This document is a project report submitted as part of an internship at JM Financial in their Derivatives division. It includes an overview of JM Financial, including their history, vision, values, and the services they provide. It also provides a high-level overview of the financial markets, including the primary market, secondary market, and derivatives segment. The report focuses on derivatives, including the origins and development of derivatives in India, as well as definitions and explanations of different derivative products like forwards, futures, and options contracts.

![5

TABLE OF CONTENTS

CHAPTER – I

JM FINANCIAL OVERVIEW--------------------------------------- [9]

COMPANY PROFILE

HISTORY

BACKGROUND

FUNCTIONS

CHAPTER– II

FINANCIAL SEGMENT OVERVIEW------------------- ----------------------------- [16]

PRIMARY MARKET

SECONDARY MARKET

CHAPTER-III

DERIVATIVE---------------------------- [19]

ORIGINE OF DERIVATIVE

EMERGENCE OF DERIVATIVE

DEVELOPMENT OF DERIVATIVE IN INDIA

MARKET PLAYERS OF DERIVATIVE

COMPONENT OF DERIVATIVE](https://image.slidesharecdn.com/prashangisip-141116233920-conversion-gate01/75/Prashangi-sip-5-2048.jpg)

![6

CHAPTER-IV

FORWARD CONTRACT-------------------------------------- [37]

DEFINATION

FEATURES

USE & LIMITATIONS

CHAPTER-V

FUTURE CONTRACT-------------------------------------- [40]

DEFINITION

FEATURES

MARGINE

CHAPTER-VI

OPTIONS CONTRACT ------------------------ [47]

DEFINITION

CALL OPTION

PUT OPTION

CHAPTER-VII

MARKET TRENDS & OPTIONS STRATEGY OVERVIEW------------------------ [50]

TYPES OF MARKET TREND

OPTION STRATEGY ACCORDING TO MARKET TREND](https://image.slidesharecdn.com/prashangisip-141116233920-conversion-gate01/75/Prashangi-sip-6-2048.jpg)

![7

CHAPTER-VIII

OPTIONS STRATEGY ---------------- ---------------------------- [57]

CHAPTER-IX

CONCLUSION------------------------------------------- [70]

FINDINGS

SUGGETIONS

LIMITATIONS

CONCLUTIONS

CHAPTER-X

BIBLIOGRAPHY-------------- ---------------------------- [74]

WEBOGRAPHY

ANNEXUTERS](https://image.slidesharecdn.com/prashangisip-141116233920-conversion-gate01/75/Prashangi-sip-7-2048.jpg)

