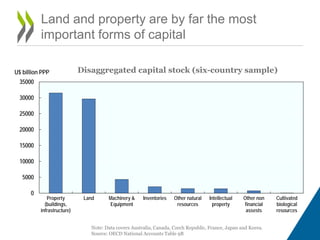

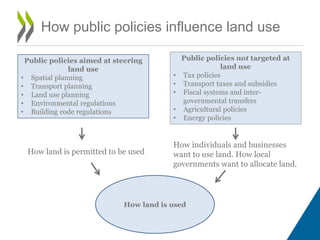

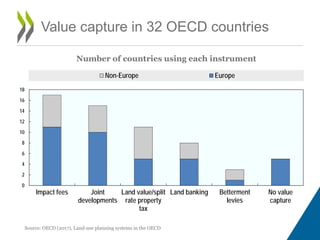

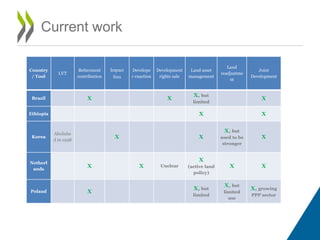

The document discusses preliminary OECD work on land value capture (LVC) and its significance as a tool to influence land use through public policies. It highlights the importance of coordination between different levels of government and the need for effective frameworks to facilitate LVC adoption across OECD countries. The document also raises questions regarding revenue distribution, integration with planning frameworks, and the role of national governance in local implementation.