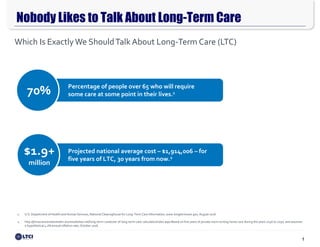

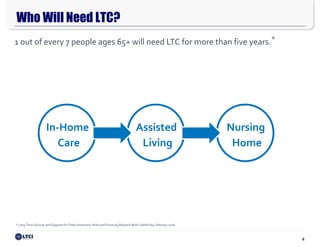

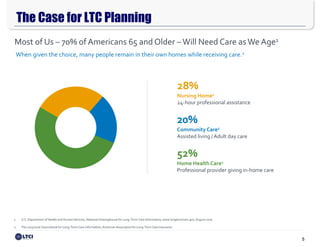

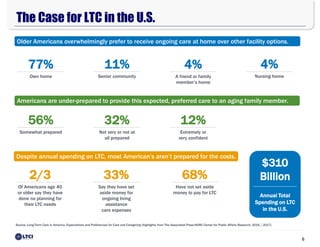

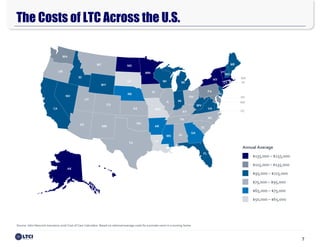

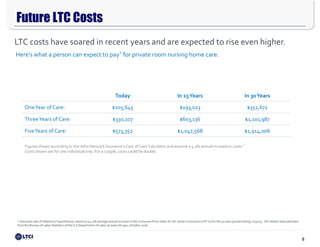

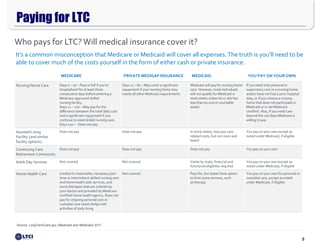

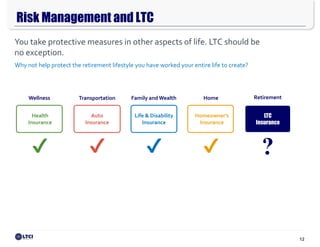

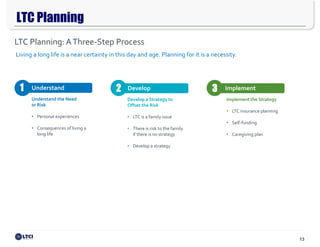

Long-term care is expensive and most people are unprepared for these costs. The document discusses how 70% of Americans over 65 will need long-term care services, with costs projected to be over $1.9 million for five years of care 30 years from now. It outlines the types of long-term care services, who pays (mostly out-of-pocket despite misconceptions about Medicare and Medicaid coverage), and encourages planning now through insurance or other means to protect assets from these substantial costs.