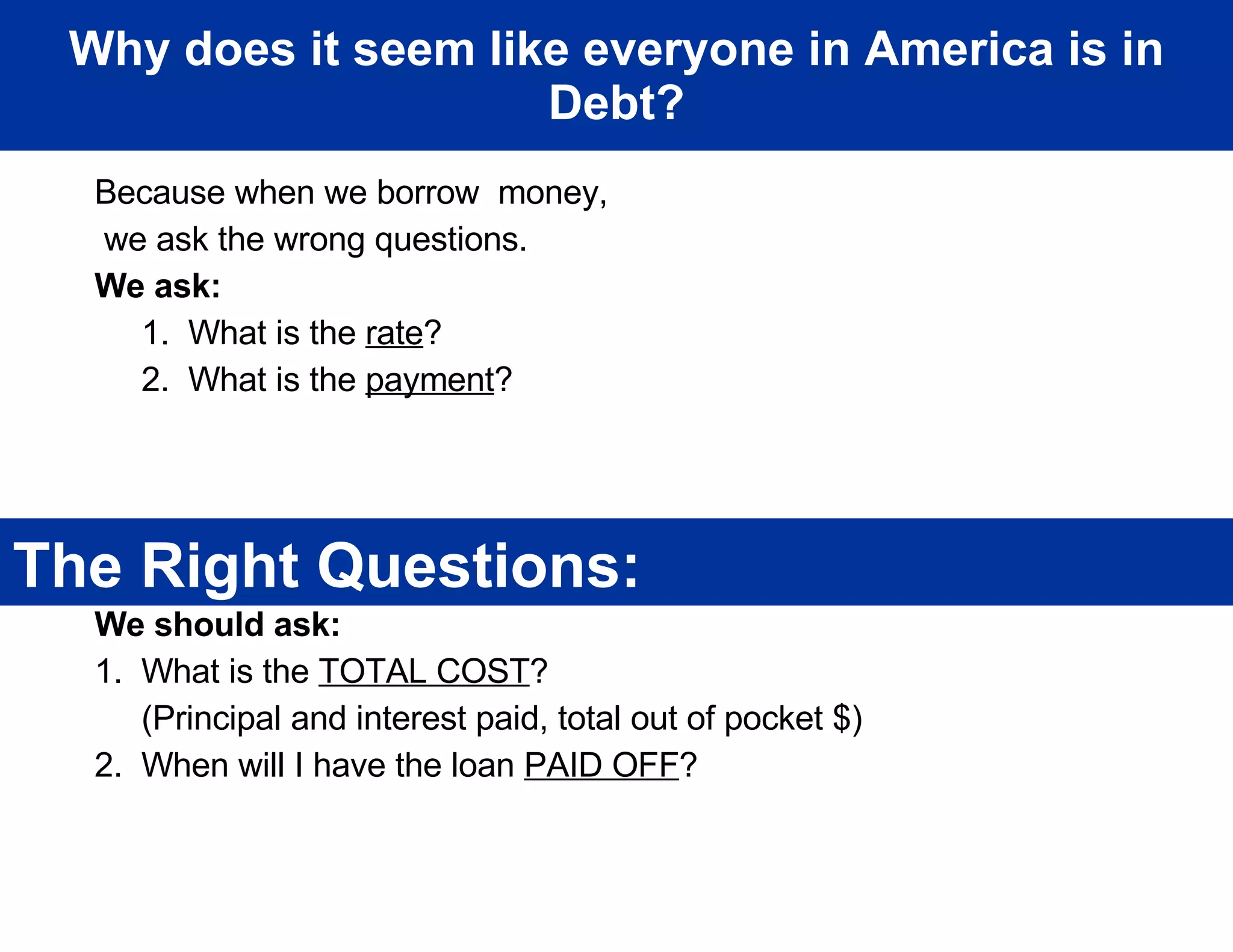

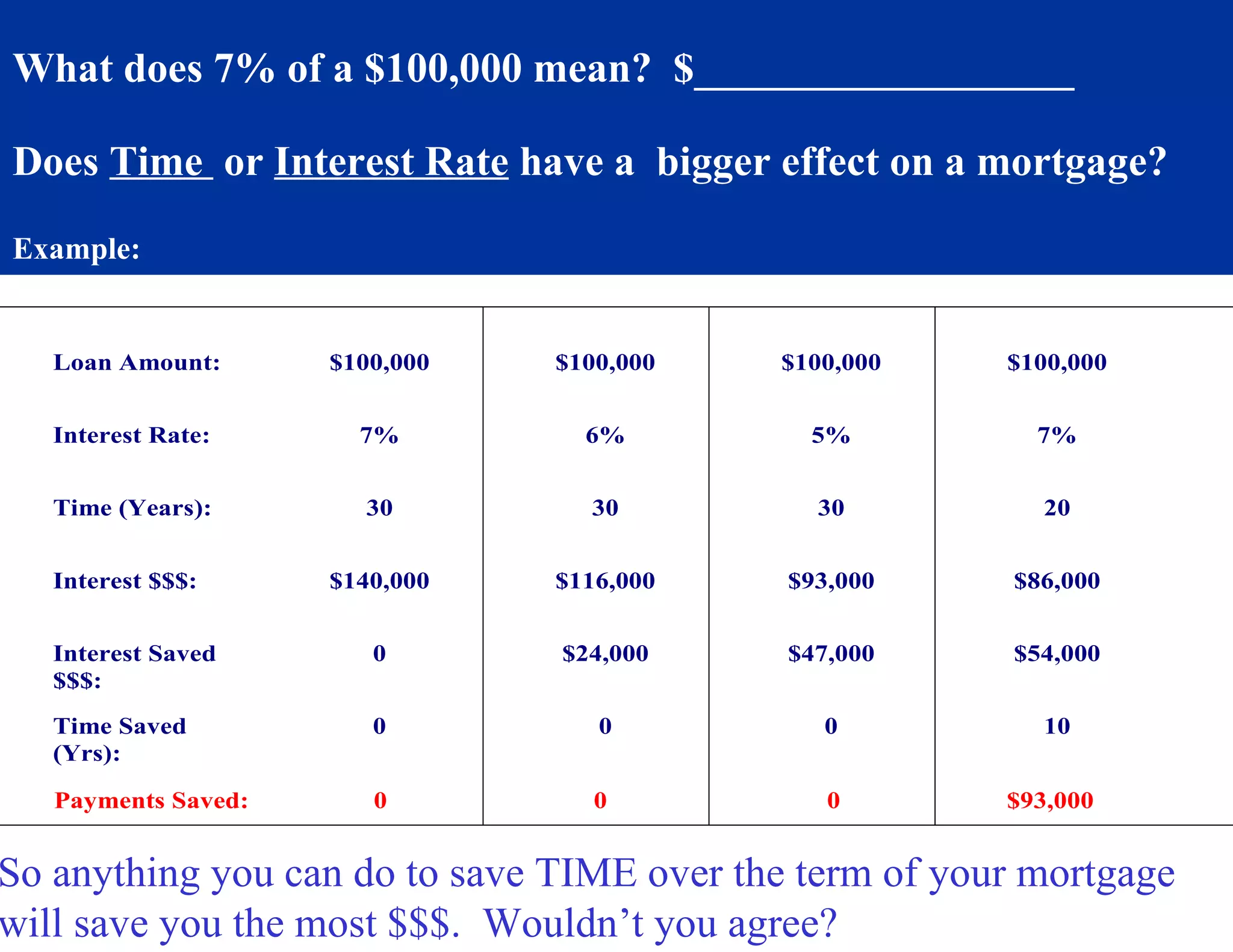

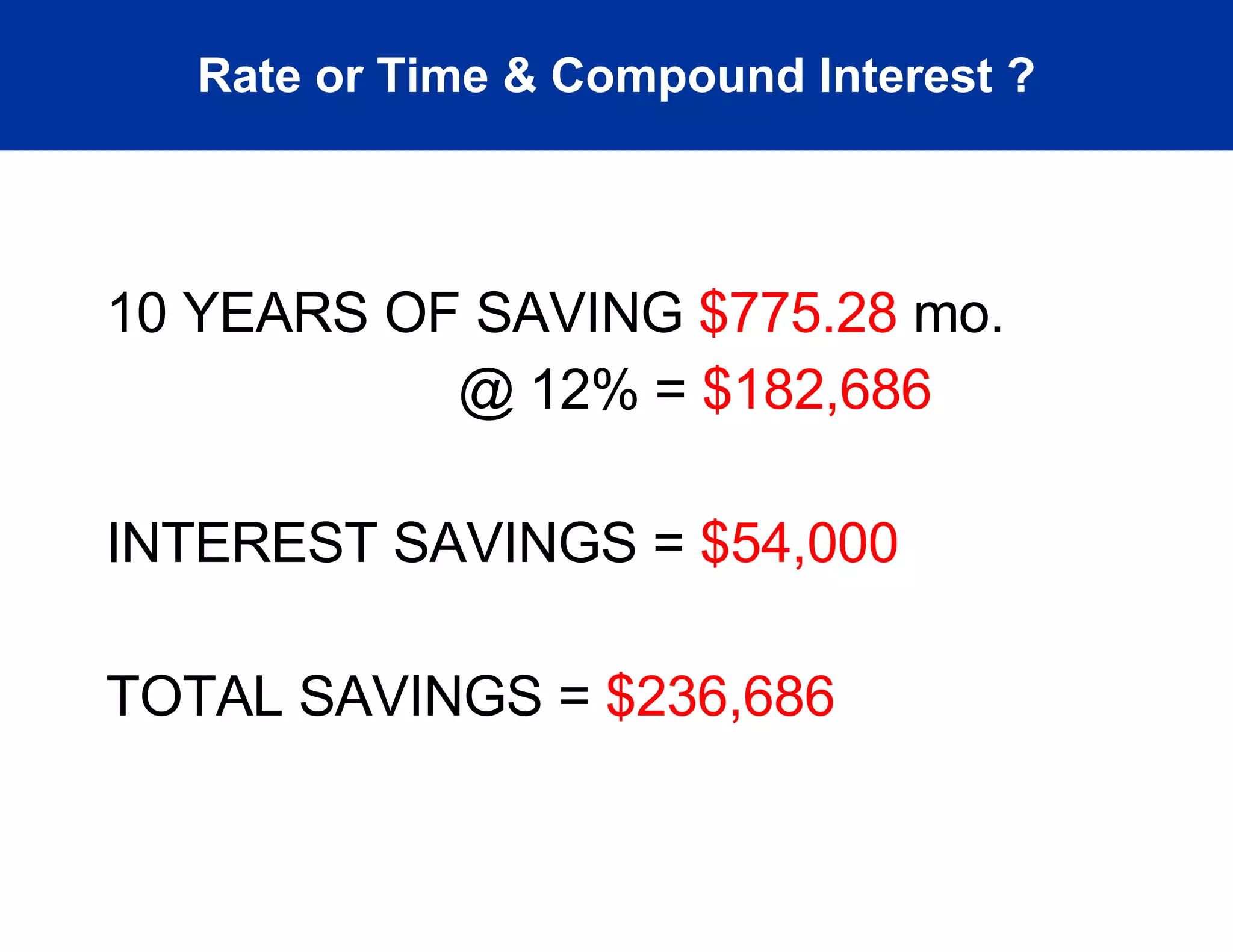

