This document summarizes the key details of LIC's Dhan Rekha savings plan, including eligibility, benefits, premiums, and riders. Some highlights include:

- It is a non-linked, non-participating individual life insurance savings plan.

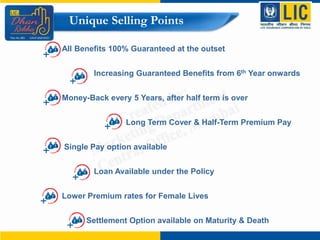

- The insured can pay premiums either as a single payment or for half the policy term.

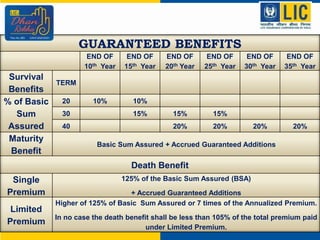

- Maturity benefits include the basic sum assured plus accrued guaranteed additions. Death benefits provide higher of 125% of the basic sum assured or 7 times annualized premium.

- The plan provides survival benefits as a percentage of the basic sum assured starting from the 10th year.

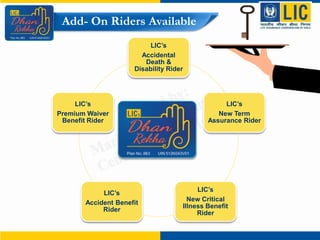

- Riders for accidental death, critical illness, and other benefits are