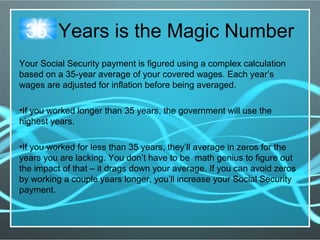

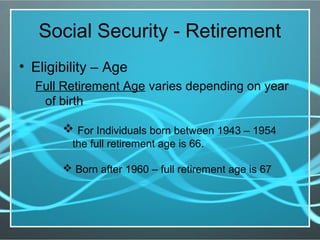

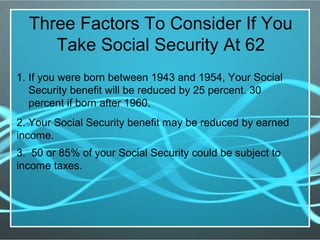

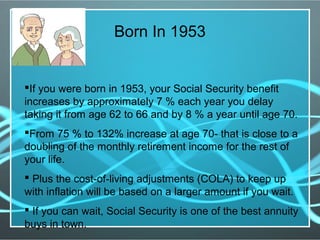

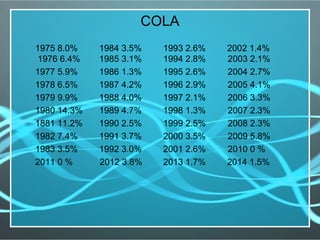

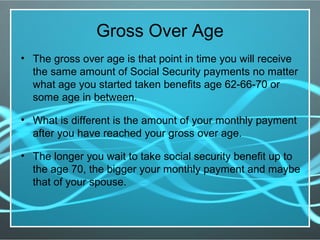

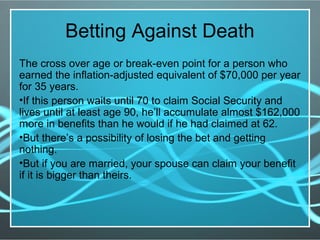

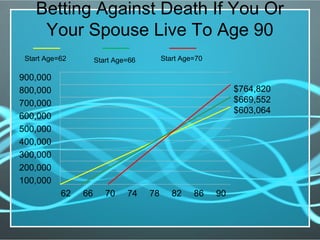

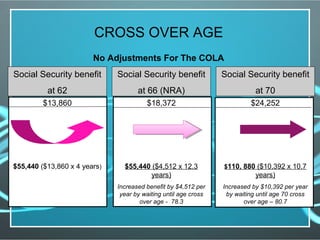

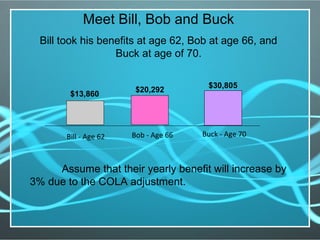

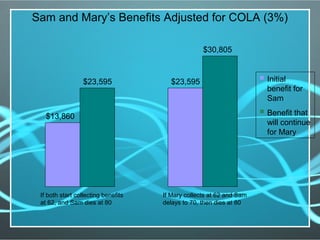

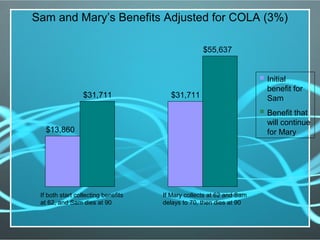

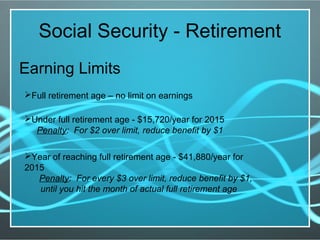

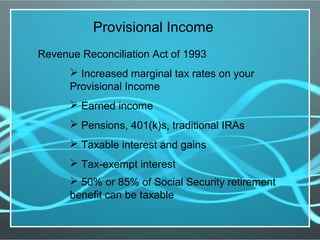

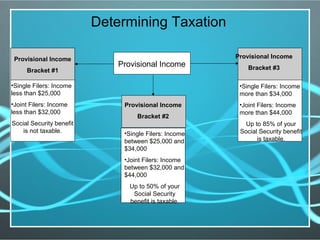

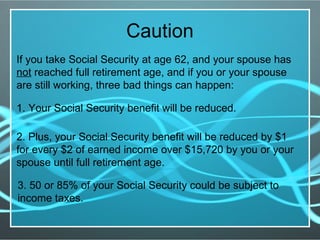

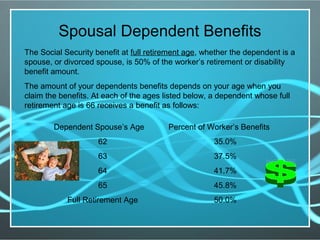

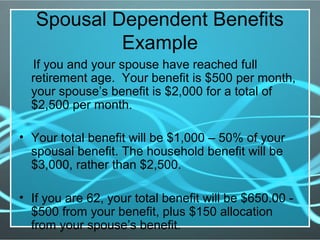

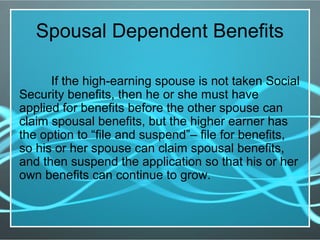

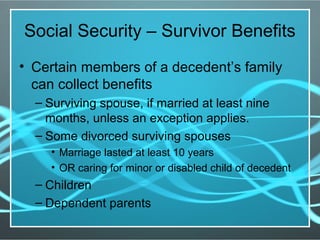

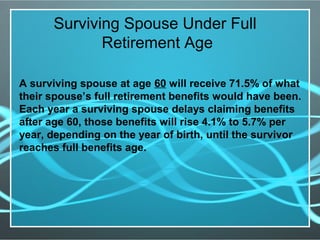

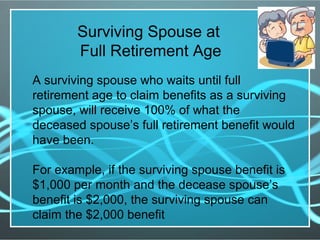

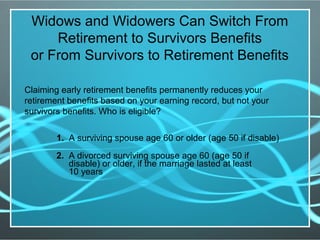

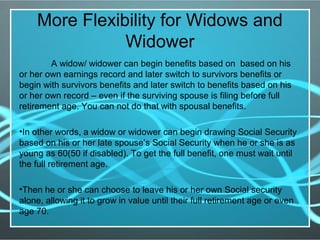

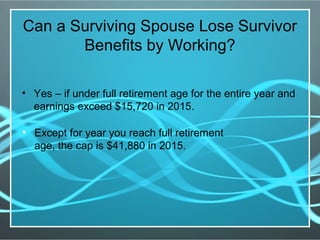

This document provides information about when to start claiming Social Security retirement benefits. It discusses that 35 years of earnings is the magic number used to calculate benefits, and that working longer can increase your monthly payment. Taking benefits as early as age 62 is possible but will result in reduced monthly payments. Waiting until full retirement age or age 70 can significantly increase your lifetime benefits. Factors like taxes, earnings limits, and spousal benefits must also be considered when deciding when to start receiving Social Security.