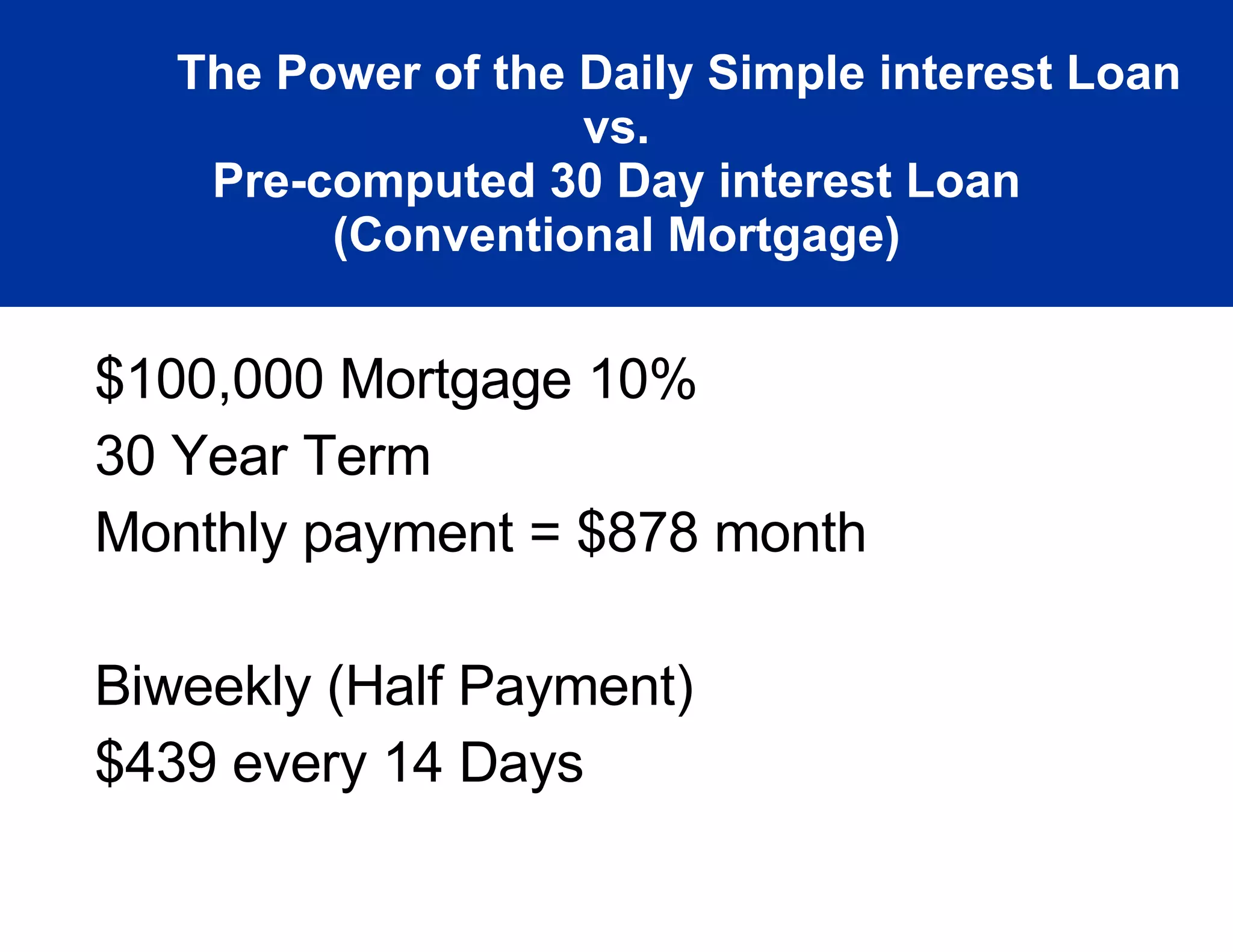

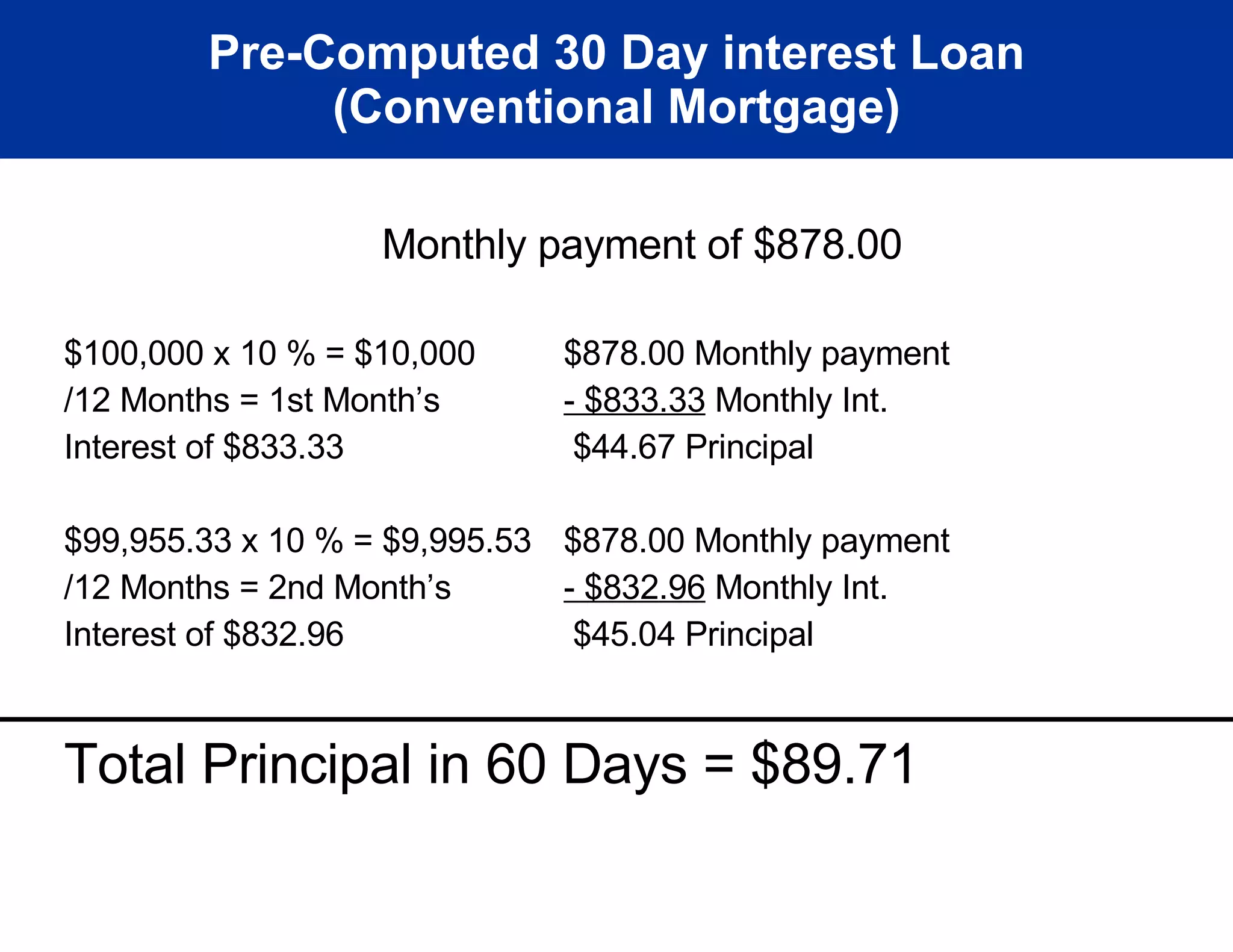

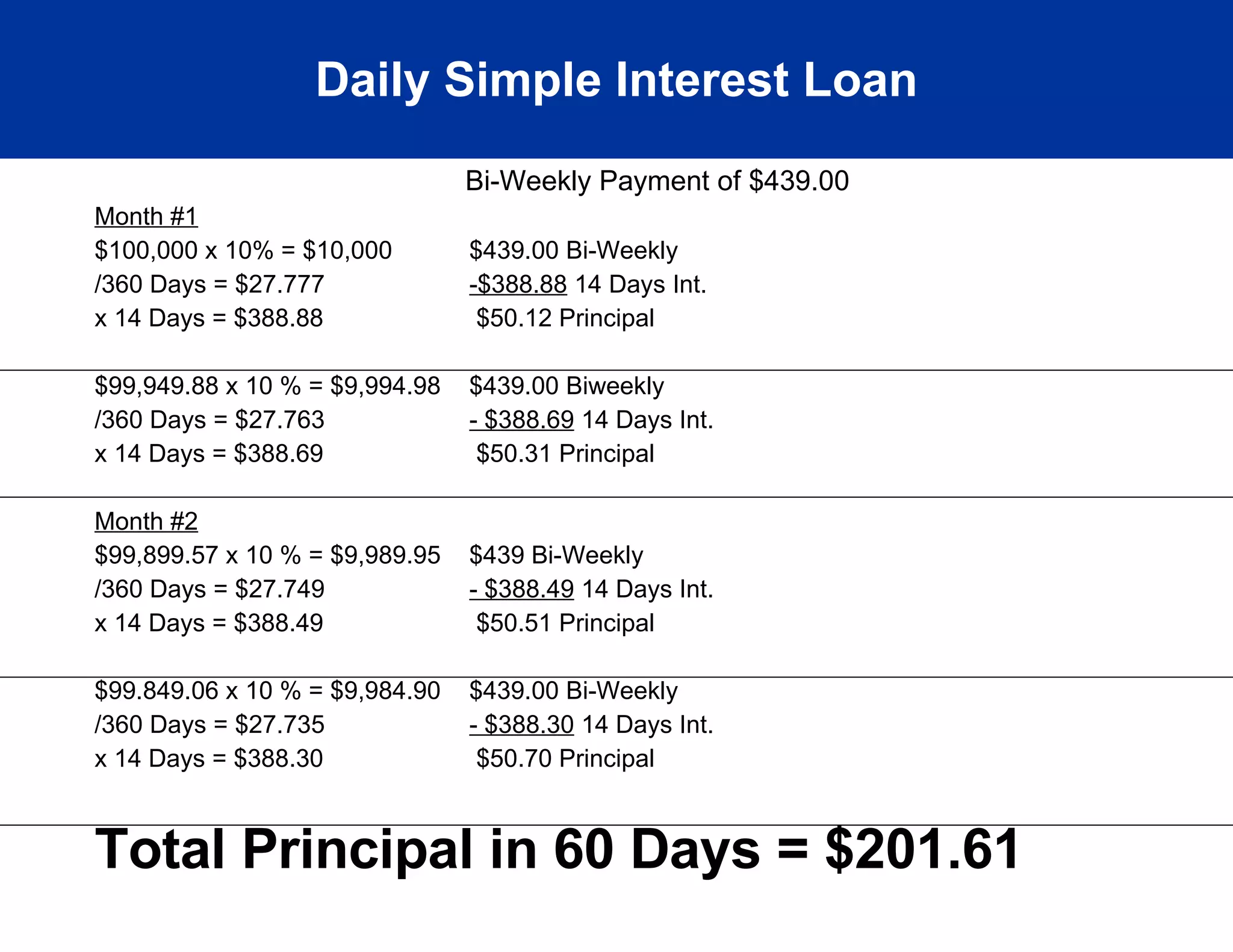

