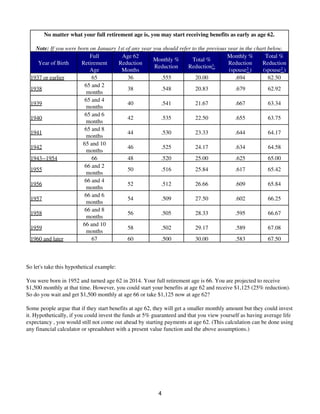

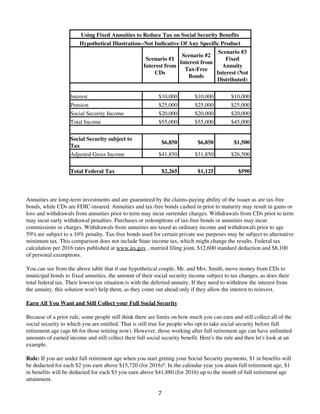

This document provides guidance on how to maximize Social Security benefits, addressing questions about optimal start age, strategies for married couples, tax implications, and income limits while collecting benefits. It emphasizes the importance of understanding one's earnings history and various strategies to enhance benefits, such as delay tactics and utilizing spousal benefits. The information is based on guidelines from the Social Security Administration for the year 2016 and encourages consulting financial advisors for personalized planning.