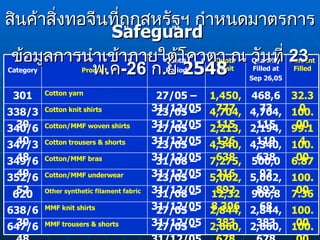

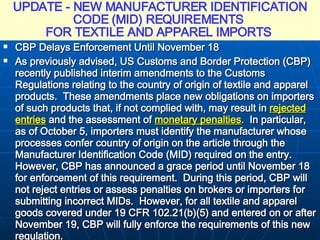

1. The document summarizes new requirements by US Customs and Border Protection (CBP) for textile and apparel imports regarding Manufacturer Identification Codes (MIDs) on import documentation.

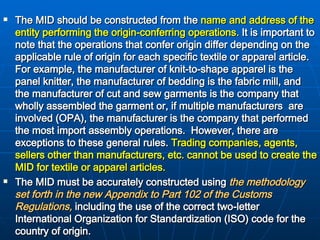

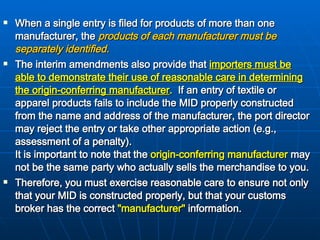

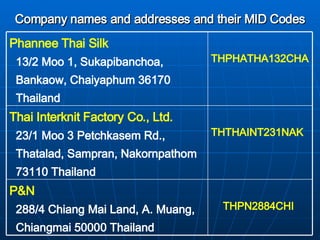

2. CBP will now require importers to identify the manufacturer that confers origin on each article using a standardized MID constructed from the manufacturer's name, address, and country code.

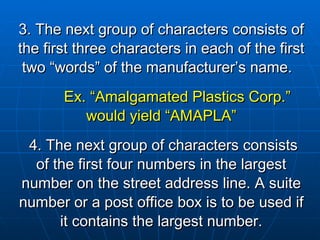

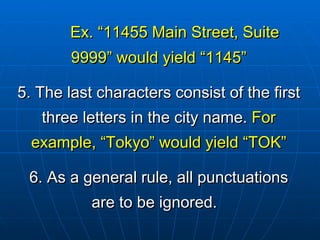

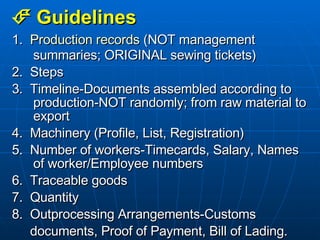

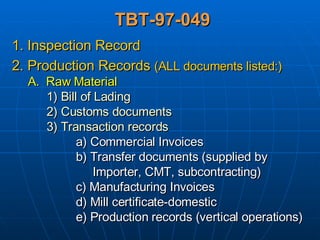

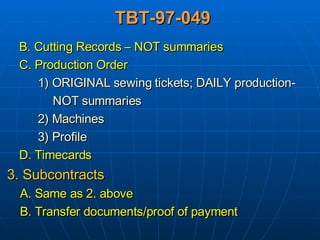

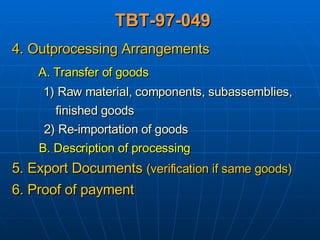

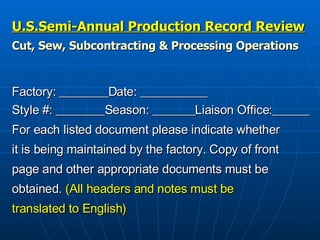

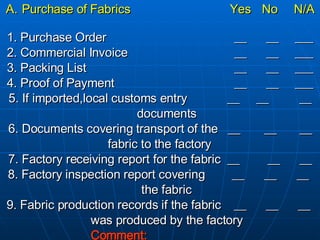

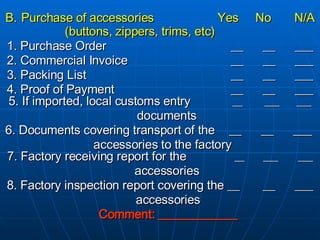

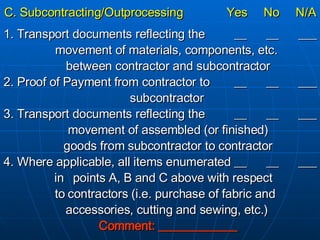

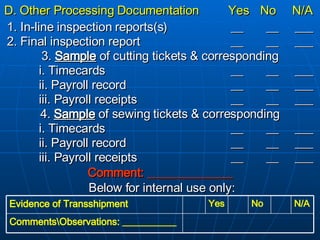

3. The document provides guidelines for constructing proper MIDs and outlines documentation that US customs may require manufacturers to present when conducting audits or investigations.