Embed presentation

Download as PDF, PPTX

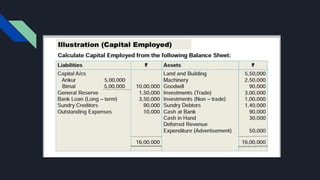

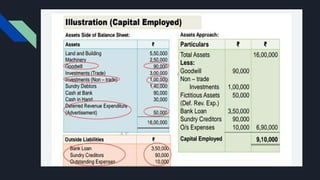

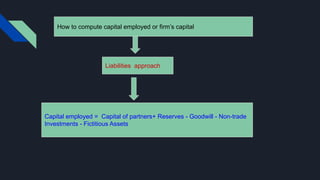

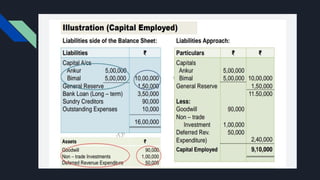

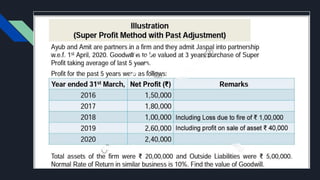

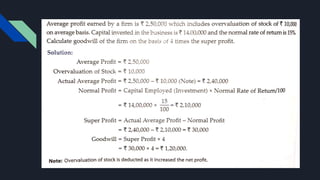

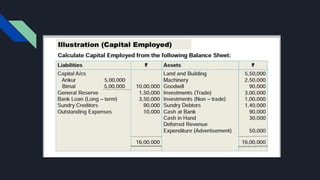

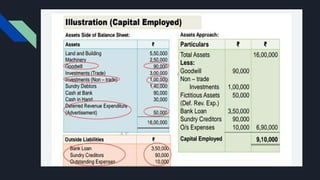

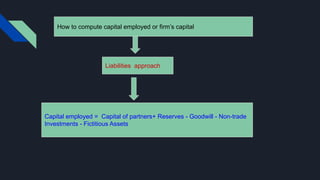

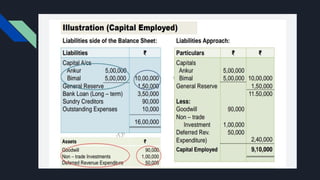

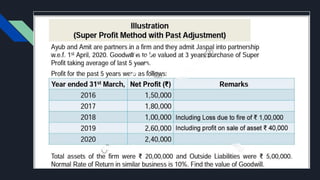

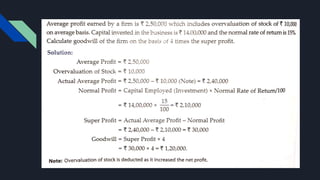

The document outlines the calculation of goodwill using the super profit method, emphasizing the formula: goodwill equals super profit multiplied by the number of years purchase. It explains super profit as the difference between actual/average profit and normal profit, with normal profit determined by the capital employed and a specific rate. Capital employed is calculated through asset and liabilities approaches, accounting for investments, fictitious assets, and partnerships.