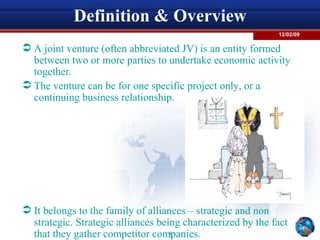

The document discusses joint ventures, including their definition, types, reasons for forming them, agreements, benefits and risks, problems, and examples. A joint venture is formed between two or more parties to undertake economic activity together for a specific project or ongoing business relationship. Reasons for joint ventures include building on strengths, risk sharing, accessing new markets or technologies. The document outlines different types of joint ventures and important issues that should be addressed in a joint venture agreement.