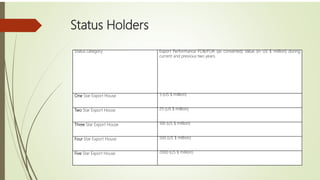

The new Foreign Trade Policy for 2015-2020 has been announced with the objectives of promoting diversification and competitiveness of Indian exports. Several schemes have been merged into single schemes like Merchandise Exports from India Scheme and Service Exports from India Scheme. Criteria for export status holders has been changed from rupee to dollar terms. Procedures have been simplified with reduced paperwork and increased online processing and data sharing between departments. This aims to provide a stable policy environment to boost 'Make in India' and link trade incentives to other government initiatives.