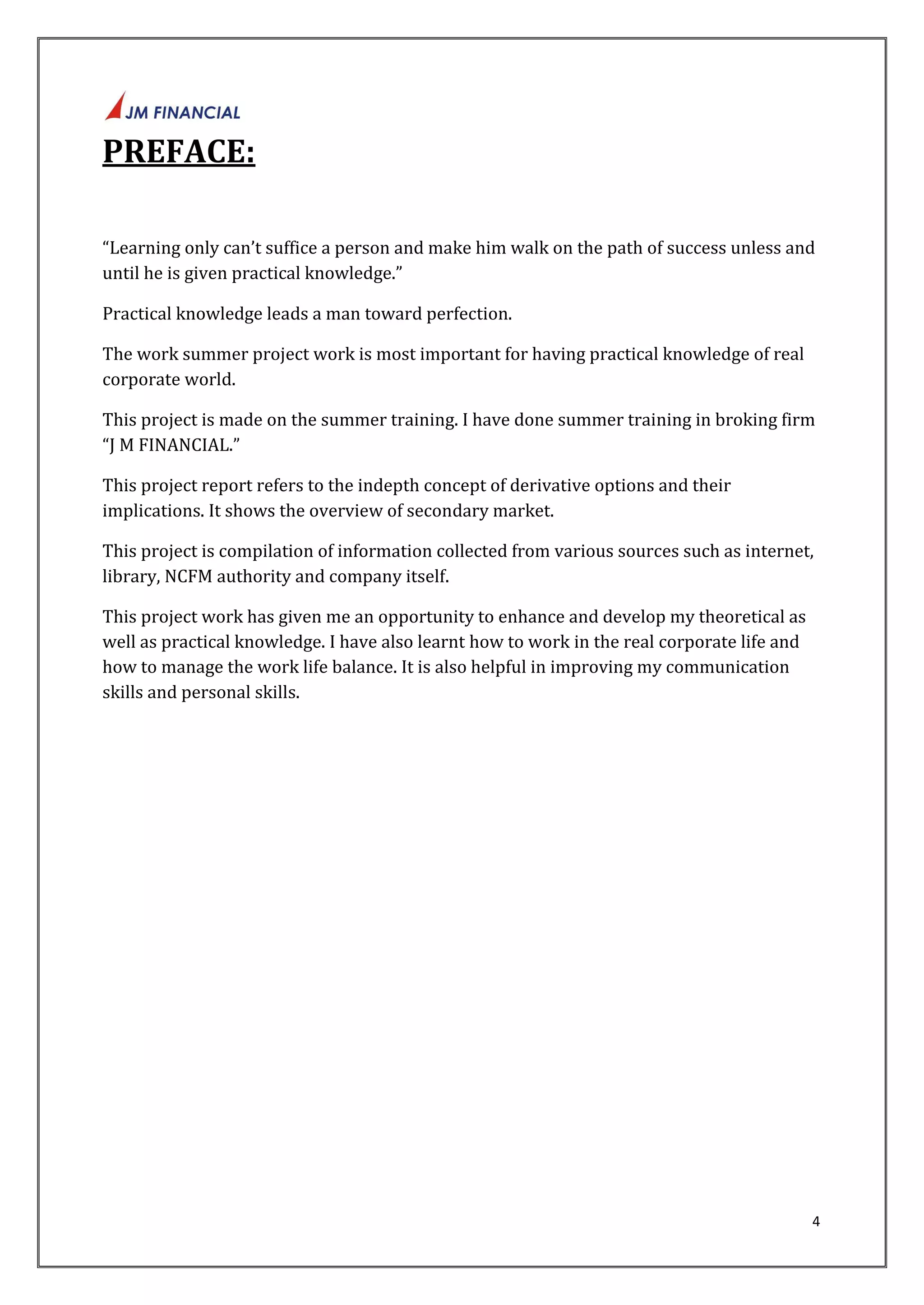

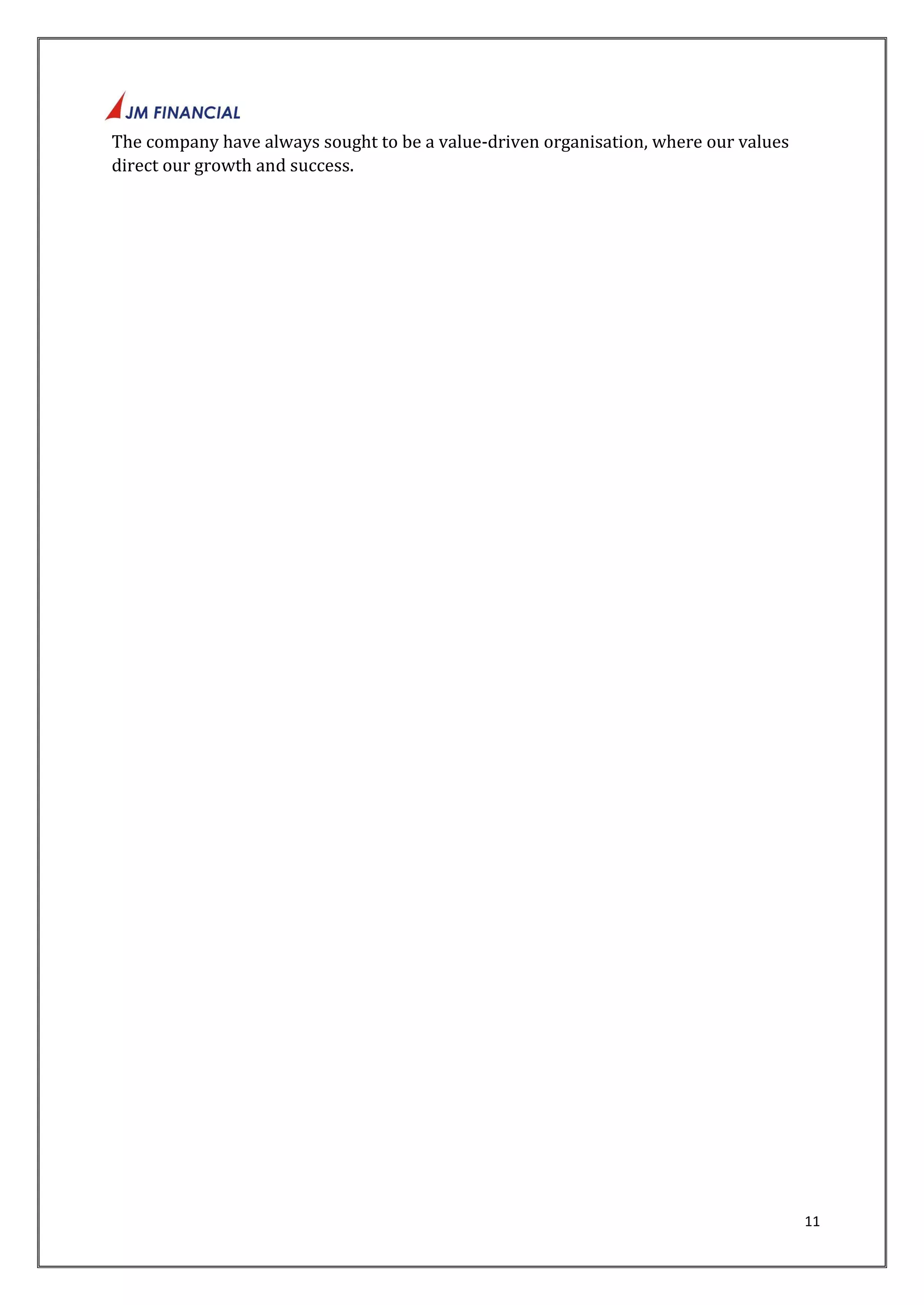

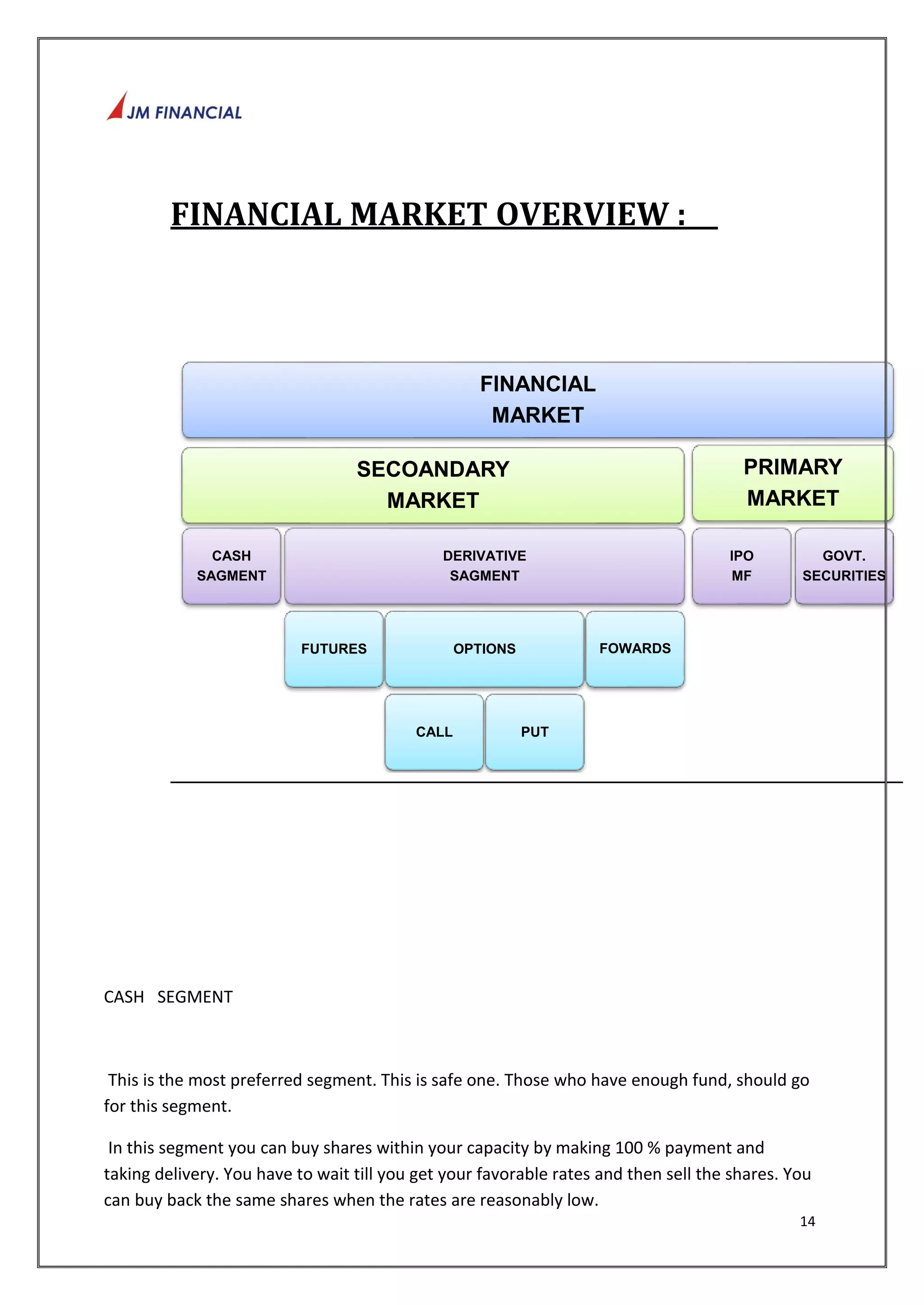

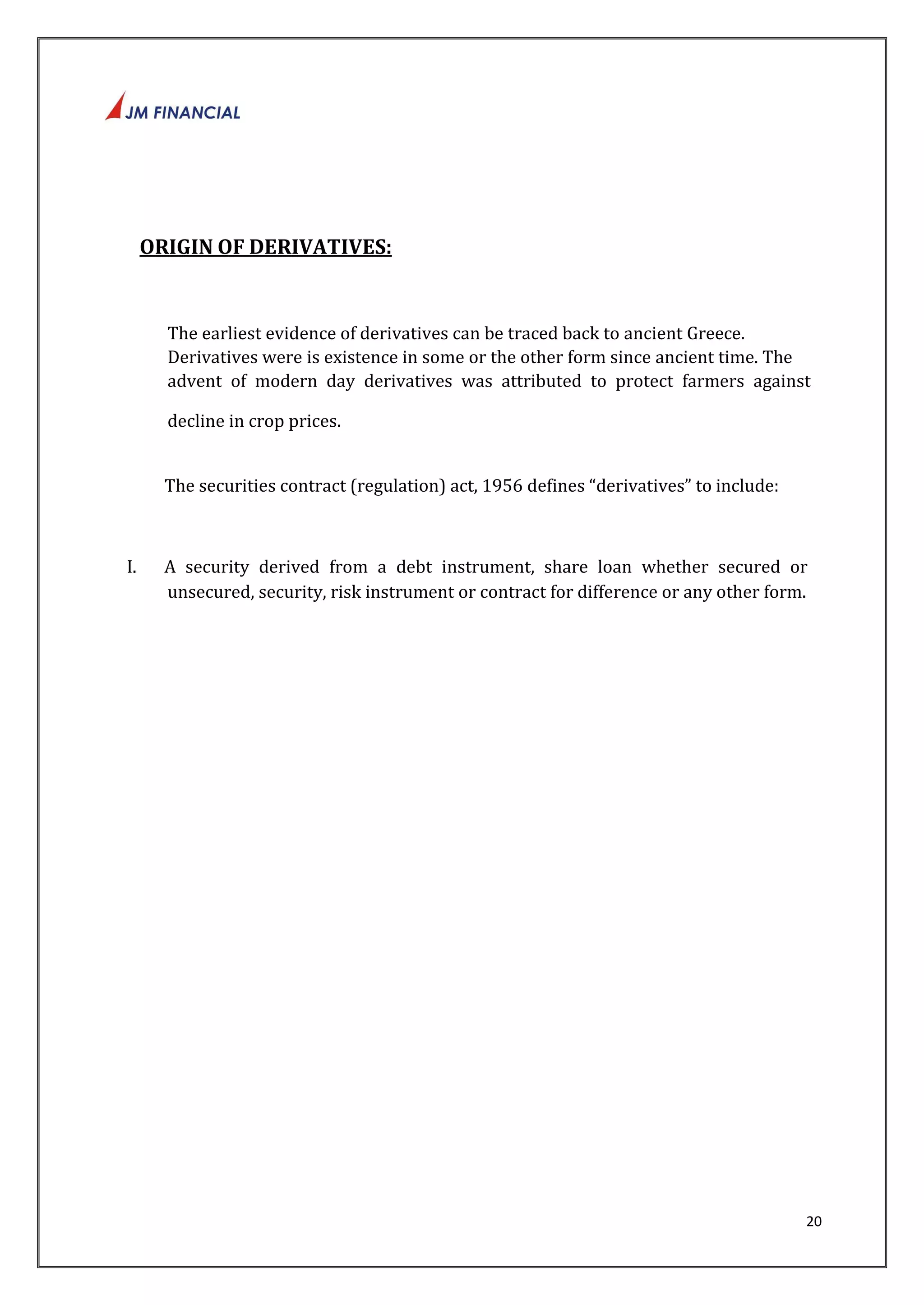

![17

DERIVATIVES

The term derivatives are used to refer to financial instruments which derive

their value from some underlying assets.

The underlying assets could be:

Interest Rate derivative

Foreign Exchange derivative

Credit derivative

Equity derivative

Commodity derivative

Other examples of underlying exchangeables are:

Property (mortgage) derivatives

Economic derivatives that pay off according to economic reports[] as measured and

reported by national statistical agencies

Freight derivatives

Inflation derivatives

Weather derivatives

Insurance derivatives

Emissions derivatives](https://image.slidesharecdn.com/prashangisip-141116233920-conversion-gate01/75/Prashangi-sip-17-2048.jpg)

