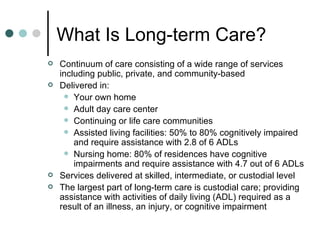

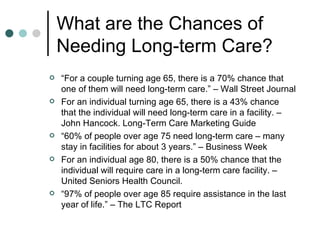

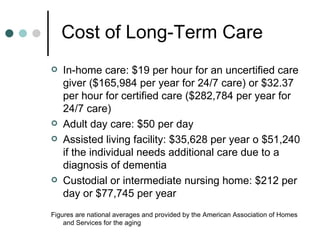

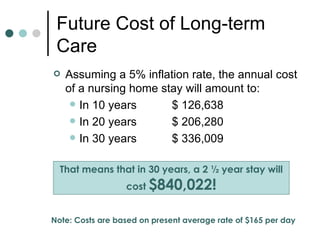

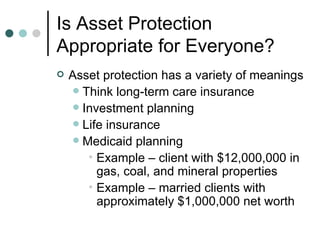

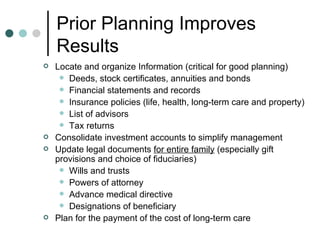

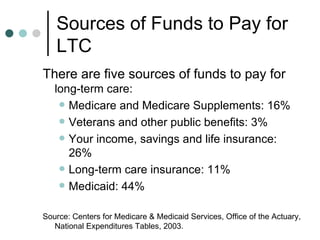

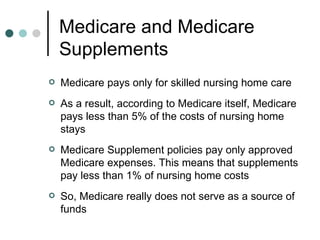

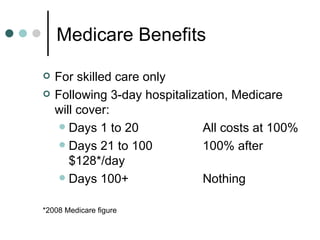

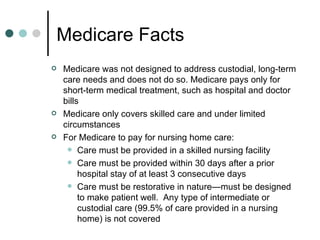

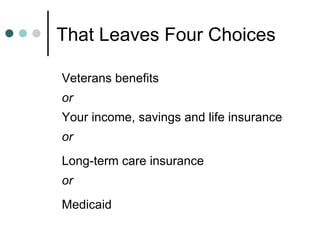

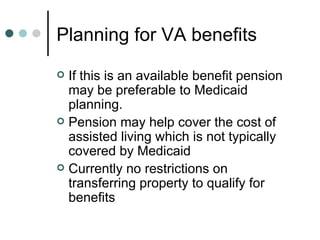

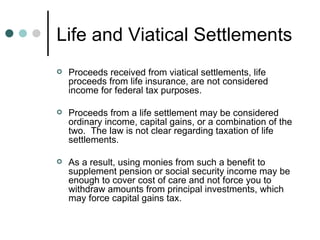

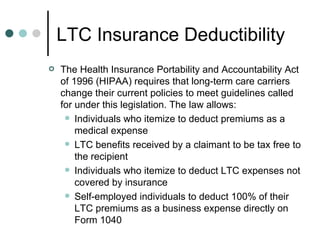

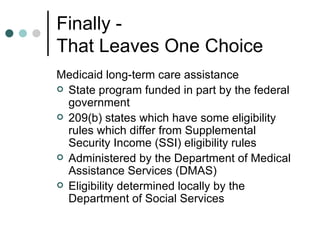

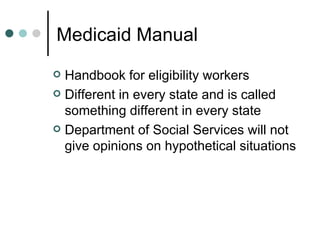

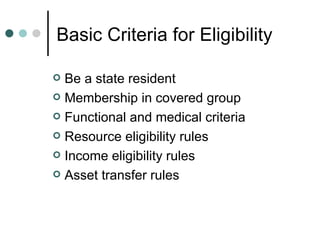

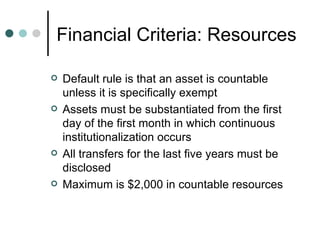

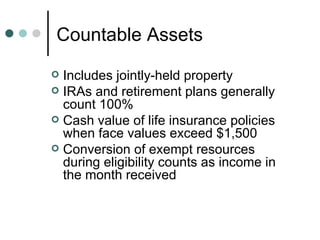

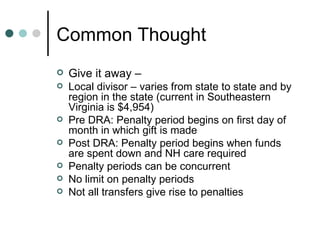

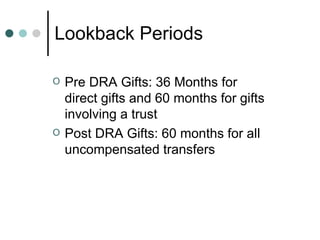

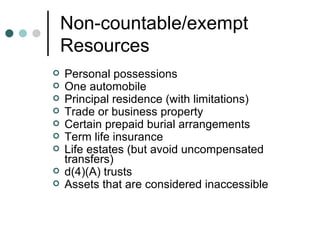

