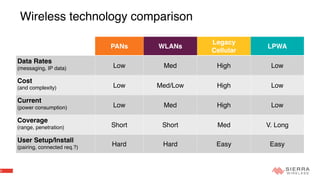

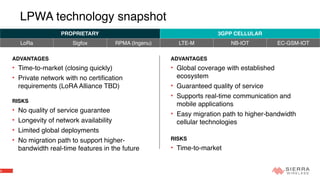

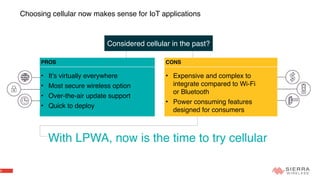

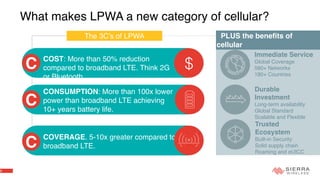

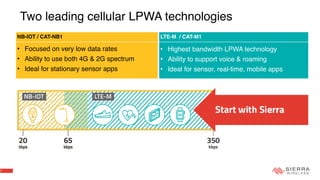

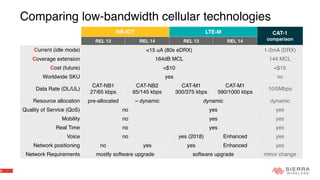

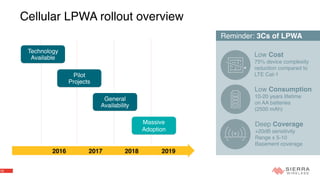

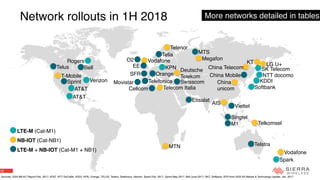

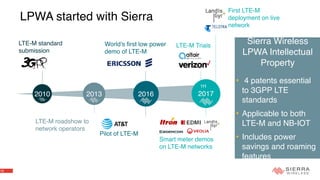

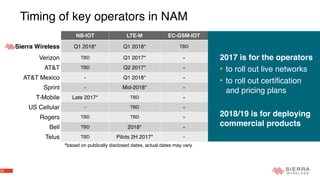

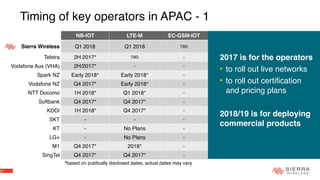

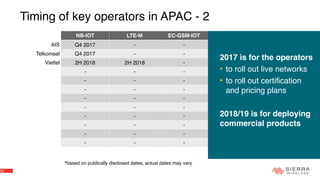

Low-Power Wide-Area (LPWA) technology is needed for Internet of Things (IoT) devices due to their low-bandwidth and long battery life requirements. Two leading LPWA cellular technologies are LTE-M and NB-IoT. LTE-M supports higher data rates and real-time communication, while NB-IoT is optimized for low data rates from stationary sensors. Major cellular networks have begun rolling out and expanding LPWA networks globally in 2017 and 2018 to support the growing demand of IoT devices.