This document provides an overview of key concepts in international business including:

1. The meaning and differences between domestic and international/foreign business.

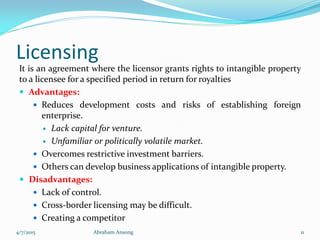

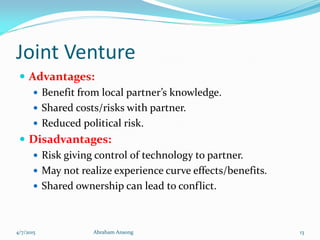

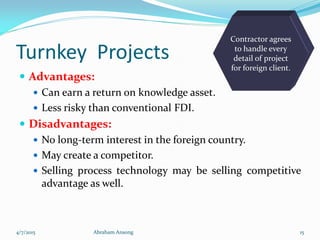

2. Why companies go international and various market entry strategies such as exporting, wholly owned subsidiaries, licensing, franchising, joint ventures, and strategic alliances.

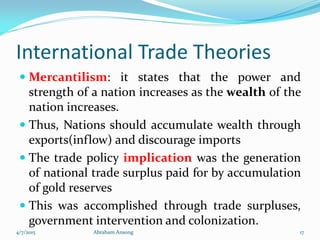

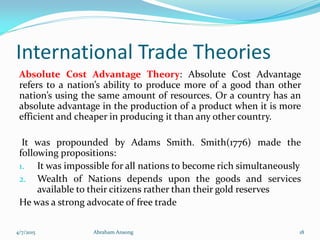

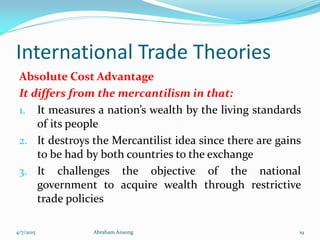

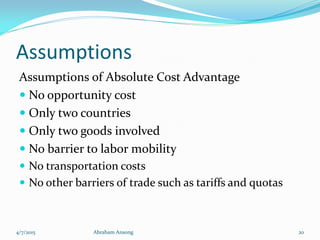

3. International trade theories including mercantilism, absolute cost advantage, comparative advantage, Heckscher-Ohlin theory, and Porter's national competitive advantage diamond.

4. Instruments of trade policy like tariffs, subsidies, import quotas, and anti-dumping policies.