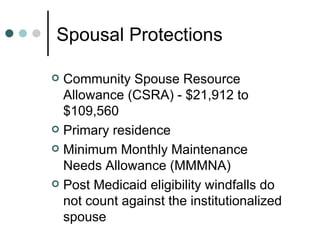

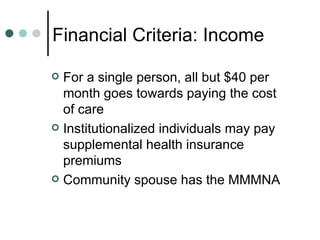

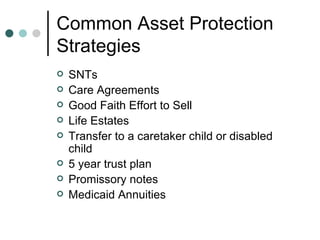

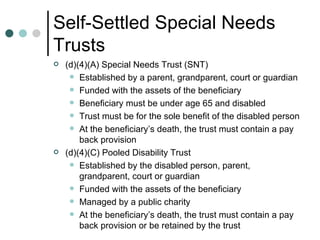

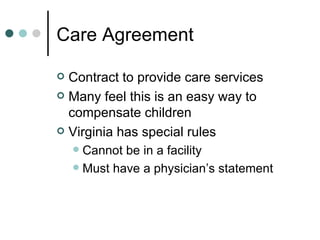

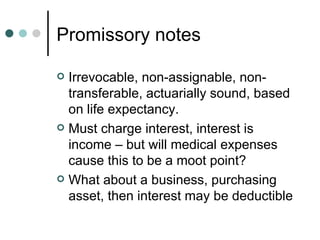

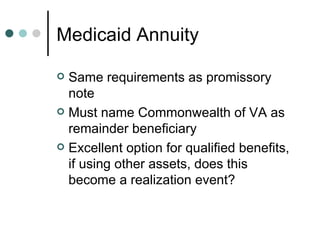

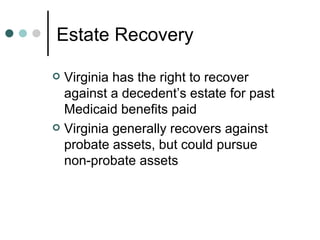

Long-term care planning involves assessing the risks of needing long-term care services and protecting assets from being depleted by high costs. Common strategies include long-term care insurance, Medicaid planning through trusts or transferring assets, and using life insurance proceeds. Medicaid is often the last option and has strict eligibility rules around assets, income, transfers, and recovery against the estate. Comprehensive long-term care planning requires working with specialists to navigate the complex rules and identify the best strategies.