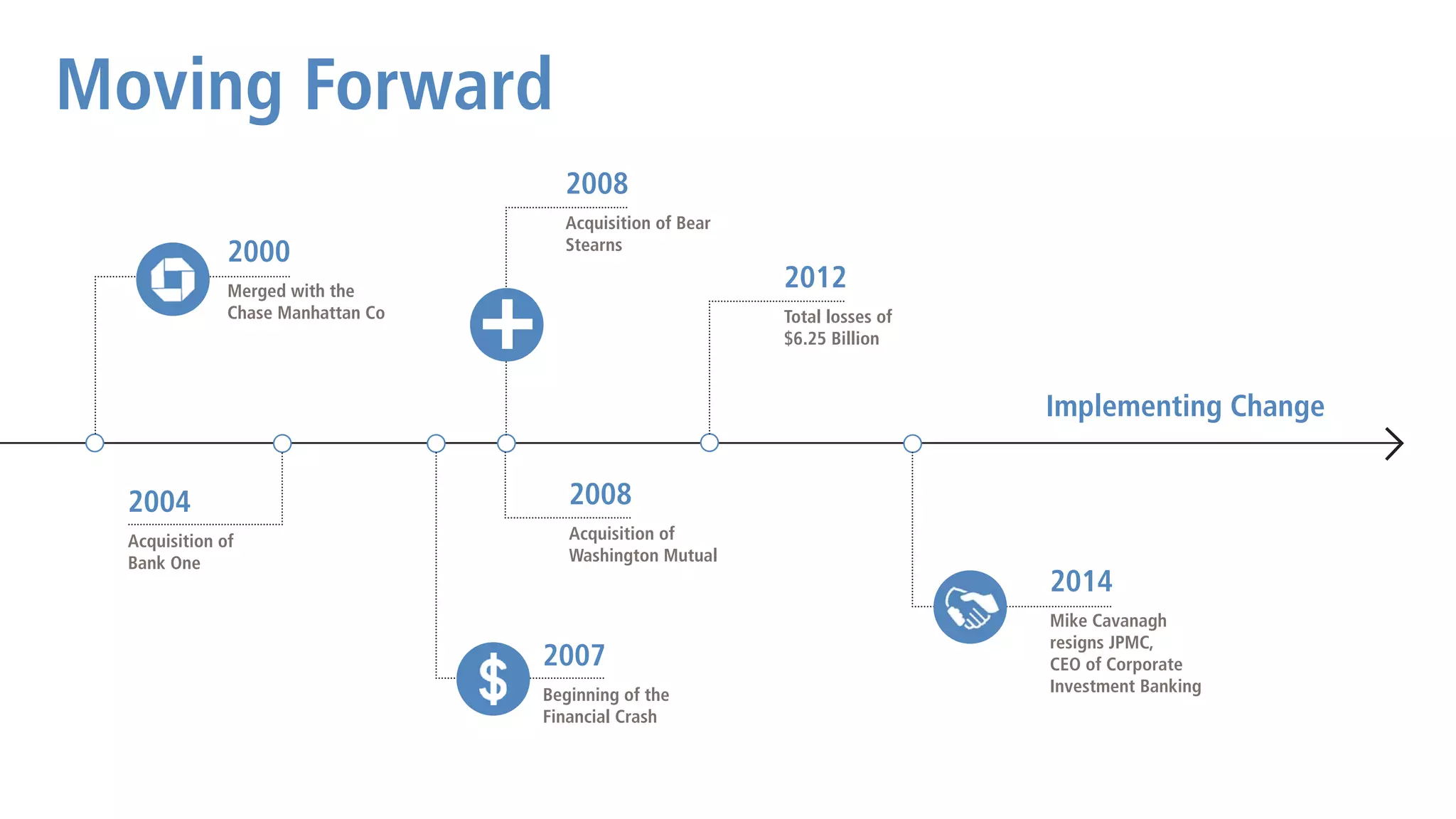

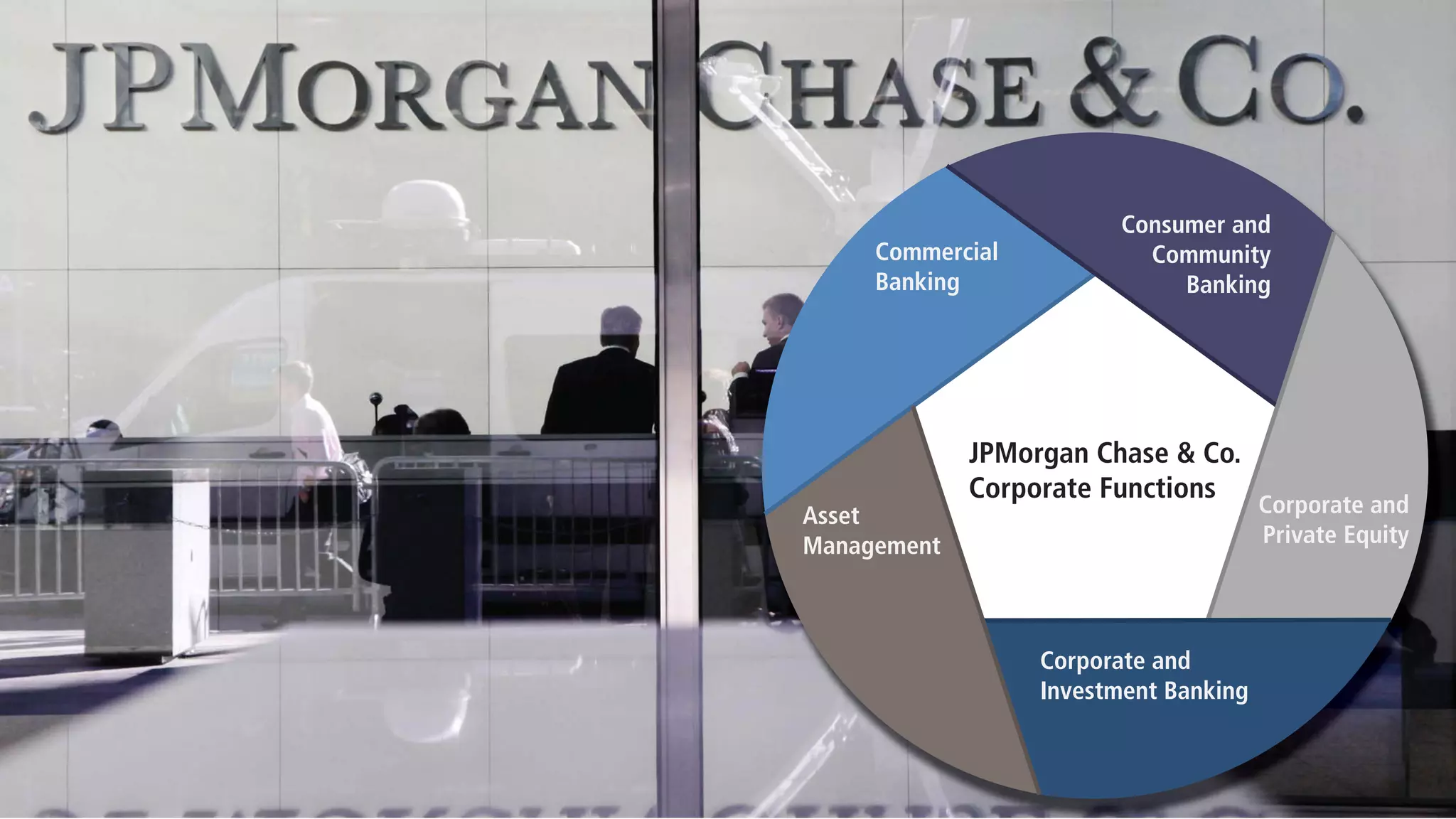

The document discusses the necessity of a change management plan following various financial acquisitions and crises faced by JPMorgan Chase. It outlines the implementation of a structured approach to risk management through team collaboration, setting clear goals, and fostering a risk-aware culture. Success measures include the alignment of business strategy with risk management and regular reviews by leadership to reduce financial losses.