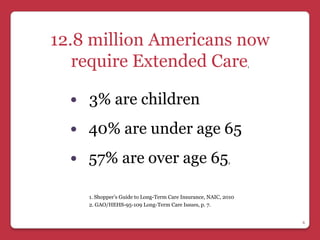

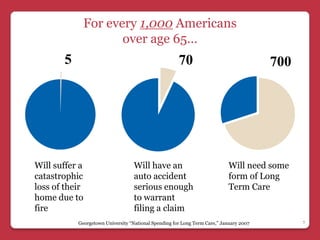

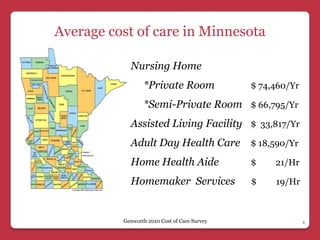

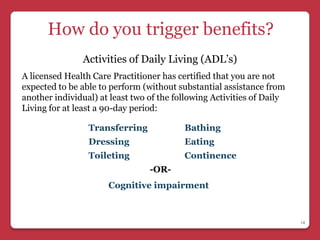

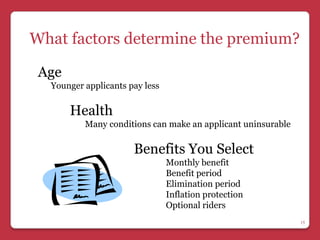

The document discusses the need to plan for extended care as people are living longer lives and may require assistance with daily activities or suffer from cognitive impairments. It notes that over 12 million Americans currently require some form of extended care, with costs averaging tens of thousands per year. The document promotes purchasing long term care insurance now at a younger age to protect assets and have more options for care settings if extended care is needed.