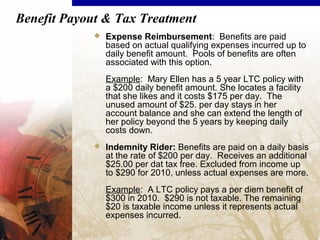

This document provides information about long term care planning from Financially Focused, LLC, an insurance brokerage and financial planning firm. It discusses the company's services, common questions about long term care insurance, the history and definitions of long term care, expenses covered by long term care insurance, state partnership plans, statistics on long term care needs, and the tax deductibility of long term care insurance premiums. The overall purpose is to educate clients on long term care planning and insurance options.