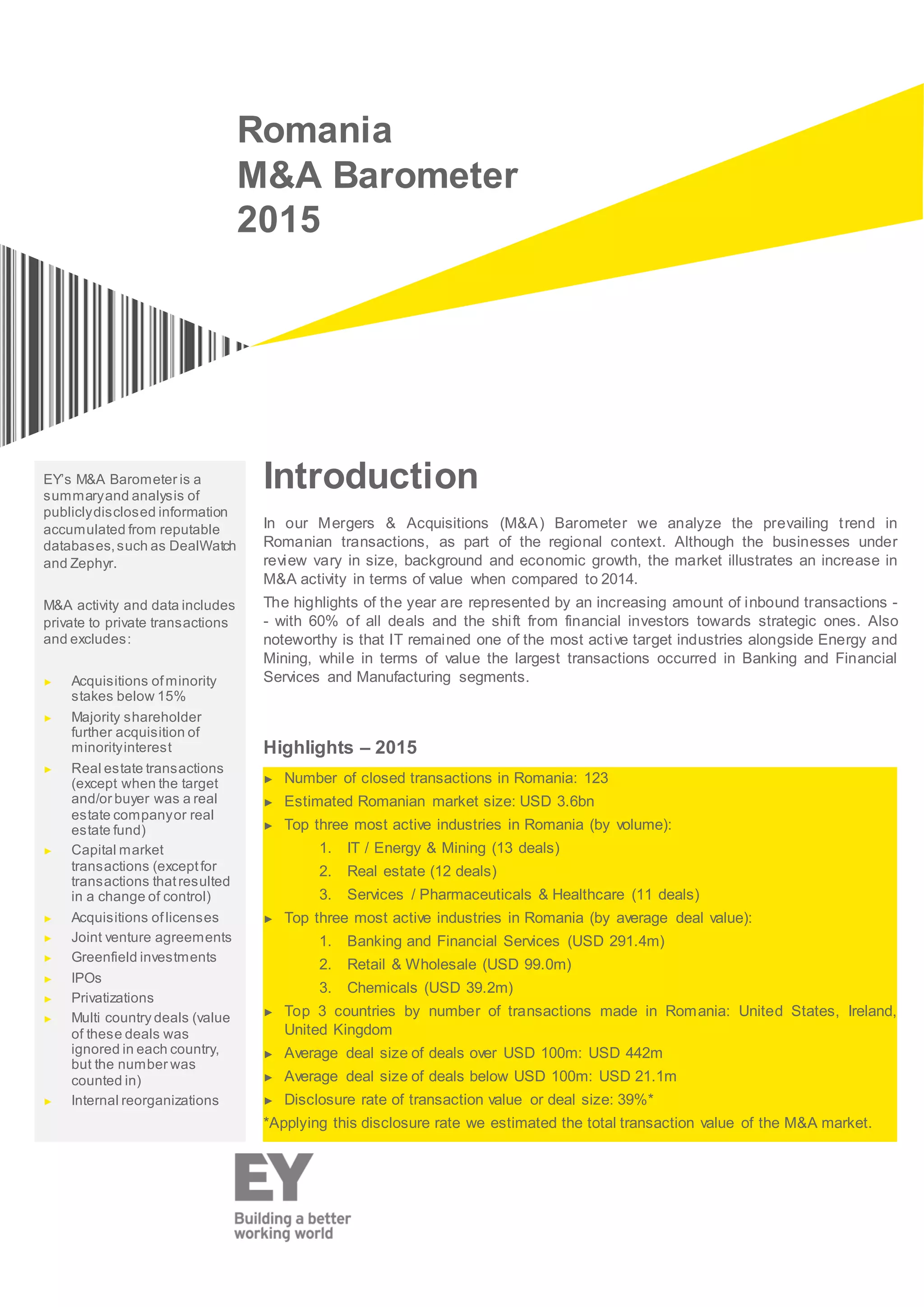

This document summarizes M&A activity in Romania in 2015. It finds that the number of closed transactions increased to 123 from 66 in 2014. The estimated market size grew 22% to $3.6 billion. Most deals were inbound transactions, with the US, Ireland and UK being the most active investors. Strategic investors dominated the market, accounting for 83% of deals. The IT, Energy & Mining, and Real Estate sectors saw the most transaction volume, while Banking and Manufacturing saw the largest deals by value.