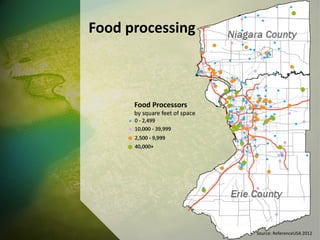

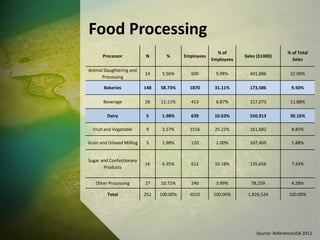

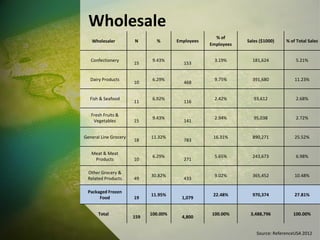

The document discusses food systems planning for the Erie-Niagara region. It addresses supporting local food producers and consumers and linking the two. Goals include telling the story of food from farm to table. The document also discusses Good Agricultural Practices (GAP) certification which demonstrates food safety practices on farms and throughout the supply chain. Food processing and wholesale businesses of different sizes in the region are outlined. Challenges and opportunities for corner stores, farmers markets, community supported agriculture, and institutional purchasing of local food are also addressed. The final sections define food hubs and their potential benefits for connecting local food producers to buyers.