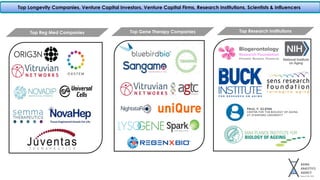

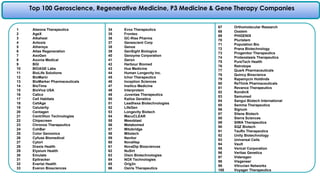

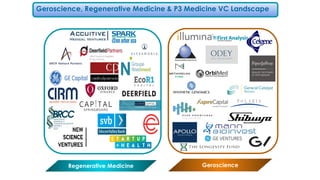

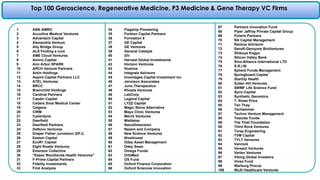

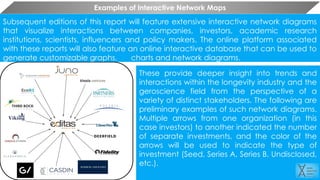

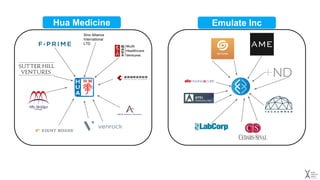

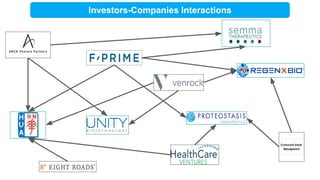

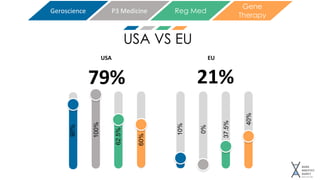

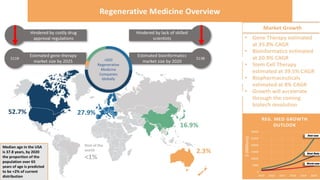

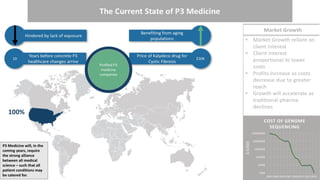

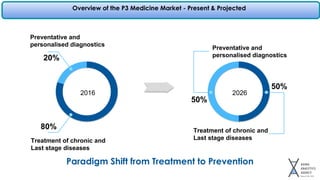

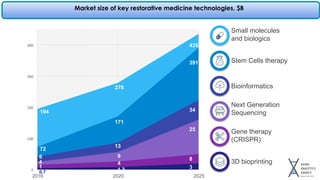

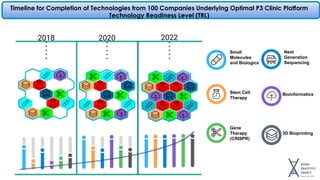

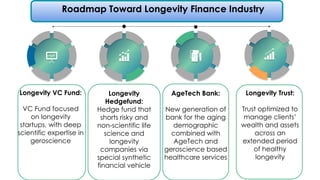

The document provides an overview of the emerging longevity industry, including key players, sectors, trends and future reports. It discusses leading companies, investors, conferences and the landscape of geroscience, regenerative medicine, gene therapy and P3 medicine. It also outlines topics to be explored in more detail in upcoming reports, such as the business of longevity, industry markets, clinics and novel investment approaches. Interactive network maps and databases will visualize specializations and interactions between stakeholders in the longevity field.