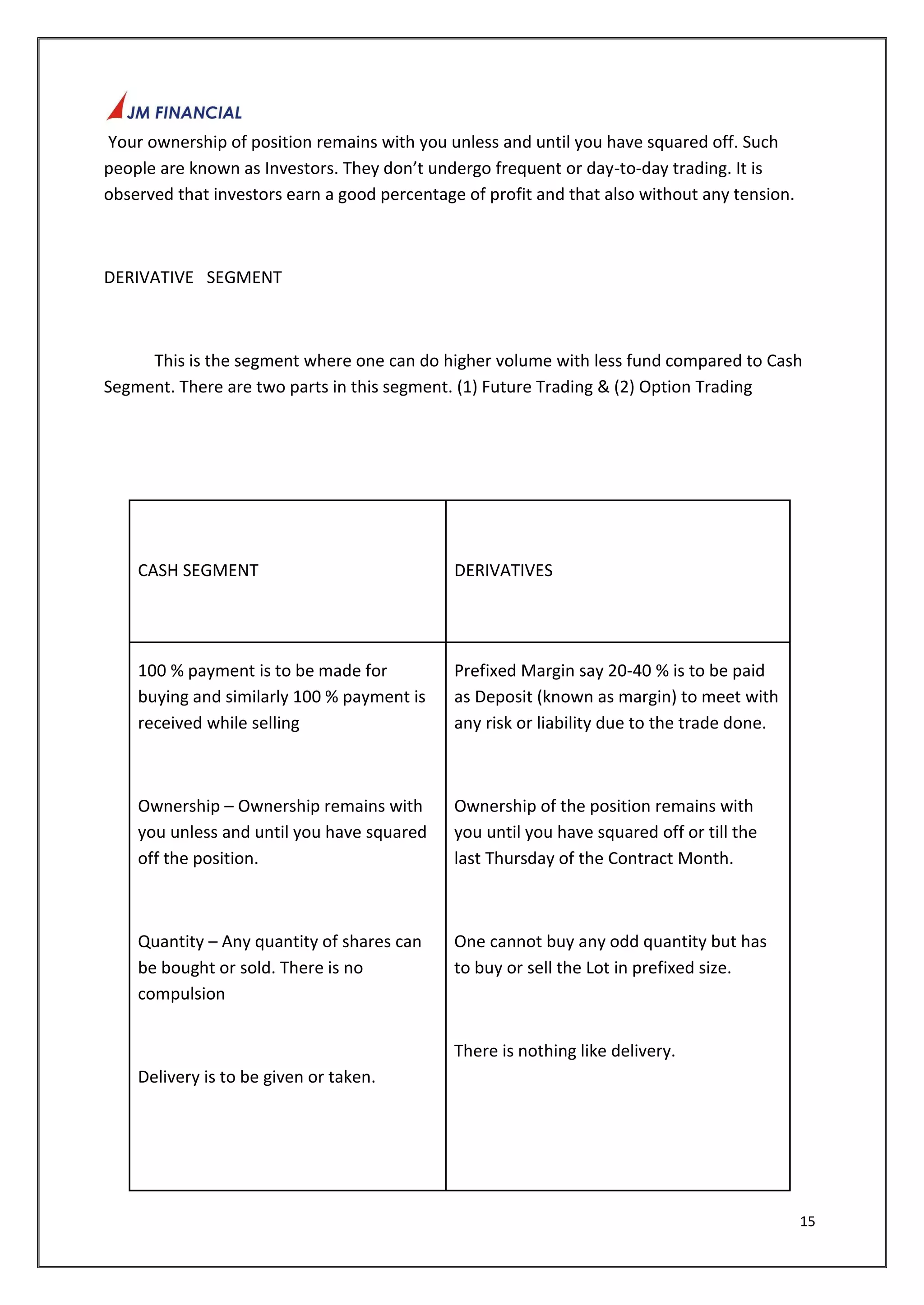

![23

TYPES OF TRADING:

OTC and Exchange-traded

In broad terms, there are two groups of derivative contracts, which are distinguished by

the way they are traded in the market:

Over-the-counter

(OTC) derivatives are contracts that are traded (and privately negotiated) directly

between two parties, without going through an exchange or other intermediary.

Products such as swaps, forward rate agreements, and exotic options are almost

always traded in this way. The OTC derivative market is the largest market for

derivatives, and is largely unregulated with respect to disclosure of information

between the parties, since the OTC market is made up of banks and other highly

sophisticated parties, such as hedge funds. Reporting of OTC amounts are difficult

because trades can occur in private, without activity being visible on any exchange.

According to the Bank for International Settlements, the total outstanding notional

amount is US$684 trillion (as of June 2008).[6] Of this total notional amount, 67% are

interest rate contracts, 8% are credit default swaps (CDS), 9% are foreign exchange

contracts, 2% are commodity contracts, 1% are equity contracts, and 12% are other.

Because OTC derivatives are not traded on an exchange, there is no central counter-party.

Therefore, they are subject to counter-party risk, like an ordinary contract, since

each counter-party relies on the other to perform.

Exchange-traded derivative contracts

(ETD) are those derivatives instruments that are traded via specialized derivatives

exchanges or other exchanges. A derivatives exchange is a market where individuals

trade standardized contracts that have been defined by the exchange.A derivatives

exchange acts as an intermediary to all related transactions, and takes Initial margin

from both sides of the trade to act as a guarantee.](https://image.slidesharecdn.com/prashangisip-141116233920-conversion-gate01/75/Prashangi-sip-23-2048.jpg)