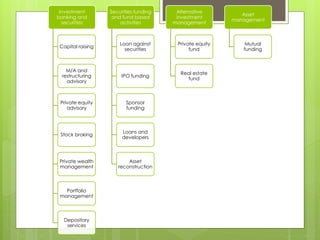

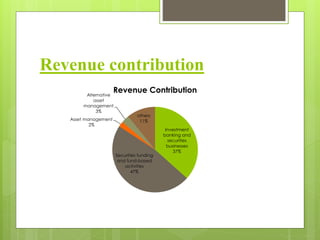

JM Financial is an integrated financial services company established in 1973 offering capital market products and services through subsidiaries. It has a presence in investment banking and securities, lending, asset management, and alternative asset management. The company generates most of its revenue from securities funding and fund-based activities (47%) and investment banking and securities businesses (37%). However, its business is inherently linked to volatility in equity markets, so revenue growth depends on improvement in capital markets. Asset quality in its lending book is also a risk factor to monitor.