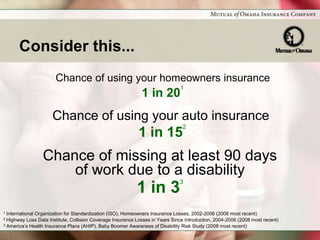

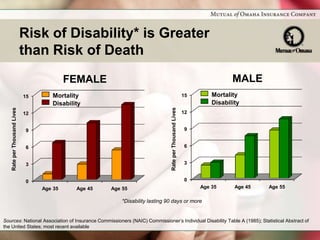

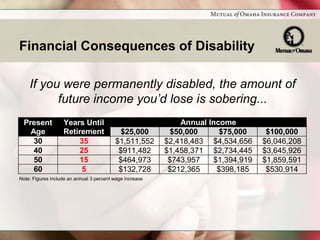

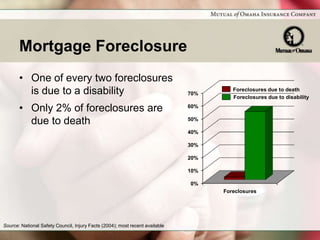

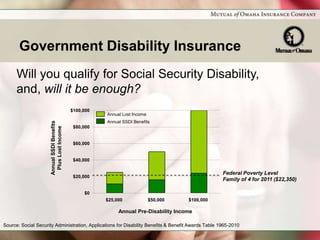

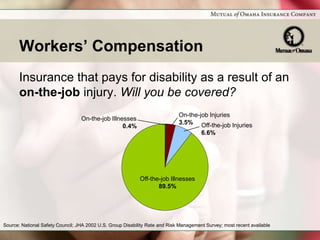

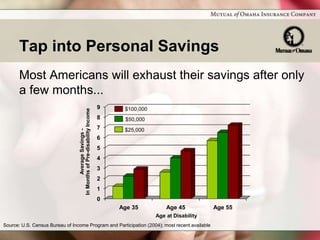

This document summarizes disability income insurance and promotes Mutual of Omaha's Disability Income Choice Portfolio. It notes that disability is more likely than death for working adults and can lead to loss of income. It outlines limitations of other potential sources of income replacement during disability, like employer policies, Social Security, workers compensation, and personal savings. The Disability Income Choice Portfolio offers different short- and long-term accident and sickness policies to help protect income in case of disability. Readers are encouraged to speak with an agent to learn more.

![Disability Income Protection

Questions?

For future assistance with your disability income or

other insurance needs,

please contact [Name] at [Phone Number].](https://image.slidesharecdn.com/disabilitychoicepowerpoint-120510184742-phpapp01/85/Disability-choice-powerpoint-18-320.jpg)