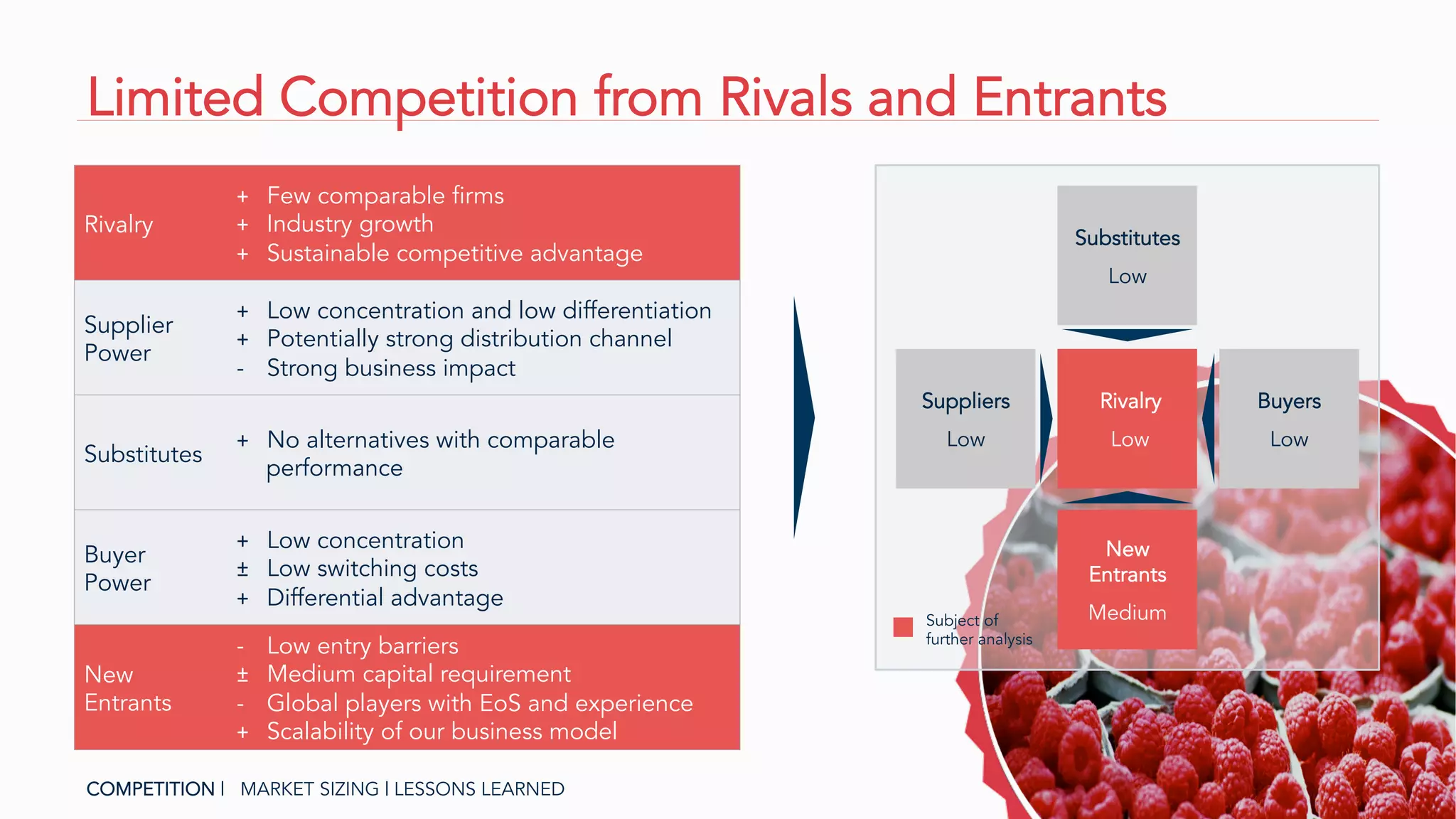

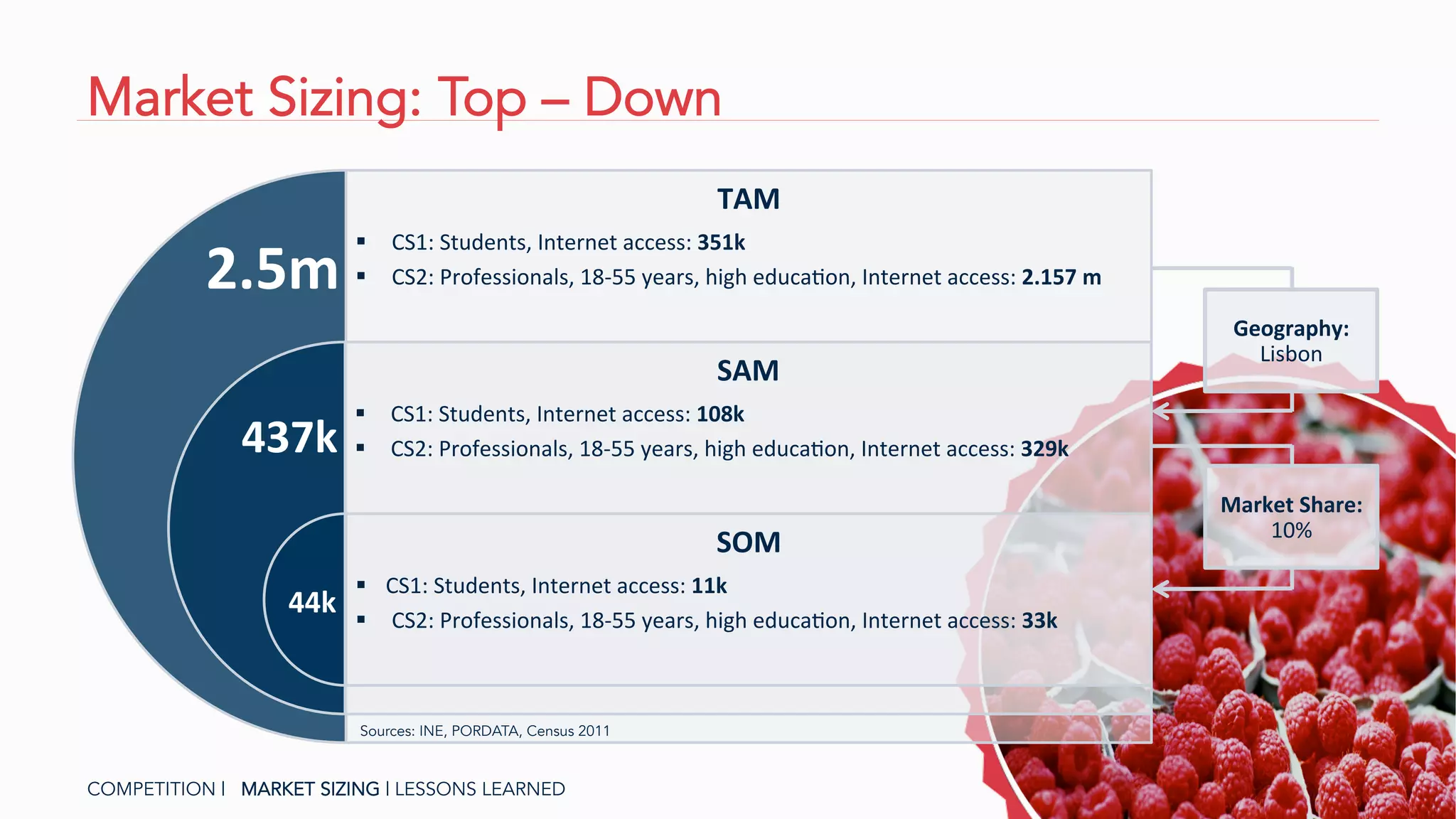

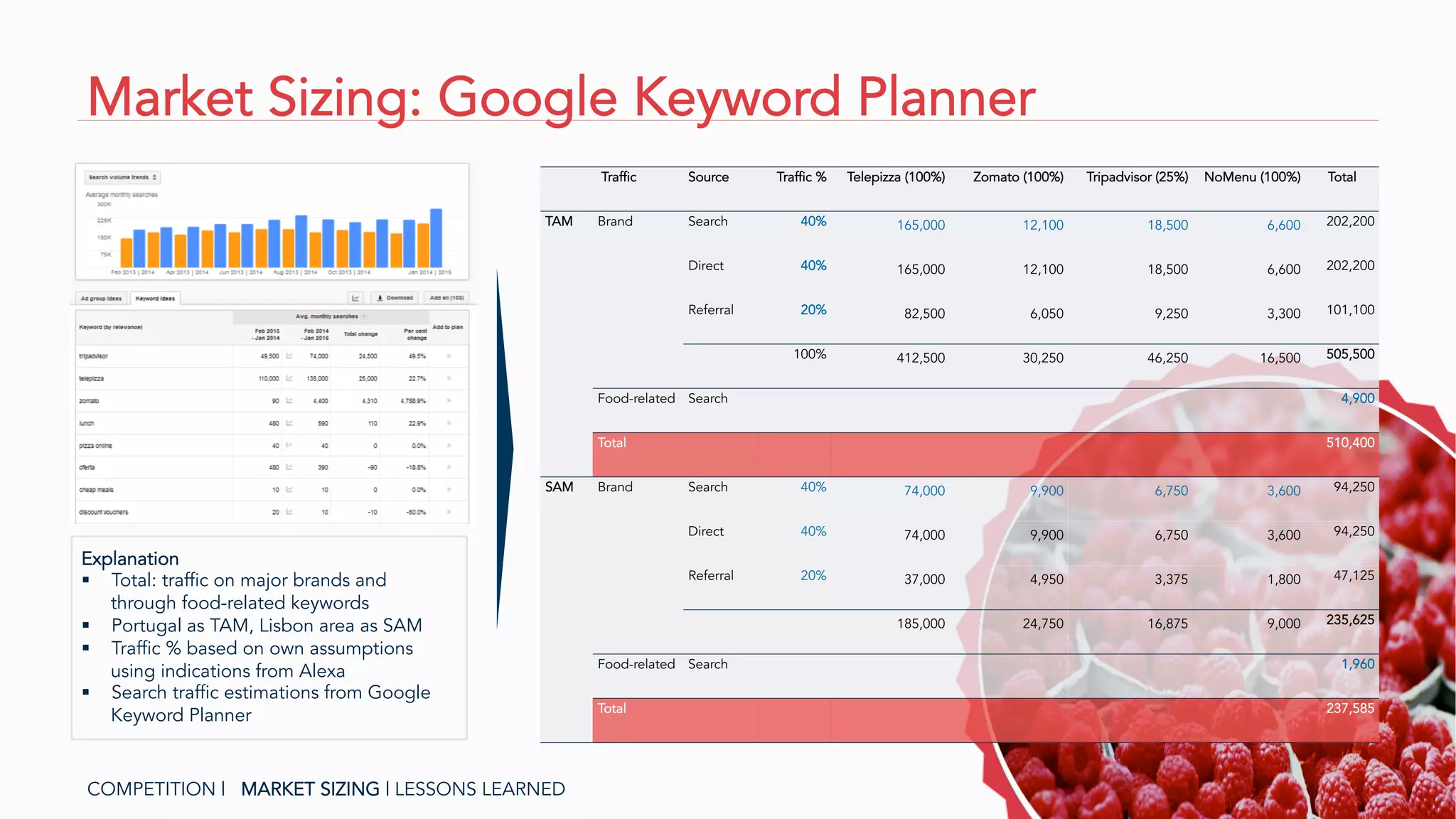

The document discusses competition in the food delivery market through a Porter's Five Forces analysis and SWOT analyses of various competitors. It then analyzes the market size using top-down estimates of total addressable market, serviceable addressable market, and serviceable obtainable market based on demographics and internet usage. Potential lessons learned from previous projects are also listed.