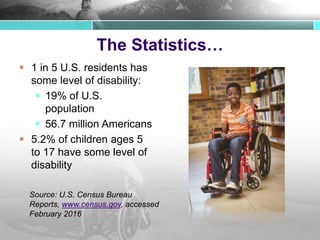

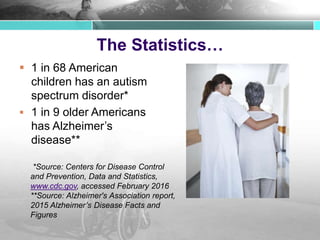

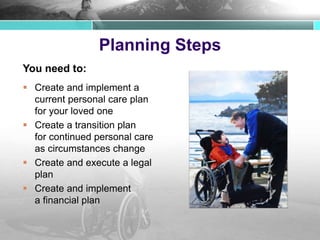

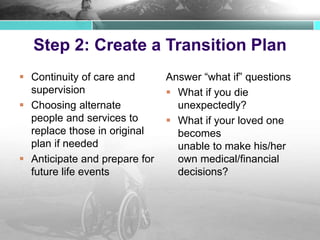

The document outlines the importance of special needs planning, highlighting that 1 in 5 U.S. residents has some level of disability, and details statistical data about disabilities among children and older Americans. It provides a step-by-step guide for creating and implementing personal care, legal, and financial plans to support individuals with special needs while preserving government benefits. Various special needs trust types are discussed, stressing the legal implications and advantages of establishing them to ensure financial security for disabled individuals.