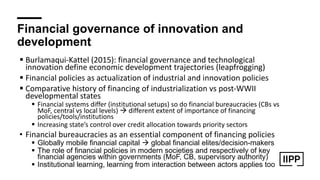

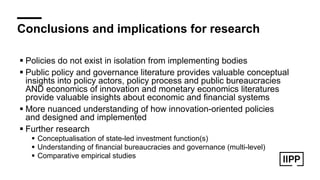

The document discusses the institutional aspects of national innovation finance, emphasizing the significance of governance, financial policies, and public-private partnerships in fostering innovation and economic development. It highlights the uncertain nature of financing and advocates for strategic state-led investments to direct financial capital toward innovation-inducing sectors. Additionally, the document calls for further research on state-led investment functions and the role of financial bureaucracies in innovation processes.