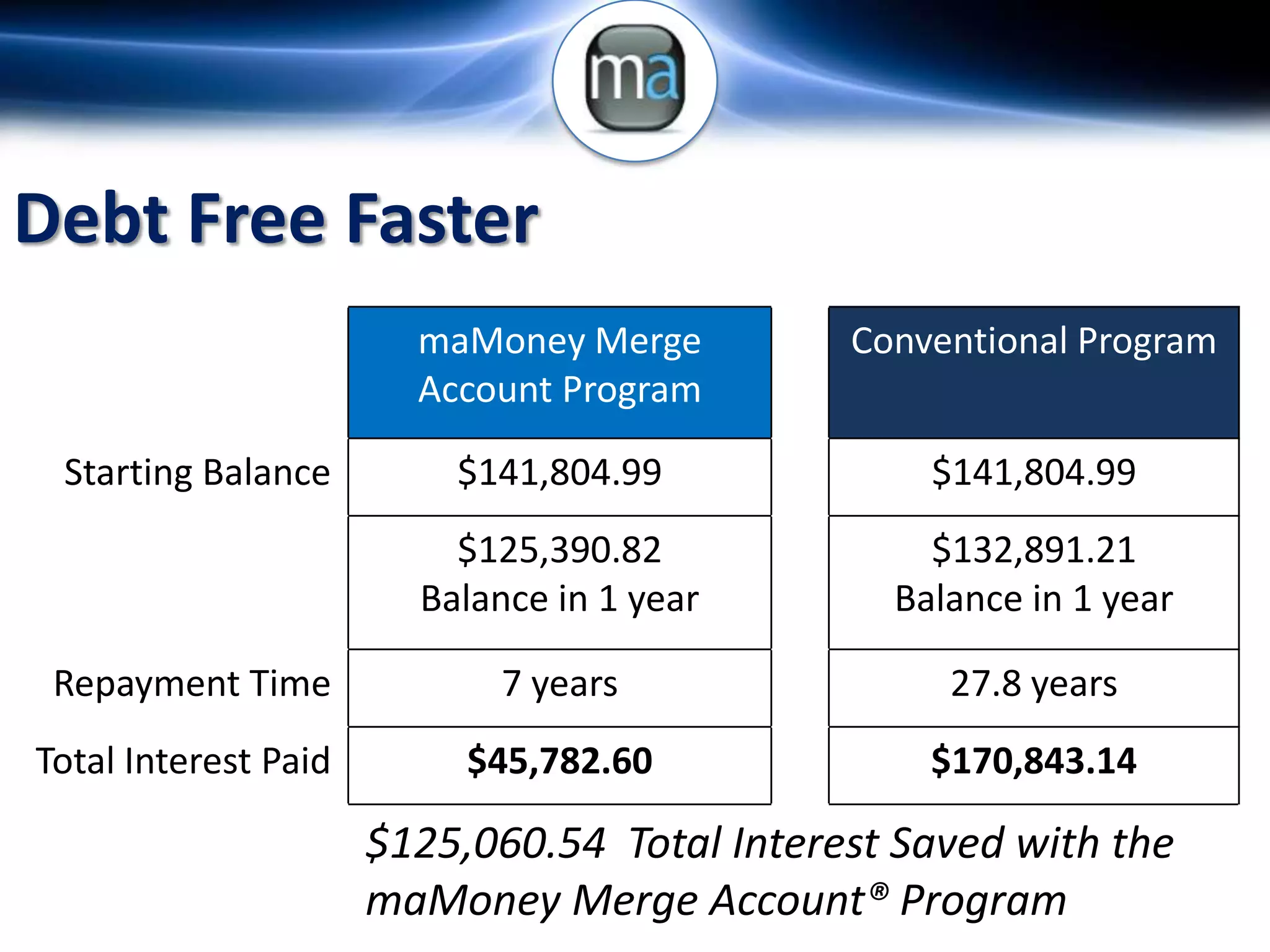

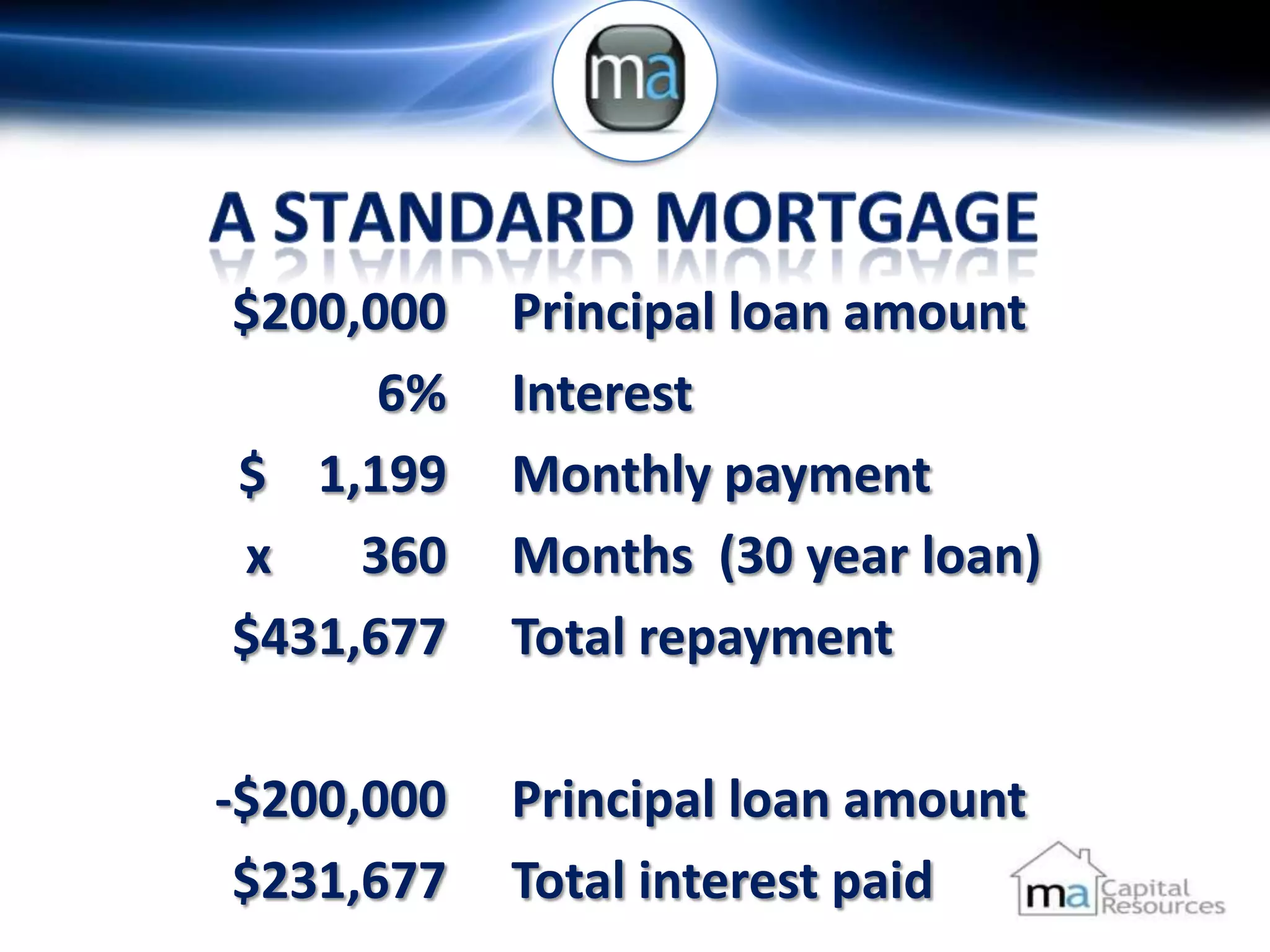

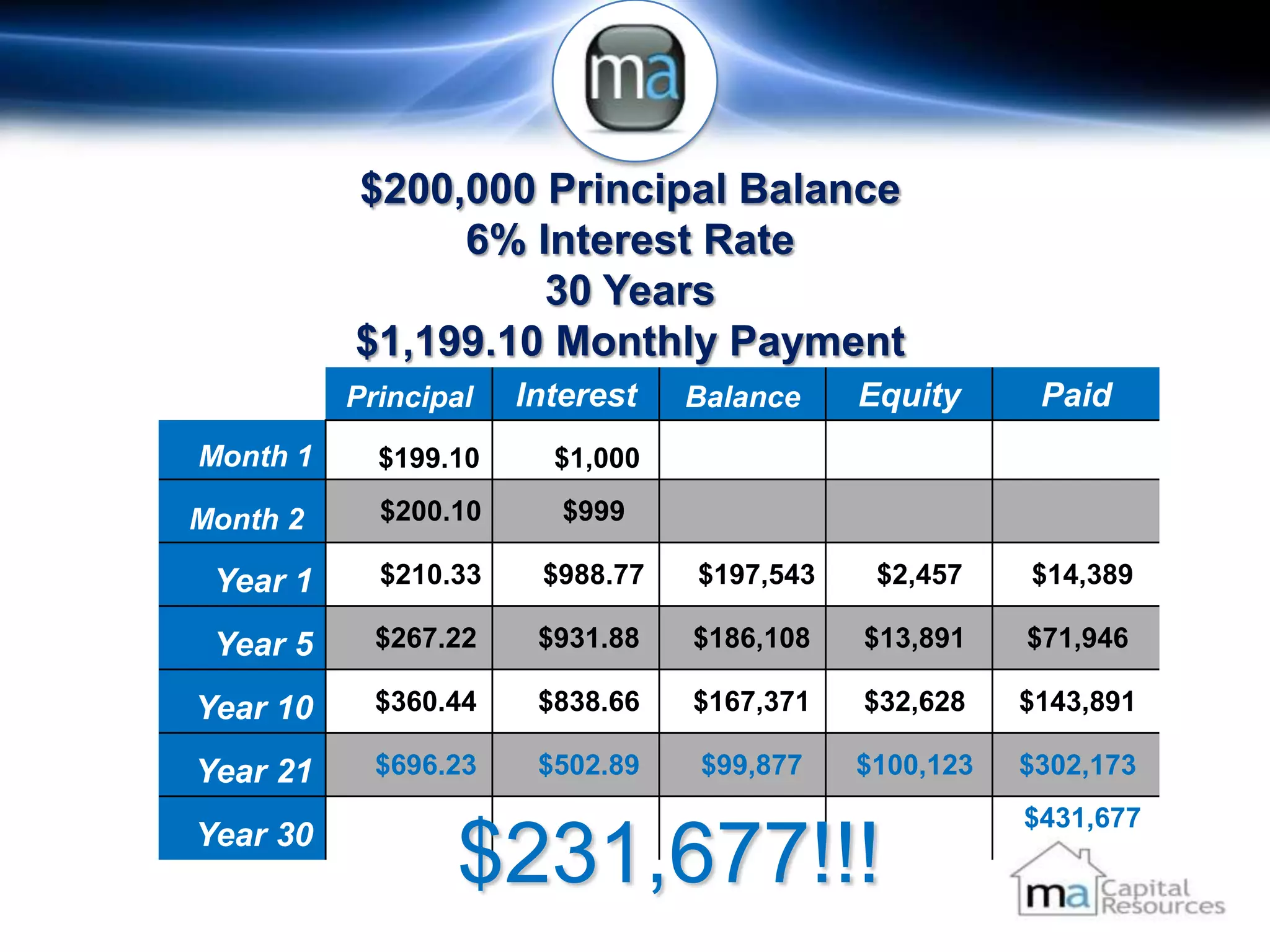

This document discusses compound interest over the course of a 30-year mortgage. It shows the breakdown of principal, interest, and balance owed monthly and yearly. It illustrates that with a $200,000 loan at 6% interest, the total repayment would be $431,677, with $231,677 of that being interest paid. The document notes that compound interest, also called the "eighth wonder of the world," can significantly increase the total cost of loans over time if interest is allowed to compound. It emphasizes the importance of making prepayments or paying off principal early to reduce the total interest paid over the life of the loan.

![Called Compound Interest:

“The 8th wonder of the World”

Equation to Compound Interest

P=L[c(1+c)n] / [(1+c)n-1]

There are two types

of people in this

world: those who

pay interest, those

Albert Einstein

who earn interest.](https://image.slidesharecdn.com/macapitalresourcespresentation-13458540568508-phpapp01-120824192123-phpapp01/75/Ma-Capital-Resources-Presentation-7-2048.jpg)