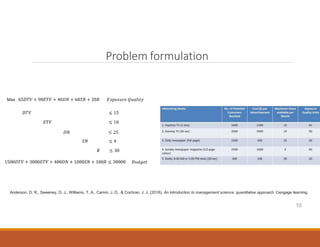

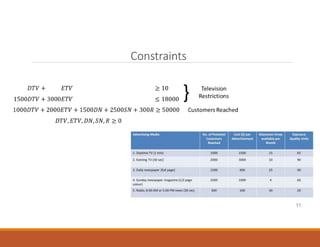

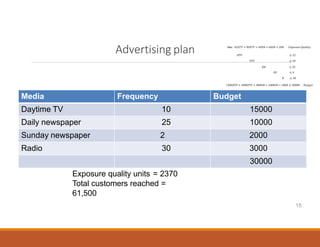

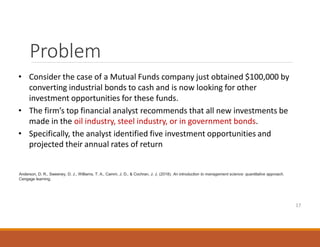

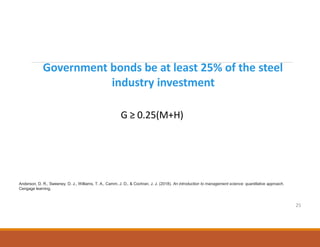

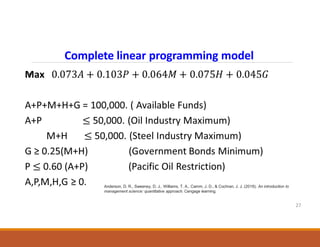

Linear programming has many applications in marketing, finance, and operations. This document discusses applications in media selection, portfolio management, and other areas. It presents an example of using linear programming to develop an optimal advertising media selection plan by maximizing exposure while staying within budget constraints. Another example optimizes investment amounts across different assets to maximize return while adhering to guidelines limiting amounts in certain industries. Solutions are provided, including dual values that provide insight into how changes in constraints would impact the optimal solutions.