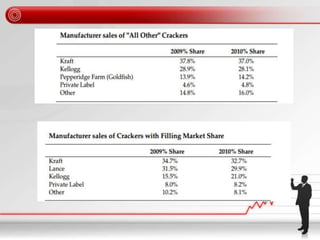

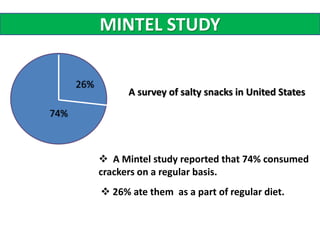

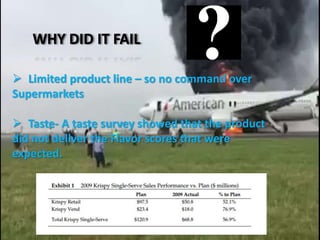

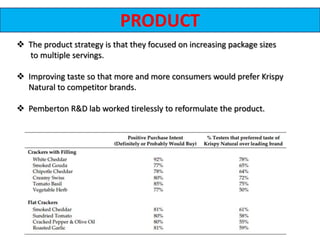

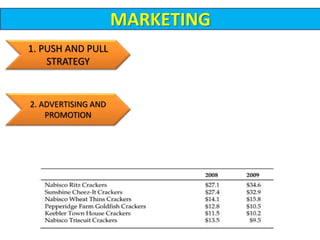

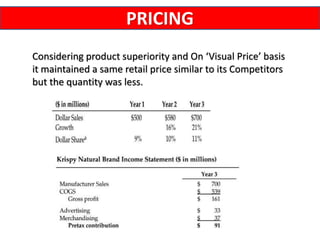

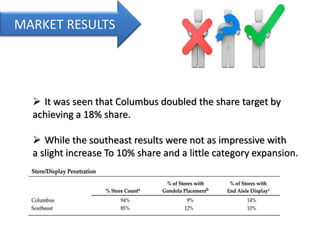

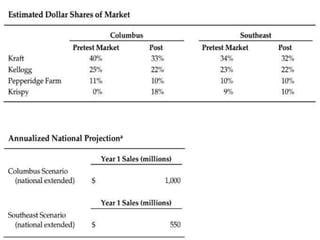

Pemberton Snack Foods launched a new cracker product called Krispy Natural to crack into the snack market. The original Krispy Single Serve product failed due to limited flavors and poor taste. Krispy Natural was redeveloped with improved taste, multiple package sizes, and a focus on being 100% natural and healthy. It utilized Pemberton's direct store delivery system and promotional advertising. In test markets, Krispy Natural gained 18% market share in Columbus and a slight increase to 10% in the Southeast, outperforming competitors. The company plans a national rollout.