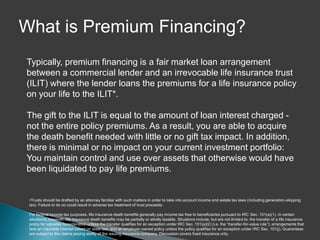

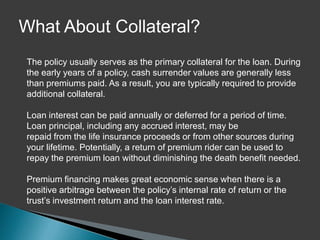

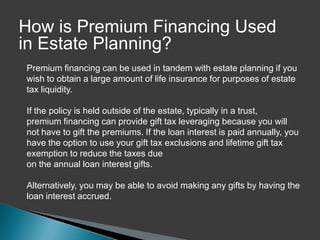

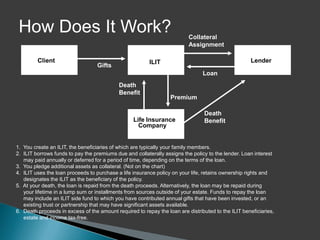

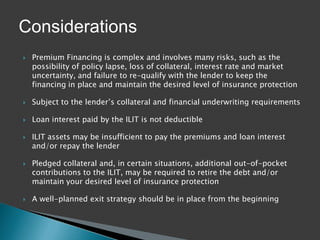

Premium financing allows an irrevocable life insurance trust (ILIT) to take out loans to pay life insurance premiums on the insured's life. This reduces gift tax costs compared to paying premiums outright. The life insurance policy serves as collateral, and additional assets may also be pledged. At the insured's death, the loan is repaid from death benefits. Exit strategies like GRATs and IDITs can provide funds to repay the loan and maintain the desired death benefit amount. Premium financing provides estate tax liquidity but involves risks like policy lapse if not properly planned and executed.