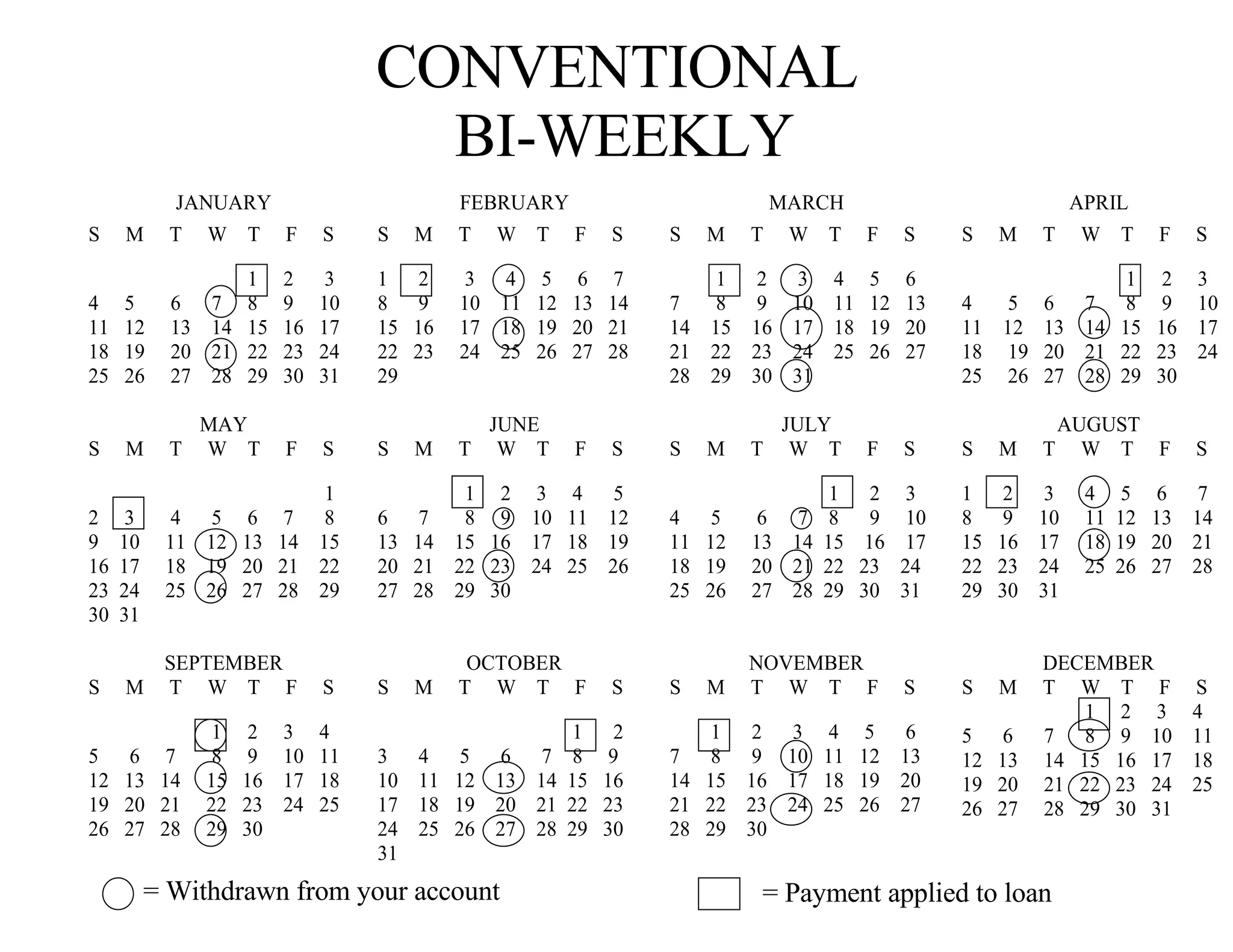

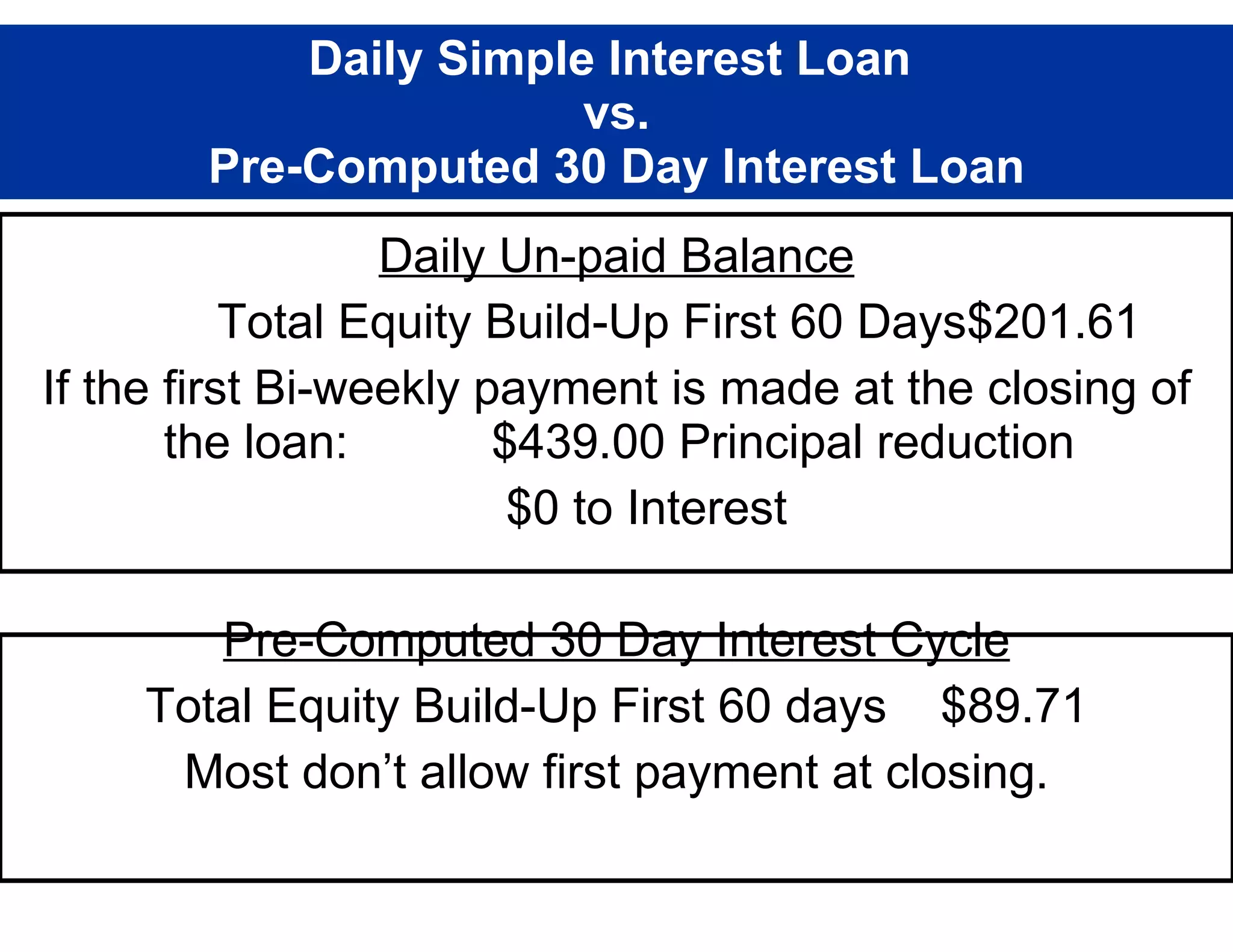

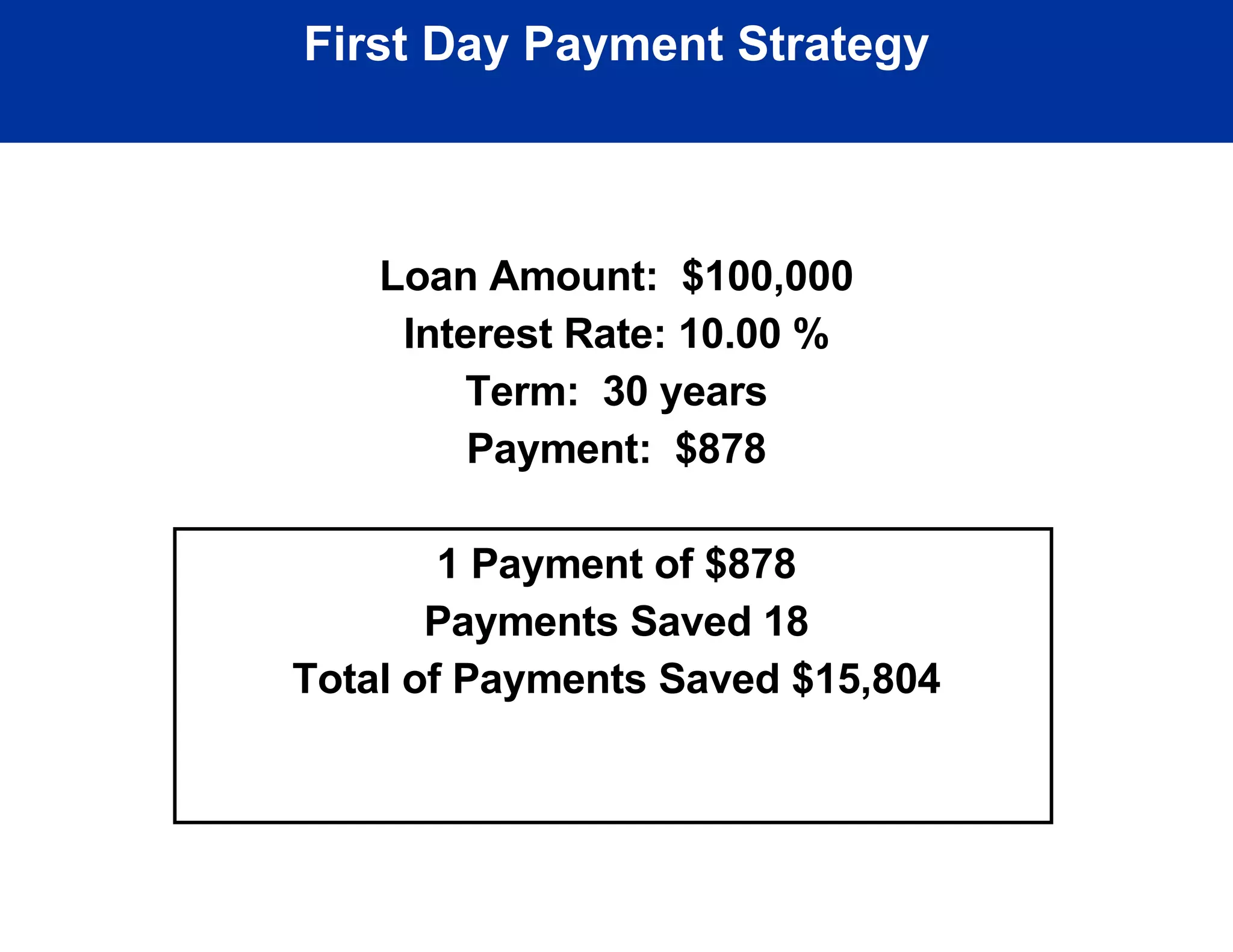

