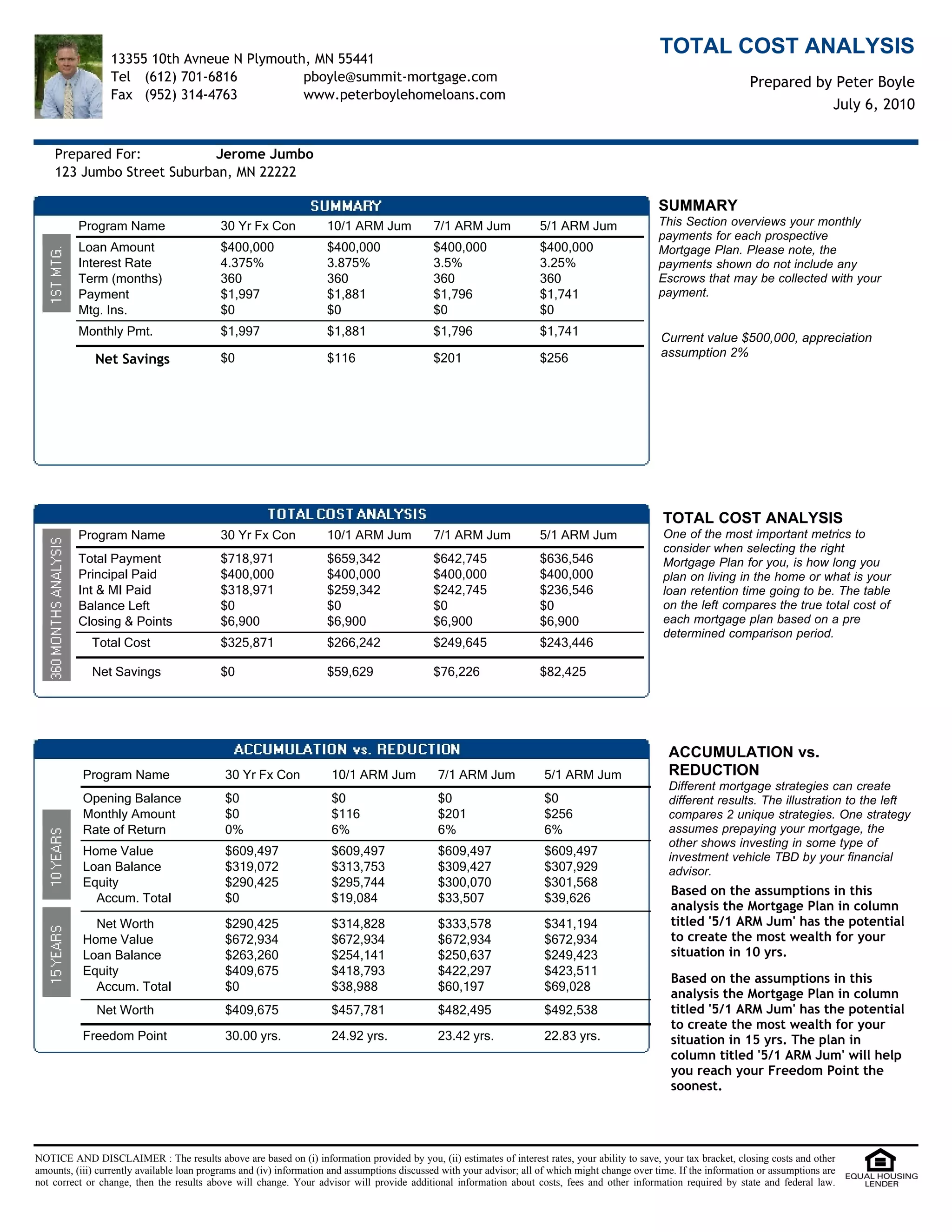

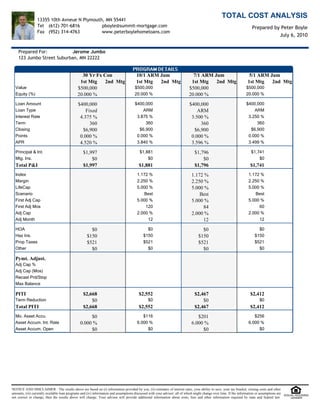

This document provides a total cost analysis for Jerome Jumbo comparing four different mortgage plans: a 30-year fixed rate conforming loan, a 10/1 ARM Jumbo loan, a 7/1 ARM Jumbo loan, and a 5/1 ARM Jumbo loan. The analysis shows monthly payments, total costs including interest and principal paid over time, accumulation of equity and net worth over 10 and 15 years, and the "Freedom Point" of being debt free for each plan. The 5/1 ARM Jumbo loan results in the lowest total costs and allows Jerome to reach his Freedom Point the soonest.