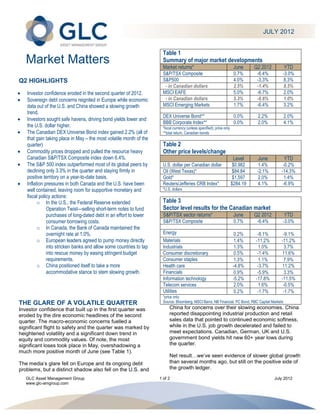

1) Investor confidence declined in Q2 2012 due to renewed sovereign debt concerns in Europe and signs of slowing economic growth in the US and China. This drove investors to seek safe havens like bonds, lowering yields.

2) Commodity prices dropped sharply, pulling the resource-heavy Canadian market down 6.4% for the quarter. The US market fell less at 3.3%.

3) Within Canada, the energy and materials sectors declined the most, around 8-11%, due to falling oil and commodity prices on reduced growth outlooks. Defensive sectors like telecoms and consumer staples outperformed.