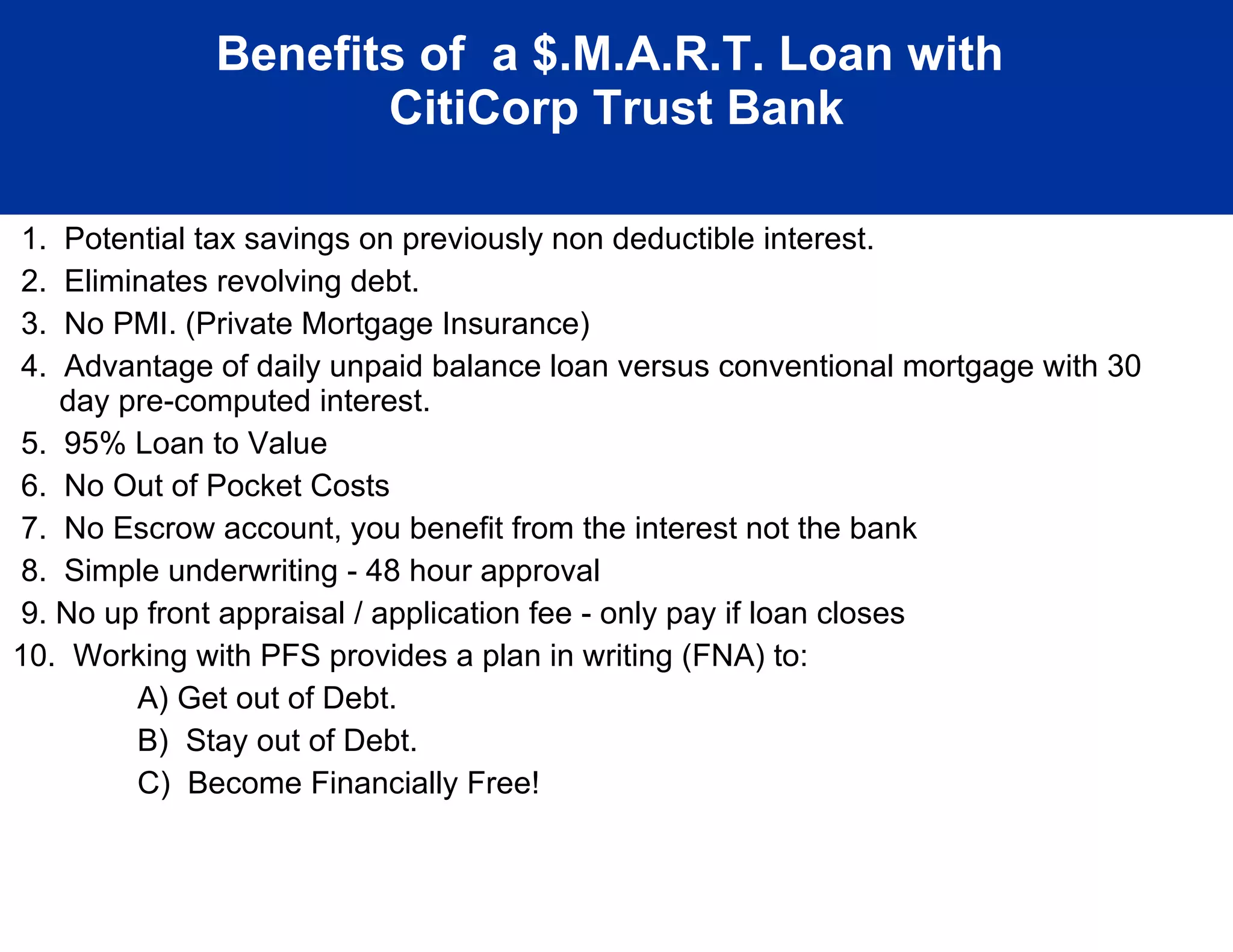

The document discusses the importance of asking the right questions when taking out loans, specifically focusing on the total cost and payoff time rather than just the interest rate or monthly payment. It provides an example showing how paying extra toward the principal can save tens of thousands in interest costs over the lifetime of a 30-year mortgage. The document also compares conventional mortgages that use pre-computed 30-day interest against daily simple interest loans, showing how the latter option reduces costs and builds equity faster in the early years of the loan.