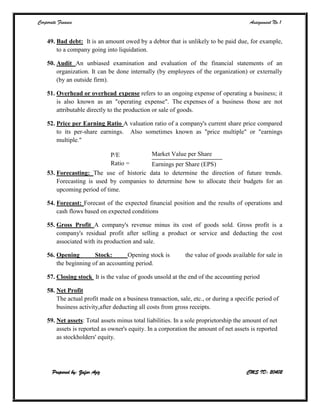

This document defines and explains various corporate finance terms and concepts. It provides definitions for 52 terms related to assets, liabilities, financial ratios, accounting concepts, and other areas of corporate finance. Some key terms defined include assets, current assets, liabilities, earnings before interest and taxes (EBIT), return on capital employed (ROCE), working capital, balance sheet, budget, and net present value (NPV).