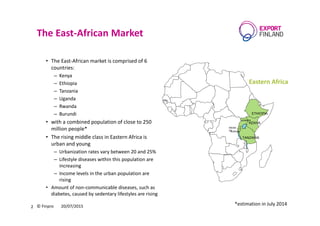

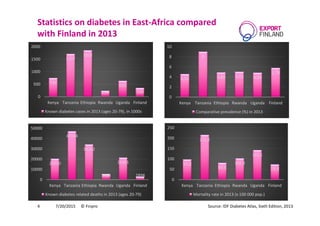

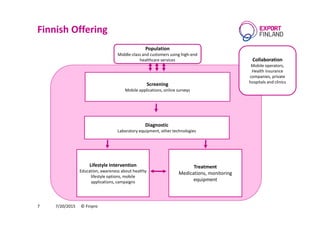

This document discusses the business opportunity in Kenya for diabetes equipment. It notes that the East African region has a population of around 250 million people across 6 countries. The rates of urbanization and lifestyle diseases like diabetes are increasing as incomes rise in the growing middle class. There is a need for modern diabetes equipment and technologies, as products are currently imported but not locally manufactured. Finnish companies that produce screening, diagnostic, treatment and monitoring equipment would find opportunities in the private and public healthcare sectors of Kenya and the broader East African market.