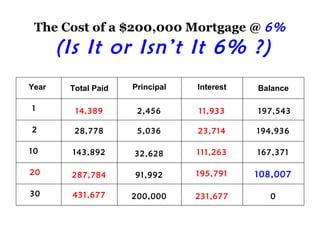

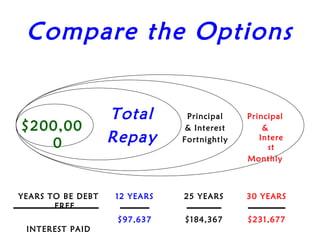

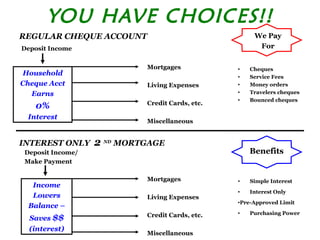

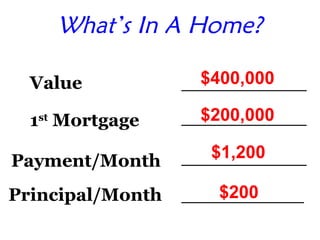

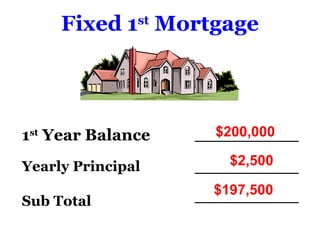

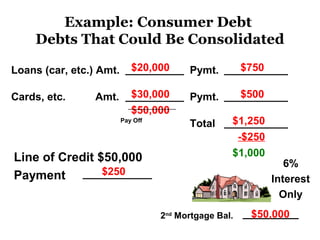

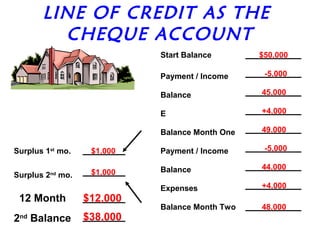

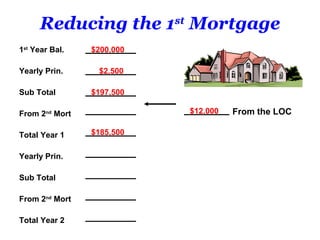

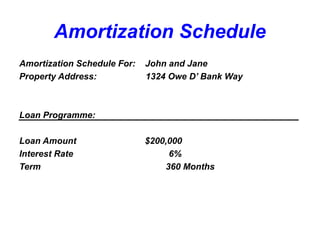

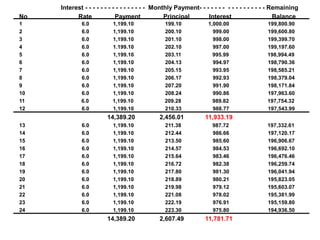

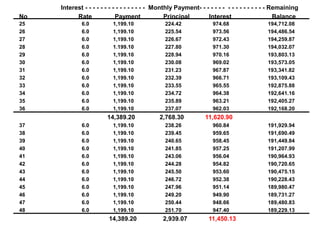

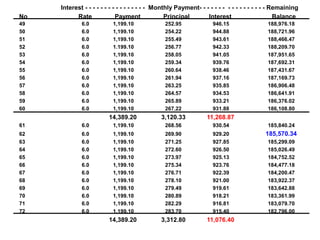

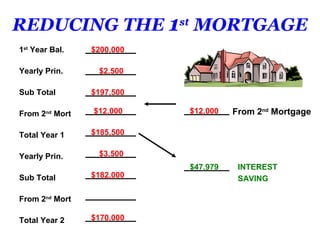

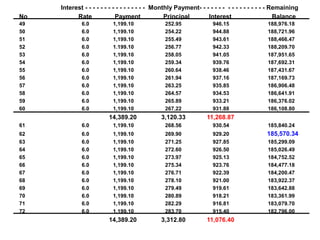

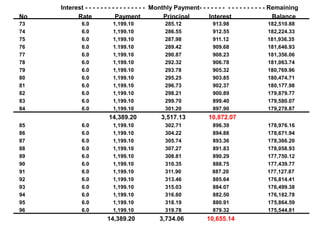

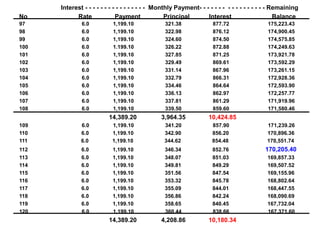

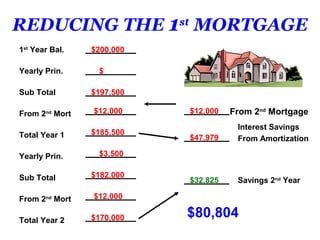

This document discusses options for paying off a mortgage more quickly. It shows that on average, clients can pay off a 30-year mortgage in 8-14 years by making additional principal payments without increasing their monthly payments. It also compares the total interest paid over 12, 25, and 30 years for a $200,000 mortgage. Finally, it provides an example of using a line of credit as a checking account to funnel extra income towards the principal each month.

![MORT – GAGE

Pledge Until Death!

mort·gage (mōŕgij) n. [[ OFr – mort, dead

+ gage, pledge]]

1 to pledge (property) by a mortgage

2 to put an advance claim on / to

mortgage one’s future/](https://image.slidesharecdn.com/seminar-120926155940-phpapp01/85/TOTAL-REPAY-6-320.jpg)